The global interactive display market was valued at USD 41.45 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. This market includes interactive kiosks, video walls, tables, monitors, and whiteboards. Interactive displays, or touchscreen displays, are screens that respond to user commands through touch, either by finger or stylus, eliminating the need for traditional input devices like a mouse or keyboard. These displays project information such as text, images, and videos and are widely utilized across industries, including retail, healthcare, hospitality, and education. Expected market growth is driven by rising demand for digital classrooms and the increasing adoption of display technologies, such as video walls and tables, commonly seen in transit areas like railway stations and airports.

The hospitality and corporate sectors are also seeing a surge in the use of touchscreen tables and video walls, which are anticipated to further drive market expansion. In hospitality, touchscreen tables can display menu options, wait times, pricing, and ingredients, enhancing customer service. Corporations use touchscreen tables in meetings to improve the interactive experience for both clients and employees, fostering engagement between employees, management, and clients.

Gather more insights about the market drivers, restrains and growth of the Global Interactive Display Market

The education sector's digitalization, involving technologies like smartphones, tablets, laptops, and interactive whiteboards, is transforming classrooms. Touchscreen displays in classrooms boost student engagement, enhance interactivity, and improve learning retention. These displays support group learning and creativity, allowing feedback exchanges not only between teachers and students but also among students. Teachers can incorporate media, games, audio, and video into lessons, which has led to a shift in student preferences toward digital learning, enabling them to learn through relevant digital content.

Additional factors, such as internet penetration and the evolving preference for touch-enabled technology, have positively influenced the adoption of touch displays. Gamification in education is also contributing to market growth. By presenting lessons as games, gamification encourages cognitive skill development and interaction. It also allows for the integration of 3D characters and game mechanics into lessons, making learning more engaging.

Display Type Insights

In terms of display type, the market is divided into interactive kiosks, video walls, tables, displays, and whiteboards. The kiosk segment dominated in 2022, holding a market share of 73.4% and a CAGR of 7.2% over the forecast period. Interactive kiosks are self-contained electronic devices that allow users to interact via touchscreens, often used to provide information, sell products, process transactions, or conduct surveys. The growth of this segment is driven by increased demand for self-service solutions in retail, transportation, and healthcare. Smart vending machines, ATMs, and other touch-enabled self-service solutions allow businesses to offer better customer service, even during peak hours. The rise in interactive kiosks has enabled companies to deliver tailored services cost-effectively.

The video wall segment is projected to grow the fastest, with a CAGR of 11.2% throughout the forecast period. Interactive video walls consist of multiple screens or projectors creating a large visual display for media such as videos, images, and animations. The growth is fueled by an increased focus on applying touchscreen video walls in healthcare, where they are used to communicate information about facilities and providers, improving patient experience and service delivery. Consumer demand for high-resolution video walls, supported by tech-savvy lifestyles, is further driving product adoption.

Application Insights

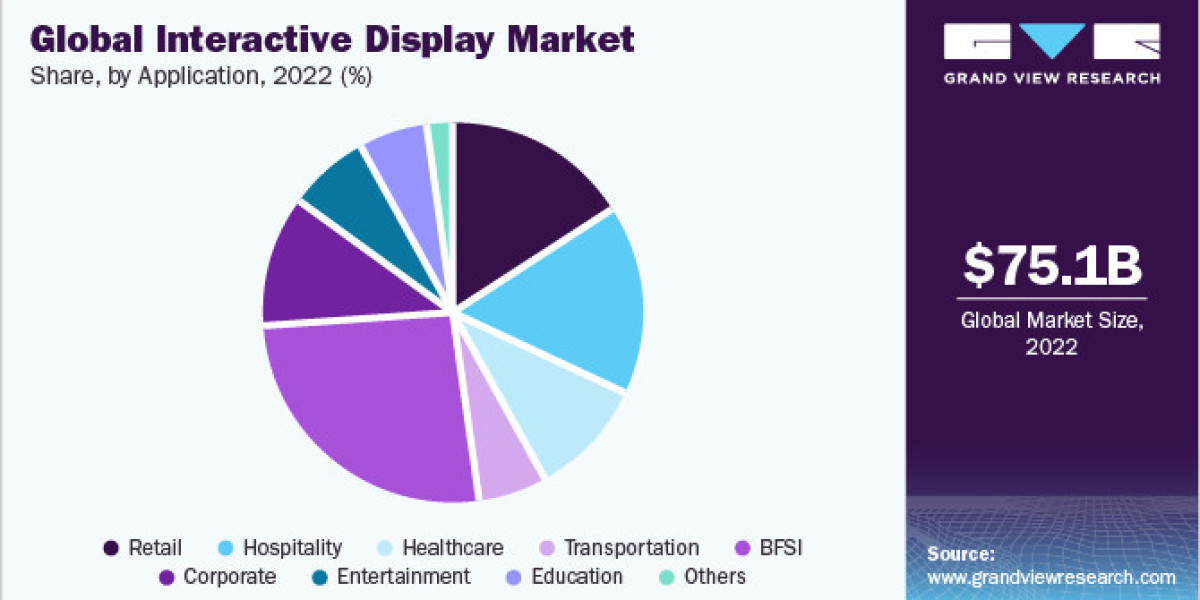

The market, segmented by application, includes retail, hospitality, healthcare, transportation, BFSI (Banking, Financial Services, and Insurance), corporate, entertainment, education, and others. In 2022, the BFSI segment led with a market share of 25.8% and a CAGR of 8.3% during the forecast period. Interactive displays are increasingly popular in BFSI due to their potential to enhance customer engagement, improve experience, and boost operational efficiency. With the digital transformation of banking and finance, customers prefer interactive displays for a more intuitive and engaging interface, facilitating access to services and products and enhancing personalization.

The retail segment is anticipated to grow at the fastest pace, with a CAGR of 9.1% over the forecast period. Demand for interactive displays is rising in retail due to the trend toward touch-enabled devices and the increasing use of interactive kiosks and tables. For instance, major retail chains like Walmart use kiosks to display product information, including pricing and specifications, to enhance in-store customer experiences. The retail segment offers significant growth potential for market players, supported by the proliferation of shopping centers and malls worldwide. Additionally, interactive video walls in retail enable users to check stock availability and browse inventory. Beyond retail, video walls are used in museums to transform spaces with virtual content, enhancing the visitor experience through immersive environments.

Order a free sample PDF of the Interactive Display Market Intelligence Study, published by Grand View Research.