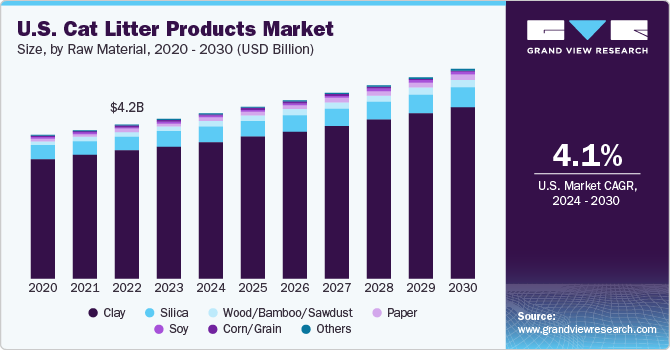

U.S. Cat Litter Products Market Growth & Trends

The U.S. Cat Litter Products Market was valued at an estimated USD 4.36 billion in 2023 and is projected to exhibit a CAGR of 4.1% from 2024 to 2030. This expansion is largely attributed to the rising rates of cat ownership and increasing pet expenditures within the U.S. A 2022 survey by the American Pet Products Association (APPA) revealed that two-thirds of pet owners consider their animals when setting financial objectives, demonstrating a strong commitment to providing necessary care, including food (75%) and exhibiting brand loyalty (56%).

Surging Pet Ownership and Prioritizing Pet Welfare

The adoption of pets in the U.S. surged in popularity, particularly during the pandemic as people spent more time at home. APPA data indicates that the percentage of homes with pets increased from 67% in 2019 to 70% in 2020. As pet owners increasingly prioritize the health, cleanliness, and welfare of their animals, the demand for cat litter in the U.S. is expected to continue rising. This trend creates a favorable environment for businesses offering premium, environmentally friendly cat litter products to anticipate steady growth and success.

Increased Spending and Product Preferences

Consumer spending on pets has reached unprecedented levels. The APPA reported that U.S. pet owners spent a record USD 103.6 billion on high-quality items for their cats in 2020. Additionally, as cats age, they can become more prone to allergies from scented cat litter products. Consequently, consumers are increasingly opting for odor-reducing and artificially odorless products.

Market Expansion and Distribution Strategies

U.S. enterprises are effectively reaching a broader global audience by supplying cat litter products through partnerships with online and offline distribution channels. For instance, in November 2020, Purina Tidy Cats introduced LightWeight Free & Clean cat litter on Loop, a global marketplace for household goods and consumables. The product was initially available for sale in ten states: New York, New Jersey, Maryland, Pennsylvania, Connecticut, Vermont, Rhode Island, Massachusetts, Delaware, and the District of Columbia, via Loop's online store.

The industry's growth is also fueled by the increasing number of people worldwide choosing cats as their preferred pets. According to APPA data, 42.7 million cats were owned in the U.S. in both 2019 and 2020. The rising demand is further driven by a growing segment of millennial pet owners who are well-informed about various pet products available in the market. For example, the American Veterinary Medical Association announced in May 2019 that millennials account for over 80% of pet owners in the U.S.

Environmental Concerns as a Restraint

Despite these positive trends, the market's expansion is being impeded by the use of ecologically unfavorable raw materials in cat litter production. For example, silica-based crystal cat litter has been identified as detrimental to the environment.

Curious about the U.S. Cat Litter Products Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends.

U.S. Cat Litter Products Market Report Highlights

- The U.S. conventional cat litter products market is projected to grow at a CAGR of 3.1% from 2024 to 2030. Growing customer preference for completely eliminating the smell of cat poop and pee is driving demand for traditional litter products.

- The demand for wood/bamboo/sawdust-based cat litter products is anticipated to grow at a CAGR of 7.1% from 2024 to 2030. The market for wood-based cat litter products is expanding as customers place a higher value on eco-friendly and sustainable options.

- Cat litter sales through supermarkets and hypermarkets channels accounted to the market share of 40.1% in 2023. Due to numerous retail discounts and offers, pet owners choose to buy pet care, food, and grooming supplies through these channels because they are less expensive than prescription-based products.

U.S. Cat Litter Products Market Segmentation

Grand View Research has segmented the U.S. Cat Litter Products market based on product type, raw materials, and distribution channel:

- Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Clumping

- Conventional

- Raw Material Outlook (Revenue, USD Billion, 2018 - 2030)

- Clay

- Silica

- Wood/Bamboo/Sawdust

- Paper

- Soy

- Corn/Grain

- Others

- Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

- Supermarkets and Hypermarkets

- Specialty Retail Stores

- Convenience Stores

- Online/E-commerce

Download your FREE sample PDF copy of the U.S. Cat Litter Products Market today and explore key data and trends.