The global biofertilizers market size was valued at USD 1.66 billion in 2023 and is expected to grow at a CAGR of 13.3% from 2024 to 2030. The growth of the market is fueled favorable regulator scenario in Europe and North America coupled with significant technological innovations aimed at improving the biofertilizer production process.

The growing awareness of the environmental impact of synthetic fertilizers has prompted manufacturers worldwide to allocate more resources to research and development for biofertilizers. This increased focus is anticipated to drive the demand for biofertilizers in the foreseeable future. Moreover, there is an increasing demand for organic food products, particularly in North America and Europe, which is expected to positively influence the product market in the coming years. Furthermore, the increasing recognition of the advantages associated with bio-based agricultural inputs, such as biofertilizers, is anticipated to enhance market growth throughout the forecast period.

Gather more insights about the market drivers, restrains and growth of the Global Biofertilizers Market

Product Categories Insights & Trends

The nitrogen fixing segment of the market was valued at USD 1,234.4 million in 2023 and is projected to reach USD 2,363.9 million by 2030. Nitrogen-fixing bacteria, such as Azotobacter, Rhizobium, and Azospirillum, are commonly used as biofertilizers because plants cannot convert atmospheric nitrogen into fixed nitrogen, which is essential for their growth. Rhizobium forms an endosymbiotic association with legume roots, making it valuable for cultivating leguminous crops. Azotobacter, with its aerobic nature and tolerance to alkaline soil, is suitable for various crops like maize, wheat, cotton, mustard, and potatoes.

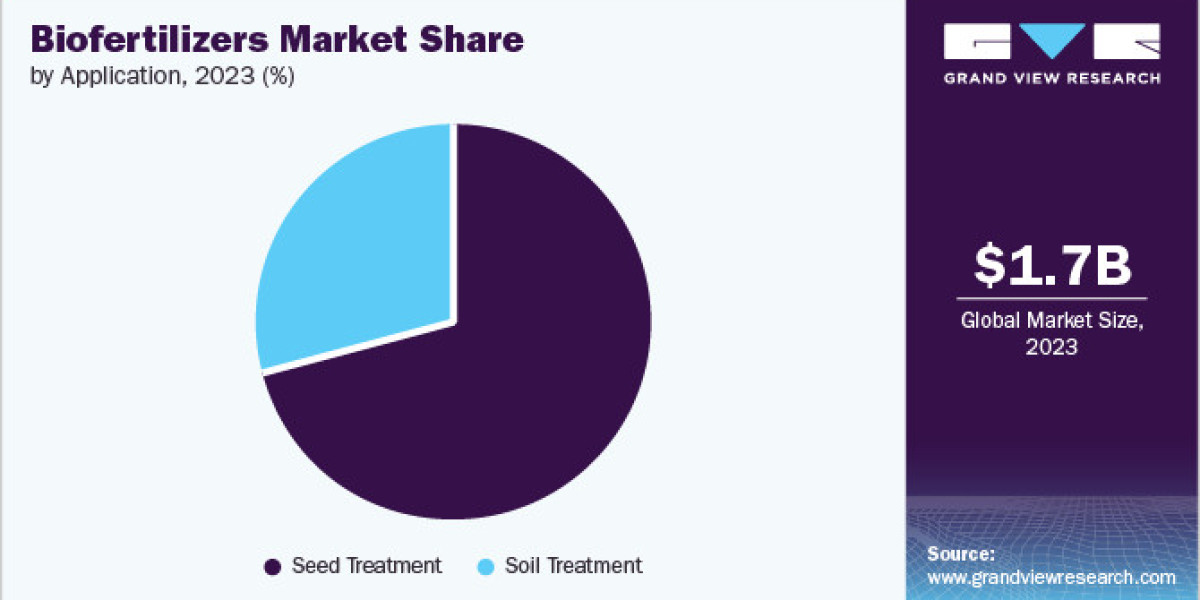

Application Insights & Trends

The seed treatment segment accounted for the largest revenue share of 71.2% of the market in 2023. Seed treatment is a crucial application for biofertilizers globally. It involves dipping seeds in a mixture of phosphorus and nitrogen fertilizers, sun-drying, and sowing in fields. Biofertilizer coating on the seeds promotes quick and healthy plant growth. The rising demand for organic foods is expected to increase biofertilizer use in seed treatment.

Crop Type Insights & Trends

The cereals and grains segment accounted for the largest revenue share of 38.8% of the market in 2023. Cereal and grain production requires significant biofertilizer use. Studies show that Azotobacter inoculation improves crop growth and reduces nitrogen needs. Additionally, phosphate-solubilizing bacteria and Azotobacter inoculation enhance wheat growth and yield. Using these biofertilizers promotes increased vegetation growth and photosynthesis activity in cereal and grain cultivation.

Browse through Grand View Research's Bulk Chemicals Industry Research Reports.

· Packaging Wax Market: The global packaging wax market size was valued at USD 1.95 billion in 2023 and is projected to grow at a CAGR of 4.5% from 2024 to 2030.

· Polycarbonate Sheet Market: The global polycarbonate sheet market size was valued at USD 4.64 billion in 2023 and is projected to grow at CAGR of 5.7% from 2024 to 2030.

Regional Insights & Trends

North America accounted for the largest revenue share of 31.9% in 2023. This growth is attributed to the surging government involvement in farming practices in U.S and Canada, resulting in considerable changes in agricultural trends & methods in the region. With stringent regulations in place, over 19,017 farming communities are practicing organic farming in the region to ensure sustainable long-term business.

Key Biofertilizers Company Insights

Some of the key players operating in the market include CBF China Biofertilizers AG, Novozymes A/S, and Biomax among others.

CBF China Bio-Fertilizer AG is a Germany-based holding group that sells biofertilizers through its fully owned subsidiary Shandong Chengwu Jiuzhou Science & Technology Development Company Limited. Biofertilizers offered by the company are marketed in two forms, liquid and powder. The products are directly sold to agricultural co-operatives, distributors, and plantations under Xin Sheng Li brand name. The company’s products are used to increase the crop yield and to reduce the use of conventional fertilizers. It is licensed by the Ministry of Agriculture of the Government of China.

Novozymes A/S, based in Denmark, is a biotechnology company involved in researching, developing, producing, and selling industrial enzymes, biopharmaceutical ingredients, and microorganisms. The company operates in household care, food & beverages, bioenergy, agriculture & feed, and technical & pharma segments. Novozymes is also part of The BioAg Alliance with Monsanto, aiming to develop improved products from natural sources. The company has operations in China, India, Brazil, Argentina, the UK, the US, and Canada.

Key Biofertilizers Companies:

The following are the leading companies in the biofertilizers market. These companies collectively hold the largest market share and dictate industry trends.

· CBF China Bio-Fertilizer AG

· Novozymes A/S

· AgriLife

· Mapleton Agri Biotec

· Biomax

· Rizobacter Argentina SA

· Symborg S.L

· National Fertilizers Ltd.

· Antibiotice S.A

· Lallemand Inc.

· Labiofam SA

· Sigma Agri-Science, LLC

· Agrinos Inc

· Fertilizers USA LLC

· Kiwa Bio-Tech Products Group Corporation

Order a free sample PDF of the Biofertilizers Market Intelligence Study, published by Grand View Research.