The global fuel cell market was valued at USD 7.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 27.1% from 2024 to 2030. This growth is driven by increasing demand for alternative energy sources, with public-private partnerships and environmental benefits playing a key role. Governments worldwide are expected to support this growth through R&D funding and financing programs. Additionally, building a strong regulatory framework will be crucial to creating an investment-friendly environment.

In the U.S., states like California and New York have implemented carbon emission mandates for commercial and industrial end users, leading to a shift toward clean energy technologies to meet these requirements. Companies like Bloom Energy provide fuel cell solutions to help businesses reduce their carbon footprint. For instance, in September 2023, FuelCell Energy and Toyota Motor North America completed a Tri-gen system at Toyota’s Long Beach facility, showcasing the potential of hydrogen-powered fuel cells. Such innovations are expected to further drive the fuel cell market during the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Fuel Cell Market

The fuel cell market presents vast growth opportunities, with ongoing technological improvements increasing efficiency and performance. Fuel cells are becoming more attractive for various applications, including transportation, where fuel cell electric vehicles (FCEVs) offer longer ranges and quicker refueling than battery-electric vehicles (BEVs). As FCEV costs decrease and hydrogen infrastructure expands, the market for fuel cell vehicles is expected to flourish. In January 2024, Nikola Corporation launched and sold Class 8 hydrogen-powered fuel cell electric vehicles (FCEVs) under its HYLA brand, offering a range of 500 miles and refueling times as short as 20 minutes.

Product Insights

Proton exchange membrane fuel cells (PEMFC) accounted for over 60% of global revenue in 2023. PEMFCs are used in a variety of applications such as forklifts, automobiles, telecommunications, and backup power systems. Their versatility is expected to drive demand in the coming years. PEMFCs operate at a relatively low temperature of around 80°C, allowing for quick starts and reducing wear on system components, making them more durable than other fuel cell types. They are also lightweight and compact, further increasing their appeal.

The U.S. Department of Energy (DOE) has provided funding for fuel cell development, particularly through its Fuel Cell Technologies Office (FCTO) and Solid Oxide Fuel Cell (SOFC) program. SOFC is expected to be the fastest-growing product segment during the forecast period, as it eliminates electrolyte loss by using solid components and operates at high temperatures, reducing the need for costly catalysts like ruthenium.

Component Insights

The fuel cell market is divided into two major components: the fuel stack and the balance of plant (BOP). In 2023, the stack segment held the largest share, accounting for over 60% of the market. The stack is the core of the fuel cell system, responsible for converting fuel into electricity through an electrochemical process. Due to its complexity and the use of expensive materials, the stack is the most costly part of the system, contributing significantly to the overall price. With fewer players producing fuel stacks, prices remain high.

The balance of plant (BOP) includes air compressors, power conditioners, thermal management systems, and control systems, all of which are critical to the efficient operation of fuel cell systems. The BOP segment is expected to grow at a faster pace over the forecast period.

Fuel Insights

In 2023, hydrocarbons accounted for over 90% of the market share. The well-established infrastructure for hydrocarbon production, transportation, and storage makes them readily available and affordable. Solid Oxide Fuel Cells (SOFC), Molten Carbonate Fuel Cells (MCFC), and Direct Hydrocarbon Fuel Cells have significant potential for hydrocarbon use in combined heat and power systems and portable power applications.

Hydrogen is gaining popularity as a clean energy alternative, driven by climate change concerns and government efforts to decarbonize. It is expected to grow at the fastest rate among fuel types due to increasing investments in hydrogen production, storage, and infrastructure. Hydrogen's role in fuel cell vehicles, stationary power generation, and industrial applications will further contribute to the market's growth.

Size Insights

The fuel cell market is categorized by size into small-scale and large-scale systems. Large-scale fuel cells, generating over 100 kW of electricity, accounted for about 70% of the market in 2023. They are used in stationary power generation, heavy-duty transportation, and industrial applications. Vendors are constantly launching innovative products to expand their market presence. For example, in November 2023, Kohler Energy introduced a 100 kW hydrogen fuel cell power system for off-highway equipment and residential and industrial solutions.

Small-scale fuel cells, generating less than 100 kW, are used in applications such as portable devices, residential backup power systems, and material handling equipment. These small-scale systems are expected to maintain steady growth, driven by ongoing efforts to reduce their size and cost. In October 2023, Toyota Industries developed a 50 kW fuel cell module for lift trucks, agricultural machinery, and construction equipment.

Application Insights

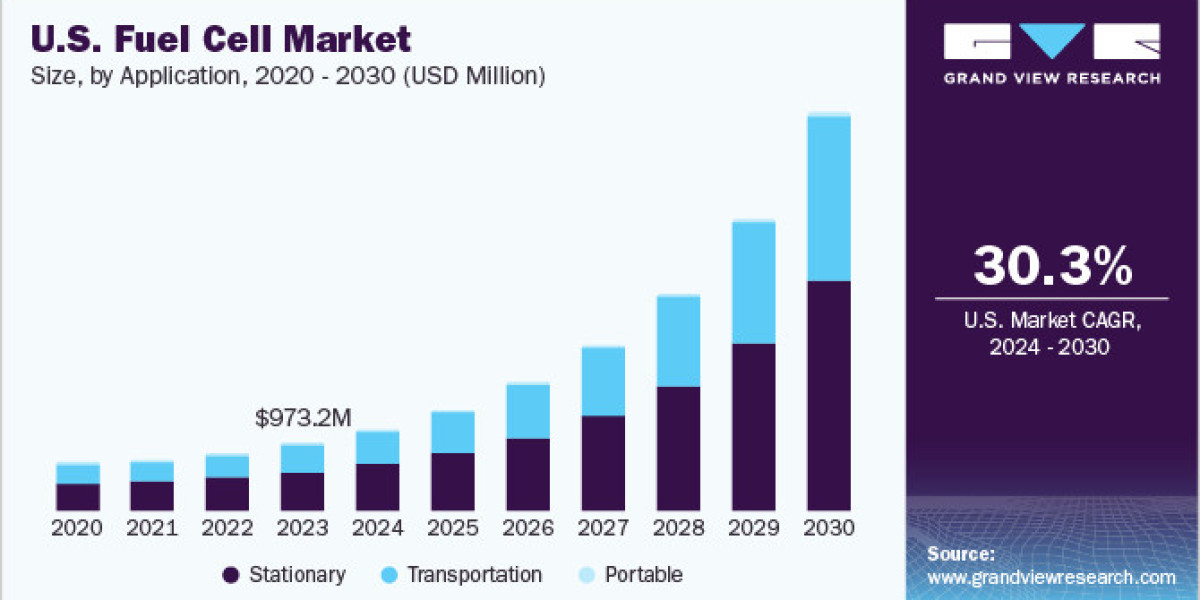

In 2023, stationary fuel cells dominated the market, accounting for over 69% of global revenue. The rising demand for fuel cells in distributed generation and backup power applications is fueling this segment's growth. Stationary fuel cells are also increasingly used in combined heat and power (CHP) systems due to their versatility and high efficiency.

The transportation segment is expected to grow the fastest, driven by the increasing adoption of fuel cell-powered forklifts and ongoing research in advanced economies like Europe. Portable fuel cells are used in personal electronics, laptops, mobile phones, and other consumer products. The market is expected to grow further as R&D activities focus on hydrogen-powered hybrid vehicles.

End-use Insights

The fuel cell market is divided into several end-use sectors, including transportation, commercial and industrial, residential, data centers, military and defense, and utilities and government. In 2023, the transportation segment led the market, accounting for over 48% of global revenue. The rising adoption of FCEVs, particularly in heavy-duty trucks and buses, is driving growth. Government investments in hydrogen infrastructure, aimed at developing a robust hydrogen fueling network, are critical for widespread FCEV adoption.

The commercial and industrial segment is expected to grow the fastest over the forecast period. Fuel cells in this segment are used in hospitals, hotels, shopping malls, office buildings, and sports centers. In February 2023, Weichai Power and Ceres launched a stationary solid oxide fuel cell system in China, achieving 30,000 hours of operation with a 60% efficiency rate. This system's ability to start and stop up to four times during power generation makes it a valuable solution for commercial and industrial end users.

Order a free sample PDF of the Fuel Cell Market Intelligence Study, published by Grand View Research.