The global wound care market size was estimated at USD 22.25 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.17% from 2024 to 2030. The demand for wound care products is increasing owing to the increasing number of surgical cases and the rising prevalence of chronic diseases across the globe. Furthermore, the increasing incidence of diabetes due to a sedentary lifestyle is one of the leading factors contributing to market growth. For instance, as per a report by Centers for Disease Control and Prevention (CDC), which was last reviewed in April 2023, 37.3 million Americans have diabetes. Similarly, as per the same source, 96 million American adults have prediabetes.

Besides, wound care products help cure diabetic foot ulcers, which are prevalent in diabetic patients. For instance, according to a National Institute of Health (NIH) report, last updated in August 2023, diabetes is a major cause of non-traumatic amputations in the U.S. Overall, 5% of patients with diabetes develop foot ulcers, of which 1% may need an amputation. Wound care products such as hydrocolloid dressings help in moisture retention and allow rapid healing of wounds internally as well as externally. Moreover, these products help in the absorption of necrotic tissues, which are effective in cases of surgical site infections. Thus, healthcare professionals prefer to use wound care products, which is anticipated to propel the market growth over the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Wound Care Market

Product Insights

Based on product, the market has been segmented into advanced wound dressings, surgical wound care, traditional wound care, and wound therapy devices. The advanced wound dressing segment held the maximum share of 34.9% in 2023 in the product segment and is expected to register the highest CAGR during the forecast period. Advanced wound dressing is mainly used to treat chronic and non-healing wounds. Thus, increasing the number of chronic wounds, such as diabetic foot ulcers, is expected to help the wound care industrial propel. For instance, as per the National Center for Biotechnology Information (NCBI), in August 2023, incidence of diabetic foot ulcers globally is between 9.1 million and 26.1 million. In addition, about 15% to 25% of patients with diabetes may develop a diabetic foot ulcer during their lifetime. Therefore, due to the above-mentioned factors, the market is expected to propel during the forecast period.

Application Insights

Chronic wounds segment held the largest share of 59.9% in 2023 and is anticipated to witness a considerable growth rate over the forecast period. An increasing number of geriatric populations, along with the rising prevalence of diabetic foot ulcers, venous pressure ulcers, and other chronic wounds, is expected to drive the segment's growth. For instance, as per a United Health Foundation report (published in May 2023), more than 55.8 million adults aged 65 and older lived in the U.S., accounting for about 16.8% of the nation's population in 2021.

End-use Insights

The hospital segment held the largest share of 39.0% in 2023. The growth of this segment can be attributed to an upsurge in surgical procedures globally because of sedentary lifestyle, and rising bariatric surgeries which require the use of wound care products to contain surgical site infections. Furthermore, surgical wound care dressings and negative pressure wound therapy (NPWT) are predominantly suitable for hospital use and are not feasible for home care. In addition, hospital institutions are considered large buyers of wound care having long-term contracts with suppliers. Hence, owing to aforementioned factors, the segment is anticipated to propel during the forecast period.

Distribution Channel Insights

Institutional sales dominated the distribution channel segment. Wound care product manufacturers may also sell products directly to healthcare providers, such as hospitals and clinics, or patients through direct-to-consumer marketing. This approach can provide more control over the distribution process and enable manufacturers to build relationships with their customers. Institutional sales comprise mainly direct distributors and manufacturers. Hospitals, clinics, wound care centers, and other healthcare facilities, such as nursing homes, long-term care facilities, diagnostic laboratories, and birth centers, usually have long-term contracts and tie-ups with distributors and manufacturers. Key players are adopting long-term contracts with end-users as a strategy to expand their reach and strengthen their foothold in the market.

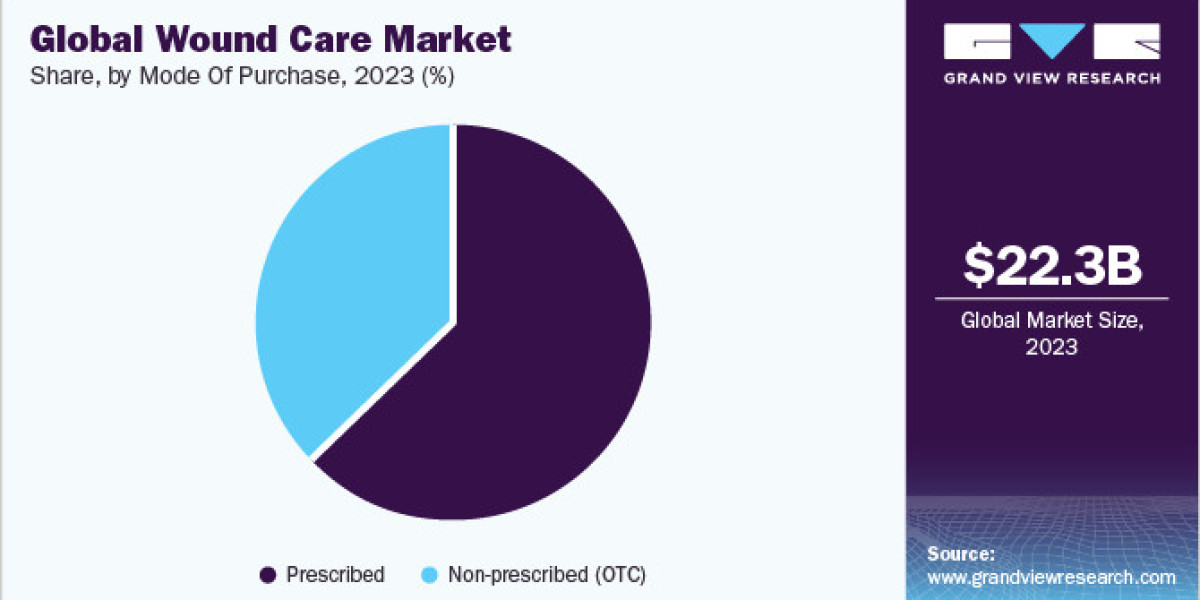

Mode Of Purchase Insights

The prescribed segment is anticipated to dominate the market and is projected to grow at a fastest CAGR of 5.0% over the forecast period. The prescribed wound care products depend on the type of product and the severity of the wound. For mild to moderate wounds, over-the-counter wound care products such as bandages, gauze, and antiseptic creams can be purchased at pharmacies, drug stores, or online retailers. For more severe wounds, prescription wound care products such as wound dressings, wound cleansers, and topical antibiotics may be required.

Browse through Grand View Research's Healthcare Industry Research Reports.

· Brain Mapping Instruments Market: The global brain mapping instruments market size was valued at USD 1.96 billion in 2023 and is projected to grow at a CAGR of 5.8% from 2024 to 2030.

· Cell Sorting Market: The global cell sorting market size was valued at USD 242.7 million in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030.

Regional Insights

North America dominated the market with the share of 45.5% in 2023 and is expected to witness the considerable growth rate over the forecast period. Presence of a large population base and, a rising patient pool in countries such as the U.S. are major factors driving the market growth in this region. Moreover, geriatric population is at a higher risk of wounds, this will surge the demand for wound care products in this region. For instance, as per a United Health Foundation report (Published in May 2023), more than 55.8 million adults ages 65 and older live in the U.S., accounting for about 16.8% of the nation's population in 2021. In addition, the increasing number of road accidents, and availability of skilled professionals in this region is expected to drive the demand for wound care products in North America.

Key Wound Care Company Insights

The wound care industry is highly fragmented in nature with the presence of several small and large manufacturers. Competitive rivalry and a degree of competition in the market are expected to intensify over the forecast period due to the presence of many players in the market. Companies in this market invest heavily in research and development to introduce new and innovative products. Advanced wound dressings, bioactive dressings, and novel technologies are areas of focus for differentiation. Key players often have diverse product portfolios covering a range of wound care products, including dressings, bandages, topical agents, and devices. This diversity allows companies to address various aspects of wound management.

Companies invest in adopting and integrating cutting-edge technologies, such as smart dressings, 3D printing, and telemedicine solutions. Technological leadership is expected to be a significant differentiator.The competitive rivalry in the market is likely to persist as companies strive to differentiate themselves and meet the evolving needs of healthcare providers and patients. Keeping abreast of technological advancements, regulatory changes, and market trends is crucial for sustained competitiveness in this dynamic industry.

Key Wound Care Companies:

The following are the leading companies in the wound care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these wound care companies are analyzed to map the supply network.

· Smith & Nephew

· Mölnlycke Health Care AB

· Convatec Group PLC

· Ethicon (Johnson & Johnson)

· Baxter International

· DeRoyal Industries, Inc.

· Coloplast Corp.

· Medtronic

· 3M

· Integra LifeSciences

· Medline Industries, Inc.

· B. Braun Melsungen AG

· Cardinal Health, Inc.

· Organogenesis Inc.

· MIMEDX Group, Inc.

Order a free sample PDF of the Wound Care Market Intelligence Study, published by Grand View Research.