The global eSIM market was valued at USD 8.07 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2023 to 2030. This growth is primarily driven by the increasing adoption of Internet of Things (IoT)-connected devices in Machine-to-Machine (M2M) applications and consumer electronics. The number of eSIM profile downloads on consumer devices is also rising rapidly. According to Mobilise, 1.2 billion eSIM-enabled devices were recorded in 2021, and this number is expected to reach 3.4 billion by 2025.

The introduction of eSIM technology in the automotive sector has greatly enhanced cellular connectivity in cars and trucks, enabling new features and capabilities. It is anticipated that in the near future, all vehicles will be equipped with cellular connectivity, providing a more advanced driving experience through new connected services. The automotive industry has made significant progress toward adopting GSMA's embedded SIM specification, which enhances vehicle connectivity and security for various connected services.

Gather more insights about the market drivers, restrains and growth of the Global Esim Market

eSIM technology offers automatic compatibility with multiple network operators, connection platforms, and remote SIM profile provisioning. However, the involvement of multiple network service providers in this operating chain has complicated security management. eSIMs store Mobile Network Operators' (MNOs') credentials within a device's embedded software, which can be vulnerable to security breaches. Additionally, the operation of eSIMs across various physical platforms and MNOs exposes them to virtual environment risks, which may undermine the operational flexibility of eSIM technology, thus hindering market growth if security issues are not addressed.

The concept of Industry 4.0 has brought technological advancements, including smart machinery that communicates and controls operations automatically. In Industry 4.0, data is transferred between M2M and Machine to Other (M2O) devices using IoT. This process involves the use of technologies like Wi-Fi, sensors, RFID (radio frequency identification), and autonomous computing software. M2M systems often rely on public and cellular networks for internet access, and these advancements have allowed electronics manufacturers to integrate eSIMs into M2M systems, contributing to the expansion of the eSIM market by enhancing the connected ecosystem.

The increasing penetration of smartphones in countries such as China, India, Japan, and the U.S. is further expected to fuel market growth. Leading smartphone manufacturers, including Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, have started incorporating eSIM technology into their devices through partnerships with several network service providers. For example, Apple, Inc. has partnered with service providers like Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone to offer eSIM services. The growing use of eSIM technology by smartphone and consumer electronics manufacturers to deliver enhanced and secure user experiences is expected to drive market growth.

Solution Insights

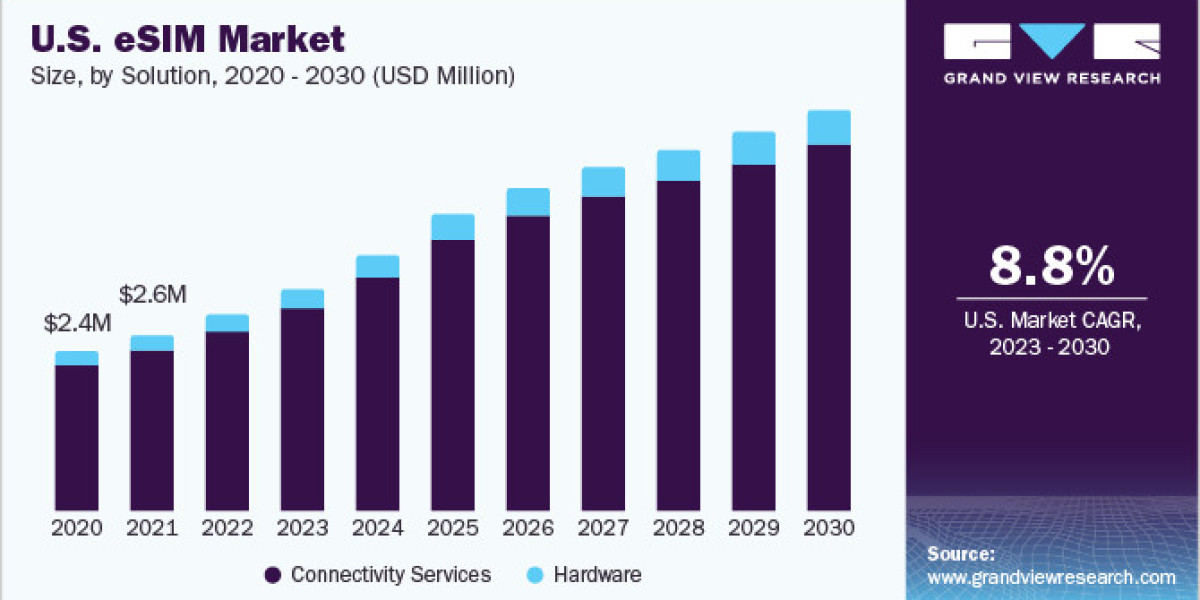

In 2022, the connectivity services segment dominated the eSIM market, accounting for 88.5% of total revenue. This growth can be attributed to the increasing use of eSIM technology for M2M connections, which allows network operators to generate revenue through subscription services. Mobile Network Operators (MNOs) provide connectivity services that allow for the secure and remote management of end-user cellular subscriptions. In the automotive sector, the adoption of the GSMA Embedded SIM Specification has improved vehicle connectivity, paving the way for a new generation of connected vehicles and bolstering security for various connectivity services, thereby supporting market expansion.

The hardware segment is expected to grow at the highest CAGR of 13.5% over the forecast period. This growth is driven by the increasing number of consumer electronics manufacturers adopting eSIM technology. Smartphone manufacturers are particularly contributing to this trend by integrating eSIMs into their devices, fueling the demand for eSIM hardware. The hardware segment is consolidated, with key players like Infineon Technologies AG, NXP Semiconductors, and STMicroelectronics holding significant shares of the total hardware revenue.

Application Insights

The M2M segment held the largest revenue share of 68.1% in 2022, largely due to the growing use of eSIM technology in the automotive sector for M2M communication. Connected cars are a major driver of demand in this industry, and the implementation of eSIMs in automotive applications is expected to simplify production processes and boost the connected car market. The increasing use of eSIM technology in connected vehicles is also anticipated to encourage the adoption of M2M and IoT technologies in other industries.

The consumer electronics segment is projected to grow at a CAGR of 9.2% over the forecast period, making it the fastest-growing application. Consumer electronics are driving innovation, growth, and disruption in many technology sectors. In smartphones, eSIM technology enables manufacturers to save space within the device, allowing for slimmer designs. eSIM technology is expected to be a transformative force in consumer electronics due to its high reliability, enhanced safety, and improved connectivity, which are key factors driving its adoption in this sector.

Order a free sample PDF of the Esim Market Intelligence Study, published by Grand View Research.