The global electrical steel market size was valued at USD 28.53 billion in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 4.7% from 2024 to 2030. Increasing electricity generation worldwide is one of the key driving factors for market growth. As the name implies, electrical steel possesses enhanced electrical properties such as high permeability, high electrical resistivity, low hysteresis loss, and low magnetostriction. These properties make it highly desirable for applications related to electricity consumption, distribution, and generation.

Electrical steel finds application in generators, electric motors, relays, solenoids, and other electromagnetic devices, which are further used in power distribution systems and other related applications. The U.S. is the second-largest electricity generator in the world. In 2022, the country generated around 4,243 TWh of electricity, a 6.4% increase compared to 2021. The growth in the electric vehicles (EVs) industry is another driver for the market. Electrical steel contains specific magnetic properties, which makes it of vital use in rotors and stators in motor of an EV. The product helps enhance motor efficiency by minimizing core energy losses and accelerating vehicle’s range.

Gather more insights about the market drivers, restrains and growth of the Global Electrical Steel Market

In 2022, electric car sector reached a notable milestone by achieving a new sales record, despite the contraction in overall car sales. In 2022, EV sales surpassed 10 million units, and this number is anticipated to reach 17 million by the end of 2023. Rising EV production propels use of electric motors, thus boosting electrical steel consumption.

Rising demand for electrical steel has compelled manufacturers to expand their production. For instance, in May 2021, JSW Steel and JFE Steel Corporation signed an MoU to begin a feasibility study for establishing a joint venture company in India for manufacturing and sales of electrical steel sheets in the country.

Application Insights

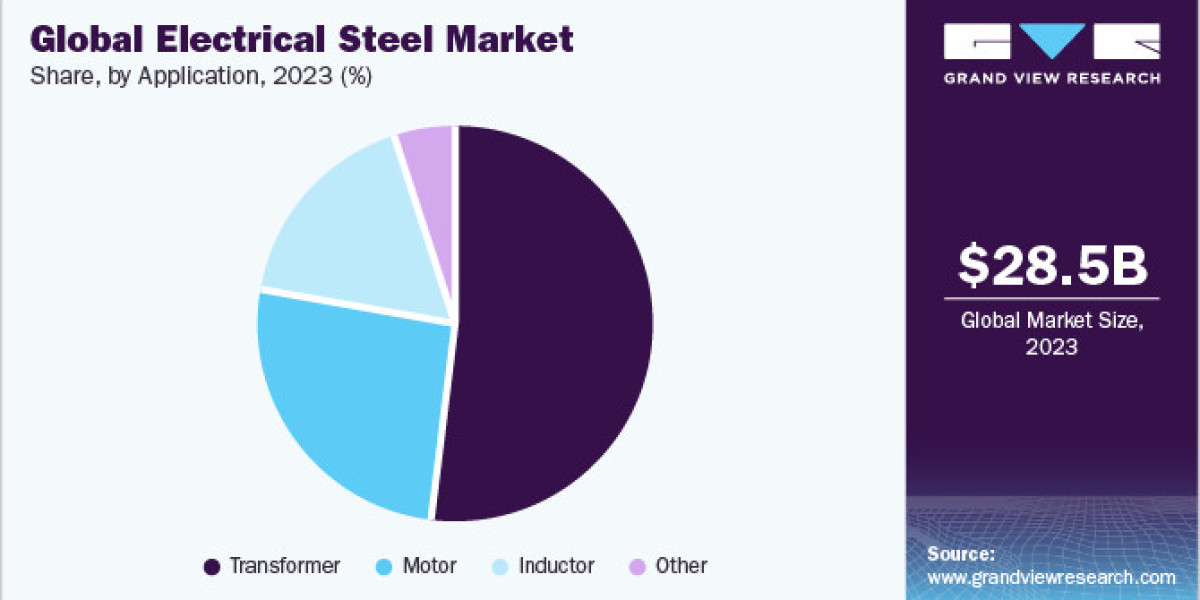

The transformer segment held the largest revenue share of more than 52.0% of the overall market in 2023. Increasing complexity in electrical grids, penetration of EVs, rise in digital loads, and growth in decentralized generation have augmented the need for transformers. For instance, as per data published by IEA, USD 24,234 billion investment is expected to be pumped between 2014 and 2035 with the aim of net addition of 24.2 million kilometers of power distribution lines.

Rising need for transformers has compelled companies to expand their production capacities. For instance, in February 2021, a new power transformer plant was commissioned in Kerala, India. This new plant was set up with an investment worth ₹12.5 crores (~USD 1.7 million). The annual production capacity of the plant for manufacturing power transformers up to 25 MVA, 132kV class is expected to be 1,500 MVA.

Browse through Grand View Research's Advanced Materials Industry Research Reports.

· Wood Plastics Composites Market: The global wood plastics composites market size was estimated at USD 7.97 billion in 2024 and is projected to grow at a CAGR of 11.6% from 2025 to 2030.

· Warm Air Furnace Market: The global warm air furnace market size was estimated at USD 8,911.2 million in 2024 and is expected to grow at a CAGR of 3.4% from 2025 to 2030.

Regional Insights

Based on region, North America held a revenue share of more than 12.0% of the global market in 2023. Growing emphasis on power generation and EV production in the region has propelled the need for electric motors and charging stations, which in turn is driving market for electrical steel. For instance, in 2020, Foxconn announced to build EVs in North America and after a year, the company unveiled three models. In October 2023, the company unveiled another new model N electric cargo van and announced to further deepen partnership with NVIDIA and ZF Group.

With increasing investments in the EV industry, companies are emphasizing electric motors as well. For instance, in April 2021, Exro Technologies Inc. announced its plan to open a 37,000-square-foot manufacturing facility in Calgary, Canada. In September 2023, the company announced its official start. This facility will produce 100,000 units of coil drivers under European automotive standards. Its current purchasers include HB4 Group and Vicinity Motor.

Product Insights

In terms of revenue, the Non-grain Oriented Electrical Steel (NGOES) segment dominated the market and accounted for the largest share of more than 71.0% in 2023. NGOES find applications in entire energy value chain, from generators to electric motors and appliances. It is available in numerous grades depending upon properties, composition, and applications. Grain-oriented Electrical Steel (GOES) mainly finds application in transformers and charging infrastructure of EVs. It has high magnetic induction and stacking factor enabling less usage of material in winding of the core. Its magnetic properties reduce core losses and provide economical and efficient solutions for transformers.

GOES is used in various types of transformers and is available in different grades. Grades differ based on their thickness. The product segment is anticipated to register a higher growth rate compared to NGOES over the forecast period. Increasing production of transformers is propelling the segment growth. Its smaller market share can be attributed to its high cost compared to NGOES.

Key Companies & Market Share Insights

The market for electrical steel is highly competitive in nature owing to presence of several major players. The key players have a competitive edge such as advanced technology, significant research activities, and a strong foothold in regional markets. To compete in the market, key manufacturers are adopting numerous strategies, such as upgrading plants to cater high-quality products to customers. In May 2023, Nippon Steel Corporation announced further expansion for its high grades non-oriented electrical steel sheets.

Key Electrical Steel Companies:

· ArcelorMittal

· Cleveland-Cliffs Corporation

· JFE Steel Corporation

· Nippon Steel Corporation

· POSCO

· Tata Steel

· thyssenkrupp AG

Order a free sample PDF of the Electrical Steel Market Intelligence Study, published by Grand View Research.