The global core banking software market was valued at USD 10.89 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 9.3% from 2023 to 2030. This growth can be attributed to the increasing adoption of technology to support core banking operations and services. Digitized operations have improved the quality of banking services and reduced processing times. Technological advancements have allowed financial institutions to better meet changing customer demands, such as providing omnichannel banking access.

Beyond enabling customers to manage their accounts remotely through online and mobile banking, core banking software offers many other benefits. It links multiple branches through a centralized system, making it easier to search and compare data efficiently. Banks can leverage these systems to analyze data and streamline internal processes. Additionally, core banking solutions enhance transaction monitoring and screening, helping detect and prevent money laundering activities.

Gather more insights about the market drivers, restrains and growth of the Global Core Banking Software Market

The rapid pace of technological innovation has had a major impact across industries. In the banking sector, integrating cutting-edge technologies like generative artificial intelligence into financial services can give firms a competitive edge. For instance, a March 2023 Accenture study involving 49,000 customers revealed that 67% used branch services for specific, complex issues that required physical presence. Furthermore, the survey suggested that banks could boost revenue by up to 20% by improving engagement with primary customers.

Digitization in core banking helps make transactions more efficient. A unified system enables seamless access to customer data, reducing the need for redundant entries, which speeds up and enhances the accuracy of transactions. Core banking systems also support real-time processing, instant updates to accounts and transactions, and quicker payments and fund transfers. Furthermore, these systems improve security and fraud detection, ensuring transaction safety and protecting customers from potential risks.

However, transitioning from legacy systems to digital core banking solutions presents challenges for many financial institutions. Concerns over privacy and data security during this transition are affecting market growth. Nonetheless, core banking solution providers are responding by offering customized solutions to address the specific needs of banks and financial institutions.

Solution Insights

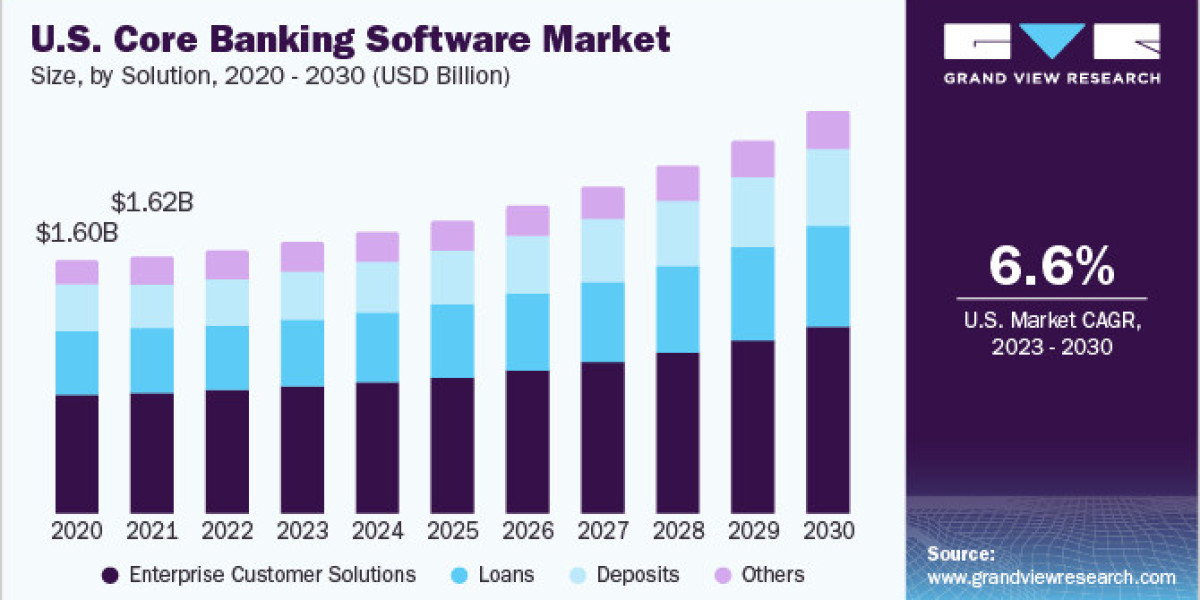

The enterprise customer solutions segment led the market in 2022, accounting for over 46.0% of global revenue. The segment's growth is driven by banks and financial institutions adopting collaborative infrastructures and implementing new solutions. For instance, in April 2023, Intellect Design Arena’s retail banking division, Global Consumer Banking, launched a core banking platform called eMACH.ai, which allows for the creation of custom products using artificial intelligence (AI). By leveraging emerging technologies like AI and machine learning, banks can offer personalized products and services, thereby improving the customer experience.

Core banking loan solutions include a comprehensive set of digital tools designed to streamline loan management processes within financial institutions. These solutions improve operational efficiency, enhance customer experiences, and ensure regulatory compliance throughout the loan lifecycle. The automation of loan applications and approvals, including data capture, credit scoring, and document verification, accelerates the approval process and reduces errors. As a result, the loan segment is expected to experience significant growth.

Service Insights

In 2022, the professional services segment dominated the market, accounting for over 76.0% of global revenue. Core banking software must be tailored to meet the unique requirements of each financial institution. Professional service providers assist banks in customizing the software to meet their specific business needs. The increasing demand for support services at every stage of software deployment, including consulting, project management, and integration, is driving the growth of this segment.

The managed services segment is expected to experience the highest growth during the forecast period. As banks grow and evolve, their technology requirements change. Managed service providers ensure that systems can scale to accommodate higher transaction volumes and the integration of new applications, offering a flexible and future-proof architecture. Efficient managed services also minimize downtime during integration, preventing disruptions to banking services.

Deployment Insights

The on-premise segment held the largest share of the market in 2022, accounting for more than 59.0% of global revenue. With on-premise systems, companies assume full responsibility for integration and management of IT and security issues. Organizations with legacy platforms often partner with IT service providers to recover data and address security concerns while reducing operational costs. On-premise deployment provides businesses with more control over their operational infrastructure.

The cloud segment is expected to register the highest growth over the forecast period. Financial institutions with on-premise infrastructure are increasingly adopting cloud-based solutions to remain competitive with more digitally advanced players. Cloud technology enables the automation of workflows and operations, improving efficiency, cost-effectiveness, and security. Cloud-based core banking solutions are flexible and scalable, allowing institutions to easily adjust to changing IT needs.

End-Use Insights

In 2022, the banking sector accounted for more than 56.0% of global revenue, making it the dominant segment. This growth is attributed to rising investments in modern IT infrastructure. Automated systems ensure accurate data processing and minimize errors. Access to real-time data and advanced analytics allows banks to gain valuable insights into customer behavior and financial trends, helping them make more informed decisions.

The financial institutions segment is expected to grow significantly over the forecast period. Financial institutions are increasingly adopting core banking software to enhance real-time banking services and prevent fraud. This rising adoption is driven by the need to close the gap between customer expectations and traditional banking operations, creating growth opportunities for the segment.

Order a free sample PDF of the Core Banking Software Market Intelligence Study, published by Grand View Research.