The global metal casting market, valued at USD 136.71 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. This growth is driven primarily by the automotive industry's increasing demand for casting. Metal casting, a widely used manufacturing process, involves pouring molten metal into a mold or die to achieve specific shapes, allowing the production of large and complex parts for various industrial applications. Stringent environmental regulations, particularly those aimed at improving fuel efficiency in vehicles, are further fueling growth in the metal casting industry. These regulations have led automakers to focus on producing lightweight vehicles.

The construction industry is also seeing rising demand for aluminum casting, driven by the material’s lightweight properties and aesthetic benefits. Aluminum castings are used in construction equipment, heavy vehicles, and building components like windows, doors, and roofing. The ability to recycle aluminum is becoming increasingly important as building owners shift towards deconstruction to minimize the environmental impact of construction activities.

Gather more insights about the market drivers, restrains and growth of the Global Metal Casting Market

Cast iron, an alloy of metals such as silicon, carbon, manganese, sulfur, and phosphorus, has broad applications in products like kitchen utensils, automotive parts, and pipes. Demand for grey iron is projected to grow due to its use in housing, engine blocks, and cylinder heads, where its properties, including stiffness and thermal conductivity, make it ideal for such applications.

The Asia Pacific region is expected to drive market growth, with rising demand for metal casting products across various end-use industries. The region’s construction sector, particularly in developing countries like China, India, and Malaysia, is a key driver. For instance, in 2018, Malaysia’s residential and non-residential sectors saw growth of 4.4%, while Indonesia’s building sector grew by 7-8%. Government incentives, such as Indonesia's removal of the 15% mortgage down payment rule, are further boosting construction activities, thereby increasing the demand for metal casting products.

The automotive industry’s increasing use of aluminum, a lightweight and efficient material, is also driving market expansion. Regulations like the Corporate Average Fuel Economy (CAFE) standards, which aim to improve fuel efficiency and reduce greenhouse gas emissions, are encouraging automakers to use aluminum for vehicle weight reduction.

Technological advancements in the automotive sector are creating more demand for metal casting products. China, the largest automobile market globally, along with South Korea, Japan, and India, are contributing significantly to aluminum demand in Asia. In the U.S., growing demand for lightweight vehicles has also led to increased use of aluminum in car manufacturing, with the average aluminum content in vehicles rising by over 4% between 2017 and 2018.

However, the metal casting industry is capital-intensive, requiring large machinery, heavy equipment, and ample space for production. Skilled labor is also essential for handling products and operating advanced equipment, which increases production costs, especially in developing and underdeveloped regions. Continuous investment in research and development (R&D) to improve manufacturing quality further adds to operational costs.

Material Insights

The aluminum segment held the largest revenue share of 38.3% in 2022, with most of the demand coming from emerging markets in the automotive, construction, and oil & gas sectors. Finished casting products are expected to remain a key area of investment. According to the World Foundry Organization, the production volume of iron casting grew by 0.8% in 2017, with ductile iron and grey iron production increasing by 1.1% and 1.3%, respectively.

The aluminum segment is expected to grow at a CAGR of 8.7% in revenue terms over the forecast period. Demand for lightweight metals like aluminum and magnesium is anticipated to create significant opportunities for market vendors, as stricter emission regulations and energy efficiency requirements drive the production of lightweight materials that reduce fuel consumption in vehicles.

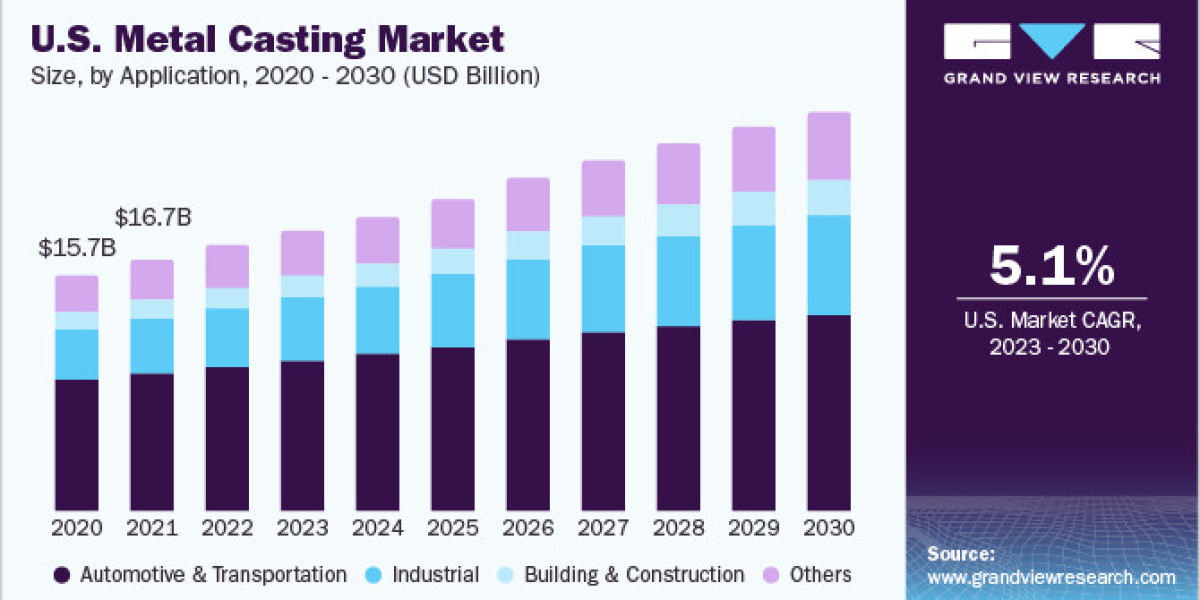

Application Insights

In 2022, the automotive segment accounted for the largest revenue share of 59.5%. Global automotive production has seen steady growth, with a 2.3% increase reported in 2017 by the International Organization of Motor Vehicle Manufacturers. The use of aluminum for weight reduction in vehicles remains crucial for automakers, as it helps meet regulatory standards for fuel efficiency and emissions.

The industrial segment is expected to grow at the fastest CAGR of 5.9% over the forecast period. This segment includes products such as metal valves, flanges, air injection tubes, radiation protection tubes, and rollers, which are produced using iron and steel materials. The expansion of manufacturing industries in China and other emerging markets is driving growth in this segment.

The building and construction industry is also a major consumer of metal casting products, with increased investment in infrastructure projects like transportation, water supply, telecommunications, and energy networks fueling demand. Government investments in infrastructure development across various countries are further supporting the growth of the metal casting market.

Order a free sample PDF of the Metal Casting Market Intelligence Study, published by Grand View Research.