The global composites market was valued at USD 93.69 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. This growth is largely driven by the rising demand for lightweight components in the automotive and transportation sectors. The increasing use of advanced lightweight materials in manufacturing industries is also expected to fuel market expansion in the coming years.

Composites are widely used in the aerospace and defense sectors due to their ability to significantly reduce the weight of military aircraft and helicopters, which in turn enhances fuel efficiency and overall performance. This reduction in weight is seen as a critical factor and is anticipated to be a key driver of market growth.

Gather more insights about the market drivers, restrains and growth of the Global Composites Market

The global outbreak of COVID-19 significantly disrupted supply chains as major economies halted trade operations. Consequently, demand for composites across various industries such as aerospace, automotive, and construction was reduced in 2020. However, as trade restrictions eased, the market was expected to recover in 2021, restoring its growth trajectory.

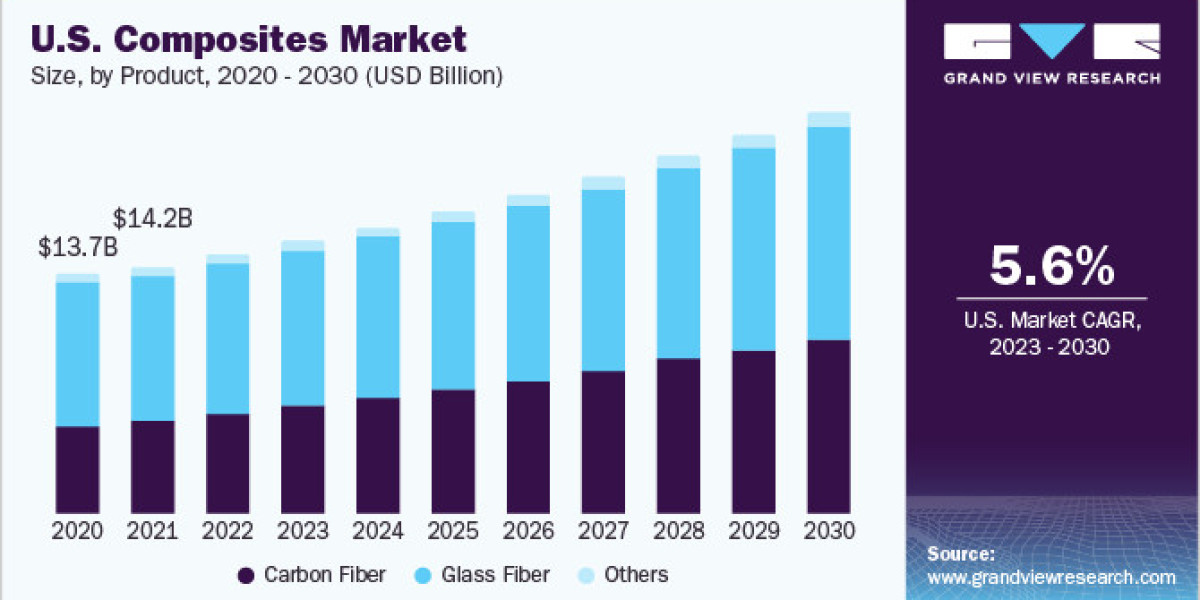

The U.S. composites market is expected to grow, particularly in the aerospace and defense sectors, due to increasing product penetration and the presence of leading aircraft manufacturers like The Boeing Company. The anticipated growth in these sectors will likely boost demand for composites over the forecast period.

Growing environmental concerns and stricter regulations regarding pollution control have pushed automotive manufacturers to innovate and develop vehicles that produce lower emissions. In response, regulations in Europe and the U.S. have encouraged automakers to incorporate composites in production, accelerating market growth.

One challenge for the composites market is the high cost of raw materials, which complicates procurement for manufacturers. Furthermore, increasing demand for these materials from other industries adds to the pressure. However, key industry players are investing in research and development to create low-cost composite grades with mechanical properties comparable to high-cost variants. This is expected to stimulate market demand during the forecast period.

Product Insights

Glass fiber led the market in 2022, accounting for 60.0% of total revenue. This is largely due to glass fiber’s high tensile strength, rigidity, and lightweight nature, making it a preferred raw material in composite manufacturing. Its excellent impact resistance also contributes to its widespread use.

Carbon fiber reinforced polymer (CFRP), formed by molding carbon fiber with plastic resin, is used extensively in aircraft applications for both interior and exterior components. These composites are lightweight, strong, fuel-efficient, and require less maintenance. CFRP helps manufacturers meet stringent environmental regulations, especially in Europe and North America.

Technological advancements aimed at enhancing the strength and durability of composites have increased their application in pipe manufacturing. The rising demand for high-strength materials in the automotive and aerospace sectors is expected to support market growth during the forecast period.

Other notable composite products include silicon carbide fiber, aromatic polyamide fiber, and hybrid fiber. Silicon carbide fiber, a compound of carbon and silicon, is known for its high-temperature resistance, tensile strength, and heat resistance, making it valuable in various high-performance applications.

Manufacturing Process Insights

The layup process was the most significant manufacturing method in 2022, accounting for 34.9% of total revenue. This process is widely used in the production of boats, wind turbine blades, and architectural moldings, contributing to its dominance in the global composites market.

The wet layup process is cost-effective and produces a wide range of composite shapes and sizes, often used in marine prototypes and storage tanks. On the other hand, the dry layup process involves pre-impregnated fibers (prepregs) that are molded under high temperature and pressure to create stronger, more durable products.

Filament winding, another manufacturing technique, produces hollow, circular parts like pipes and tanks by continuously winding fibers through a resin bath over a mandrel. This method finds applications in industries such as energy and consumer products.

The pultrusion process, which involves drawing fiberglass through liquid resin, is an efficient method for manufacturing fiber-reinforced composite products. This process enables continuous production of fiber-reinforced polymer, saving resources and enhancing efficiency.

Resin transfer molding (RTM) is a vacuum-assisted process used for producing larger components. This method is ideal for medium-volume production and creates parts with a high strength-to-weight ratio.

End-Use Insights

The automotive and transportation sectors dominated the market in 2022, accounting for 21.0% of total revenue. Composites are used in various vehicles, including automobiles, trucks, trailers, buses, trains, subways, and motorcycles, to manufacture lightweight and strong components that replace traditional metal parts.

In the wind energy sector, composites are primarily used to control blade weight and provide properties such as fire retardancy, corrosion resistance, design flexibility, and durability. As wind energy farms continue to expand, the use of composites is expected to grow rapidly, making it the fastest-growing application segment in the market.

The increasing demand for advanced electronics in both residential and industrial settings is driving the need for composites in electrical and electronics applications. Common uses include terminal boxes, lamp housings, electrical enclosures, plugs, sockets, and energy distribution components.

The construction and infrastructure sectors are also adopting composites at a rapid pace, particularly for refabrication and retrofit applications. Composites are used in building windows, doors, gratings, bridge components, roof structures, panels, and interior furniture. Their versatility and durability make them increasingly valuable in the construction industry.

Order a free sample PDF of the Composites Market Intelligence Study, published by Grand View Research.