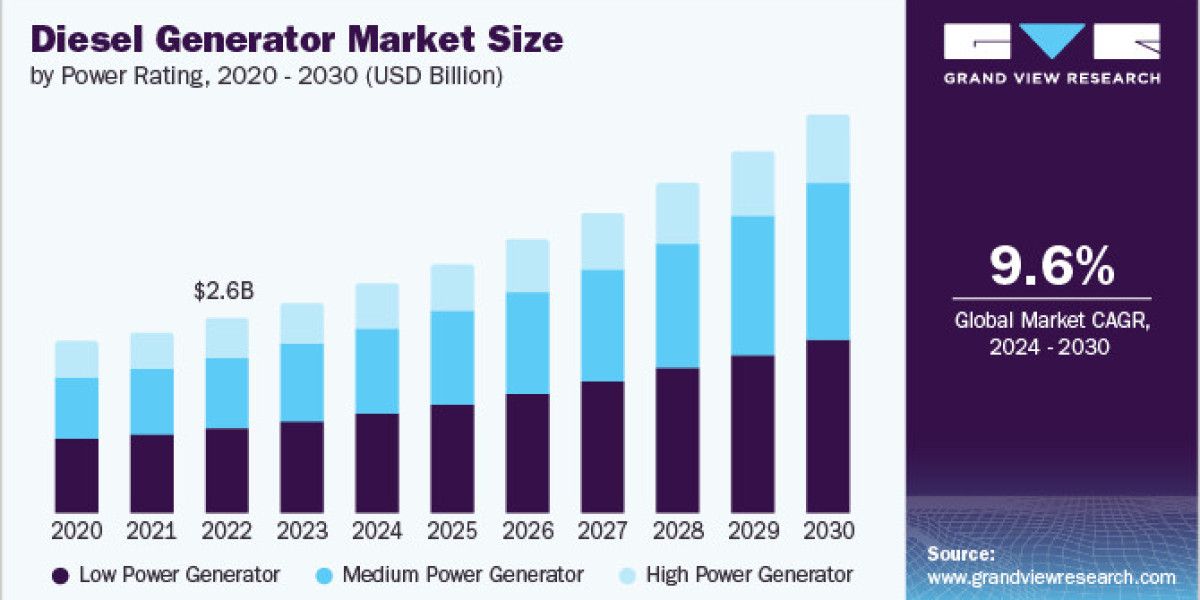

The global diesel generator market was valued at USD 16.36 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.6% between 2024 and 2030. This growth is driven by the global increase in energy demand, which is outpacing supply. Key factors such as population growth, infrastructure development, and rapid industrialization, particularly in emerging economies, contribute to this rising demand for power. Diesel generators are popular in these regions, especially in the Asia Pacific, due to their advantages like lower operating costs and fuel efficiency. However, they come with drawbacks, including noise pollution and the emission of harmful gases. According to the World Nuclear Association, electricity demand could double from current levels, and the U.S. Department of Energy has forecasted that solar energy will emerge as the most abundant energy source.

Gather more insights about the market drivers, restrains and growth of the Global Diesel Generator Market

Major developing economies, including India and Brazil, are expected to experience significant growth by 2050. India is projected to rise from being the third-largest economy to the second-largest, following China in terms of GDP based on purchasing power parity (PPP). Countries like Brazil, India, and South Africa are already facing issues with power shortages. It is predicted that emerging economies will represent 65% of the global economy. In the U.S., the market for diesel generators is expected to grow significantly due to the rising costs of power outages affecting IT service firms and data centers, along with growing consumer awareness of the importance of having reliable backup power. Additionally, the increasing vulnerability of grid power stations to weather-related disasters is also driving demand.

Solution providers in the diesel generator market are responsible for manufacturing, installation, maintenance, and repair. Supply and maintenance agreements are typically handled by dealers or electrical contractors, who serve consumers across various sectors, including commercial, residential, and small businesses. These agreements provide emergency power backup solutions. In industrial settings, companies often hire in-house engineers to monitor multiple generators. However, stringent government regulations on carbon emissions are expected to drive the adoption of gas-based generators, which could limit the demand for diesel generators. Despite this, diesel generators remain in demand due to their low operating costs and relatively low initial investment.

Power Rating Insights

In 2023, the power generator segment held a significant market share of 44%, primarily due to its widespread use in commercial and residential applications. Generators with a capacity below 80 kW are commonly used in residential settings for backup power to run appliances like water pumps, air conditioners, and other devices. Their affordability is expected to support product demand in the coming years.

The high-power generator segment is expected to see strong growth due to rising demand from industries such as power generation, manufacturing, and marine, which require continuous power supply. These generators are particularly useful in off-grid remote areas where connecting to the main power grid is not cost-effective.

Application Insights

The commercial application segment accounted for the largest revenue share in 2023 and is anticipated to grow rapidly over the forecast period. This growth can be attributed to the broad range of industries relying on diesel generators, including data centers, government offices, educational institutions, healthcare, hospitality, telecom, and agriculture. In these sectors, diesel generators provide backup power during outages and voltage fluctuations, helping to prevent financial losses.

The industrial segment, which includes sectors like manufacturing, construction, electric utilities, mining, transport, and oil & gas, held the second-largest revenue share in 2023. These industries have high power consumption needs, and favorable government policies in developing economies such as China, India, and Brazil are driving further demand. The residential segment is also expected to grow significantly, driven by increasing consumer awareness, rising demand on the primary power grid, and frequent power outages. Diesel generators provide a reliable secondary power source in homes during grid failures.

Order a free sample PDF of the Diesel Generator Market Intelligence Study, published by Grand View Research.