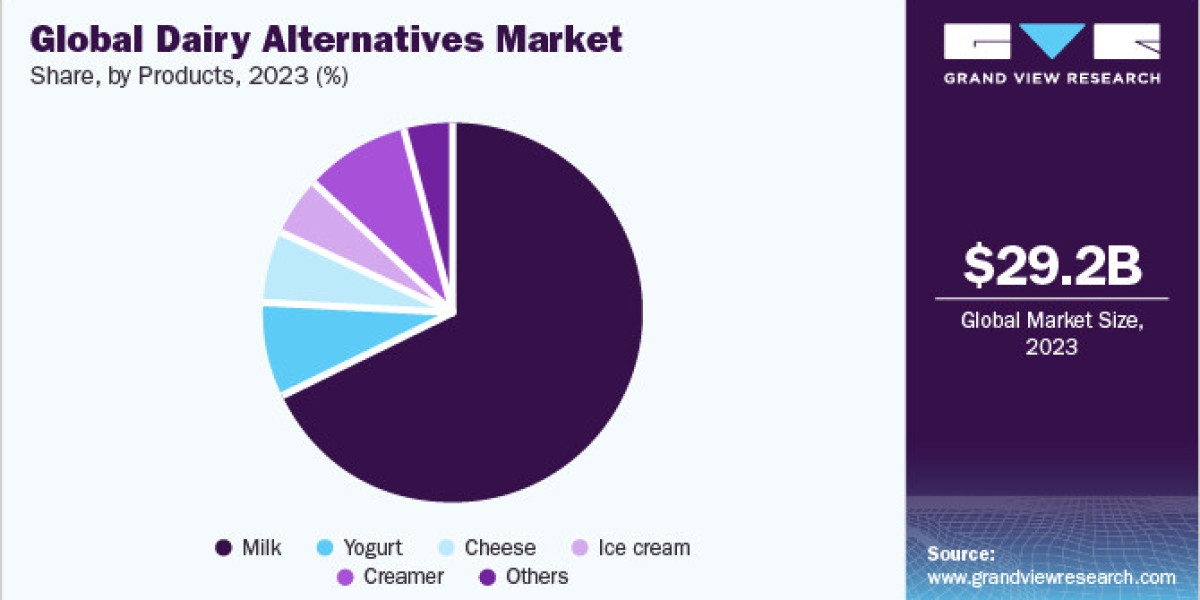

The global dairy alternatives market size was valued at USD 29.18 billion in 2023 and is anticipated to grow at a CAGR of 12.6% from 2024 to 2030. The market is gaining momentum and witnessing high demand due to changing consumer eating patterns and diet trends. Rising cases of milk allergies and lactose intolerance are expected to increase demand for dairy alternatives in the coming years. Over 60% of the world's population has some level of milk allergy, according to the World Health Organization. More than 30 million American adults are lactose intolerant. Primary lactose intolerance seems to have a genetic component, with high intolerance levels in specific populations: About 95% of Asians, 60-80% of African Americans and Ashkenazi Jews, 80-100% of American Indians, and 50-80% of Hispanics. Lactose intolerance is least common among people of northern European origin, with a prevalence of only about 2%. Many food and beverage products are using these alternatives to appeal to the growing number of consumers choosing plant-based and other dairy substitutes.

Soy milk is gaining popularity among elderly and female consumers in the U.S. due to its isoflavones, which may reduce heart disease and breast cancer risk. Soy contains phytoestrogen, which acts like estrogen. Women use soy milk as an alternative therapy to increase estrogen levels, likely driving market growth.A wide range of manufacturers are planning on expanding their product portfolios to maintain their dominance in the dairy alternatives industry. For instance, in February 2023, Milo introduced "Milo Soy," marking its entry into this category. This innovative offering blends the advantages of soybeans with malt derived from barley, resulting in a unique beverage.

Gather more insights about the market drivers, restrains and growth of the Global Dairy Alternatives Market

Detailed Segmentation:

Source Insights

The soy segment had a revenue share of 35.08% in 2023 succeeded by almond milk. It's rich in Vitamin B, which raises the body's metabolic rate, helping burn fats and calories efficiently. This nutritional benefit may contribute to market growth. According to ProVeg’s report on the environmental cost of dairy compared to plant-based alternatives, the VAT on alternative milk beverages is significantly higher than that of conventional milk in six countries across Europe, including Italy, Greece, Austria, Slovakia, Spain, and Germany. In Italy, soymilk has a VAT rate of 450% higher than cow milk which has restricted the growth of non-dairy beverages in the recent past. However, initiatives taken by non-profit organizations, along with ProVeg international’s initiative on ending unfair VAT on dairy alternatives, are expected to boost market growth over the forecast period.

Product Insights

The milk segment had the largest revenue share in 2023. Beverage manufacturers are introducing new products for higher market capitalization. Growing consumer demand for varied beverage options has led to diverse flavored beverages made with dairy alternatives. These flavored beverages appeal to lactose-intolerant consumers seeking variety in milk-based dairy alternative drinks.

Distribution Channel Insights

The supermarkets and hypermarkets segment led the market in 2023. These are large retail outlets offering multiple product categories. For accessibility, supermarkets are usually near residential areas. Due to land scarcity, many chains are opening new stores outside cities.

Supermarkets and hypermarkets are more prevalent in developed regions like Europe and North America than in developing regions. The wide variety of products available in one place and ease of buying contributed to their market dominance in 2023.

Browse through Grand View Research's Consumer Goods Industry Research Reports.

· Baby Stroller Market: The global baby stroller market size was valued at USD 2.63 billion in 2024 and is expected to grow at a CAGR of 5.9% from 2025 to 2030.

· Self-defense Products Market: The global self-defense products market size was valued at USD 3.03 billion in 2024 and is expected to grow at a CAGR of 6.5% from 2025 to 2030.

Regional Insights

North America is a major market for dairy alternative products, with a high consumption of products like ice cream and yogurt. Flavored milk makes up over two-thirds of milk products sold in North American schools. Growing demand for sweetened flavored soy and almond milk is likely to drive the industry.

Key Dairy Alternatives Company Insights

The market is highly competitive, with prominent, well-established players holding a large share in 2023. These manufacturers have a strong market presence and can serve local and international markets. They have a broad clientele base within and outside their countries.

Key success factors for industry participants in the coming years are expected to be new product development in food & beverages and the creation of alternatives to milk-based products. For example, Hershey Trust Company's brand Sofit is customized for Indian customers, offering a Kesar Pista flavor. Similar variations exist across companies developing products for increased market penetration.

Most dairy alternative manufacturers are vertically integrated through established processes in the end-user phase of the value chain. Many manufacturers produce food products containing dairy alternatives and beverages using alternatives like almond or soy milk.

The manufacturing process for dairy alternatives doesn't require highly complex technology, making it easier for new entrants to join the industry. This has led to high market competitiveness with moderate to high rivalry among competitors seeking to capitalize on growing opportunities in dairy alternatives during the forecast period.

Key Dairy Alternatives Companies:

The following are the leading companies in the dairy alternatives market. These companies collectively hold the largest market share and dictate industry trends.

· ADM

· The Whitewave Foods Company

· The Hain Celestial Group, Inc.

· Daiya Foods Inc.

· Eden Foods, Inc.

· Nutriops, S.L.

· Earth’s Own Food Company

· SunOpta Inc.

· Freedom Foods Group Ltd.

· OATLY AB

· Blue Diamond Growers

· CP Kelco

· Vitasoy International Holdings Limited

· Organic Valley Family of Farms

· Living Harvest Foods Inc.

Order a free sample PDF of the Dairy Alternatives Market Intelligence Study, published by Grand View Research.