The global patient engagement solutions market was valued at approximately USD 22.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 17.7% from 2024 to 2030. Key drivers for this growth include ongoing technological advancements, the increasing adoption of Electronic Health Records (EHR) and mobile health (mHealth) solutions, the rising prevalence of chronic diseases, supportive initiatives from major stakeholders, and a growing consumer focus on healthcare. A survey conducted by NextGen Healthcare in 2021 revealed that 83% of ambulatory healthcare providers believe that patient engagement solutions are essential for achieving both financial success and improved patient outcomes, with the COVID-19 pandemic further accelerating market growth.

Gather more insights about the market drivers, restrains and growth of the Global Patient Engagement Solutions Market

Segmentation Analysis:

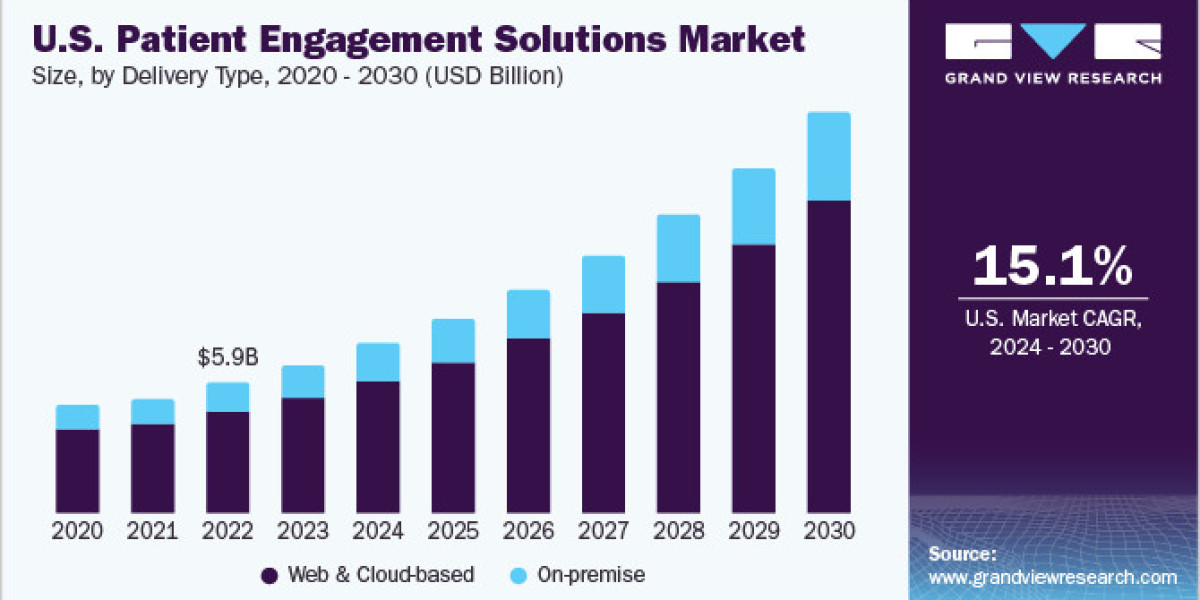

Delivery Type Insights

In 2023, the web and cloud-based segment dominated the market, holding a substantial 78.0% revenue share, and is projected to experience the fastest growth throughout the forecast period. The increasing adoption of these solutions is attributed to their ability to provide remote access to real-time data tracking, integrated features, easy accessibility, low handling costs, and straightforward data backup. Consequently, companies are increasingly investing in web and cloud-based patient engagement solutions. For instance, Microsoft introduced Microsoft Cloud for Healthcare in May 2020, aiming to enhance patient engagement and facilitate collaboration among healthcare teams through telehealth and data analytics capabilities.

On-premise services also play a crucial role, offering secure patient data management and ease of access, driven by the desire for comprehensive information access within healthcare facilities.

Component Insights

The software and hardware segment accounted for the largest revenue share of 62.7% in 2023 and is anticipated to grow at the fastest CAGR over the forecast period. These components form the core offerings of patient engagement solutions, providing intuitive user interfaces and continuous product upgrades that simplify installation, usage, and record retrieval. An example is FollowMyHealth from Allscripts, a widely used mobile-first, customizable patient engagement solution that enhances care quality and patient satisfaction.

The services segment is essential for the effective operation of patient engagement solutions, aiding in their optimization based on customer needs and maximizing health outcomes. This segment encompasses consulting, implementation, training, support and maintenance, as well as services related to interoperability and access to EHR data.

Functionality Insights

In 2023, the communication segment held the largest revenue share at 35.0%, forming the foundational offering of any patient engagement solution. This dominance is driven by the growing demand for telehealth, mHealth, and various virtual communication channels, including audio, video, and text. The pandemic accelerated the adoption of these virtual communication solutions, extending their applications to remote patient monitoring and mental health services.

The health tracking and insights segment is projected to grow at the fastest rate of 19.1% over the forecast period, fueled by the increasing integration of data analytics, artificial intelligence (AI), and machine learning to provide actionable insights for patients and their healthcare providers. For instance, Nuance Communications, Inc. introduced Nuance Mix, a conversational AI platform utilizing deep learning-based speech and natural language understanding technologies. In September 2021, Leidos partnered with Nuance to incorporate this platform and its omnichannel development tools into custom patient engagement solutions.

End-use Insights

The providers segment captured the largest revenue share, exceeding 47.0% in 2023. Providers, who cater to the highest volume of patients and serve as the primary point of contact for health consultations, are the leading adopters of patient engagement solutions. For example, in December 2021, Northwell Health in the U.S. implemented a patient engagement platform by Playback Health at select clinical sites, promoting mobility and secure sharing of point-of-care medical data.

Conversely, the payers segment is expected to grow at the fastest rate of 18.0% during the forecast period. The expansion of this segment is attributed to the increasing adoption of patient and customer engagement solutions that enable broad coverage and support value-based care delivery. Payers are focusing on managing patient care and ensuring connectivity at every stage of the treatment process.

Therapeutic Area Insights

Chronic disease management dominated the market in 2023, holding a revenue share of over 44.7%. The growing geriatric population in key markets, along with the rising prevalence of chronic diseases and accelerated adoption of digital technologies driven by the COVID-19 pandemic, have significantly contributed to the segment's large share. Patient engagement solutions facilitate chronic disease management by enabling prevention and detection of conditions and supporting both provider-led and self-management strategies.

The health and wellness segment is projected to experience the fastest growth rate of 18.0% over the forecast period, driven by initiatives from leading companies, an expansion of product offerings covering mental health, weight management, and pregnancy, as well as increased research activities. For instance, in June 2023, Cardinal Health finalized an agreement to transfer its Outcomes business to Transaction Data Systems, enhancing patient engagement and clinical pharmacy solutions, thereby strengthening connections between payers and pharmaceutical companies within its extensive pharmacy network.

Application Insights

Outpatient health management accounted for over 39.0% of the market share in 2023, highlighting its dominance. The segment encompassing research and development (R&D) and preventive care is expected to grow at the fastest rate of 18.0% throughout the forecast period. Patients with chronic conditions require continuous monitoring and updates regarding their health management. The rise of healthcare consumerism has also led patients to become more engaged in care planning, tracking, and optimization.

Patient engagement solutions enable remote connections between patients and their healthcare providers, facilitating the efficient exchange of information, patient feedback, and other health-related data. For example, in November 2019, the CDC funded 13 state-level arthritis management and prevention programs to enhance the quality of life and monitoring for rural arthritis patients. Additionally, the adoption of patient engagement solutions for R&D purposes by medical device manufacturers, pharmaceutical companies, and other life sciences entities is expected to grow significantly due to increasing product availability and demand.

Order a free sample PDF of the Patient Engagement Solutions Market Intelligence Study, published by Grand View Research.