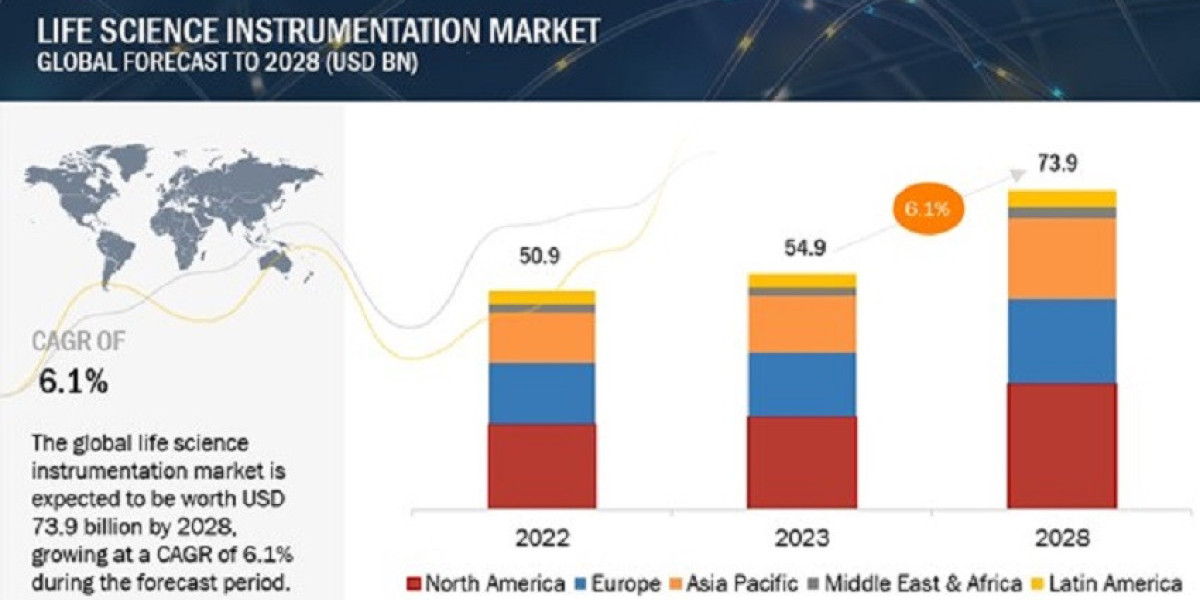

The global life science instrumentation market in terms of revenue was estimated to be worth $54.9 billion in 2023 and is poised to reach $73.9 billion by 2028, growing at a CAGR of 6.1% from 2023 to 2028. The increasing number of research grants, rising prevalence of chronic diseases, and rising focus on precision medicine are expected to drive the market during the forecast period.

Prominent players operating in the global life science instrumentation market are Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), Waters Corporation (US), Shimadzu Corporation (Japan).

Download the PDF Brochure at https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38

Driver: Increasing investments in pharmaceutical R&D

The pharmaceutical industry focuses and invests in research to manufacture protein-related products. Drug development and manufacturing involve different types of analytical instruments. Analytical instruments evaluate drug molecules, protein analysis and purification, and quality control. Protein identification and separation is an important step in drug manufacturing. Technologically advanced equipment helps understand the characterization of a molecule and ensure its safety and purity. In recent years, emerging markets have also witnessed a significant increase in foreign direct investment and government investments in pharmaceutical R&D. Thus, increasing R&D spending in the life sciences, pharmaceutical, and biotechnology sectors will likely increase the application usage of life science instruments.

Restraint: High equipment costs

Recent technological advancements and newly added features have increased the cost of life science instruments. There is a consistent rise in the cost of these systems with the introduction of automation with the help of AI. The new state-of-the-art equipment consumes less time and provides users with accurate results but is often costly. In addition, there are recurrent expenses in the form of maintenance costs, which ultimately drive up the overall cost of ownership. Small-scale users such as academic and research institutes, diagnostic laboratories, and small and medium-sized pharma-biopharma companies find it difficult to afford such equipment due to restricted budgets. This high cost has left users reliant on government and private research funding, which restricts market growth to a certain extent.

Opportunity: Widening application scope of analytical instruments

Analytical instruments find a wide range of applications in food and beverage, environmental testing, and forensic industries, among others. Analytical techniques play an important role in analyzing food materials before, during, and after manufacturing. Pesticides, additives, and other contaminants can be detected with the help of analytical equipment. The instruments also help conduct quality control of packaging materials. Analytical technologies play a crucial role in the environmental testing industry. Different analytical techniques can analyze air and water samples and detect solids, liquid aerosols, trace gases, and volatile organic compounds. A rising focus on environment conservation and preservation has increased the demand for life science instruments and technologies in this application segment.

Challenges: Inadequate infrastructure for research in emerging countries

Adequate infrastructure is very important to conduct research and development. Appropriate financial support, good research laboratories, and trained professionals are required to use life science instruments for research. Emerging countries in Asia (such as India, Indonesia, and the Philippines), the Middle East (such as Oman, Iraq, and UAE), and Africa lack the necessary infrastructure. This ultimately creates a challenge for the growth of the market in emerging countries.

By technology, the spectroscopy segment accounted for the largest share of the life science instrumentation market in 2022.

Based on technology, the global market is segmented into spectroscopy, chromatography, PCR, immunoassays, lyophilization, liquid handling, clinical chemistry analyzers, microscopy, flow cytometry, NGS, centrifuges, electrophoresis, cell counting, and other technologies. In 2022, the spectroscopy segment accounted for the largest market share. The rising use of advanced instruments in oncology research and the need for better sensitivity and enhanced speed is driving the segment growth.

Direct Purchase at https://www.marketsandmarkets.com/Purchase/purchase_reportNew.asp?id=38

By application, the research applications segment of the life science instrumentation market to register significant growth in the near future.

Based on application, the global market is segmented into research applications, clinical & diagnostic applications, and other applications. Research applications to register the highest growth rate during the forecast period. The major factors responsible for the highest growth rate of this segment are the availability of funding for R&D in academic institutes.

By region, North America is expected to be the largest region in the life science instrumentation market during the forecast period.

North America, comprising the US and Canada, accounted for the largest market share in 2022. Factors such as growing funding for research, and increasing applications in the healthcare/medical sector, and presence of major players in the region are driving market growth in North America.