The global meat substitutes market size was valued at USD 18.78 billion in 2023 and is expected to grow at a CAGR of 42.4% from 2024 to 2030. Diets that reduce or eliminate animal products are gaining popularity, which is expected to fuel the growth of the market. More people are adopting vegan lifestyles, driven by increased awareness of the health risks associated with meat consumption, as well as concerns about the ethical and environmental impacts of animal agriculture. A 2023 study by Soylent found that 68.1% of those who choose veganism are motivated by animal welfare, 17.4% by health reasons, and 9.7% by environmental and sustainability concerns.

Additionally, the fear of increasing animal-borne diseases has heightened health concerns, leading to a decline in animal product consumption. As awareness of meat substitutes grows, more consumers are turning to these alternatives, recognizing their potential health benefits, including the prevention of non-communicable diseases, digestive issues, and obesity.

The rising importance of a flexitarian diet, driven by increased awareness of the cardiovascular risks associated with red meat and a growing emphasis on health and active lifestyles, is expected to boost the growth of the pea protein segment in the plant-based meat market. Pea proteins, known for their benefits in weight loss, muscle repair, and energy balance, are gaining global popularity. For example, Beyond Meat Inc. uses pea proteins to develop products with a chewy, meat-like texture, and Lightlife offers its Lightlife Burger with pea proteins as a key ingredient. This burger contains 20 grams of pea protein, 2.5 grams of saturated fat, and zero cholesterol, compared to 9.3 grams of saturated fat and 80 milligrams of cholesterol in a traditional beef patty.

Gather more insights about the market drivers, restrains and growth of the Global Meat Substitutes Market

Detailed Segmentation:

Source Insights

In 2023, the plant-based protein segment held the lion's share and is expected to stay the same during the forecast period. There is growing interest in plant-based seafood, with an increasing number of these products being sold in the U.S. retail sector. This trend is driven by consumers' desire for healthier, customized options that do not sacrifice taste. In December 2023, Konscious Foods, a plant-based seafood brand, announced plans to expand its food service offerings across North America by 2024. The company has partnered with Affinity Group Canada to establish a presence in the Canadian market. Konscious Foods' diverse range of products includes sushi varieties, poke cubes, sno' crab packs, and plant-forward onigiri options. In 2023, their frozen sushi, poke bowls, and onigiri gained popularity and were introduced to numerous retail outlets across North America.

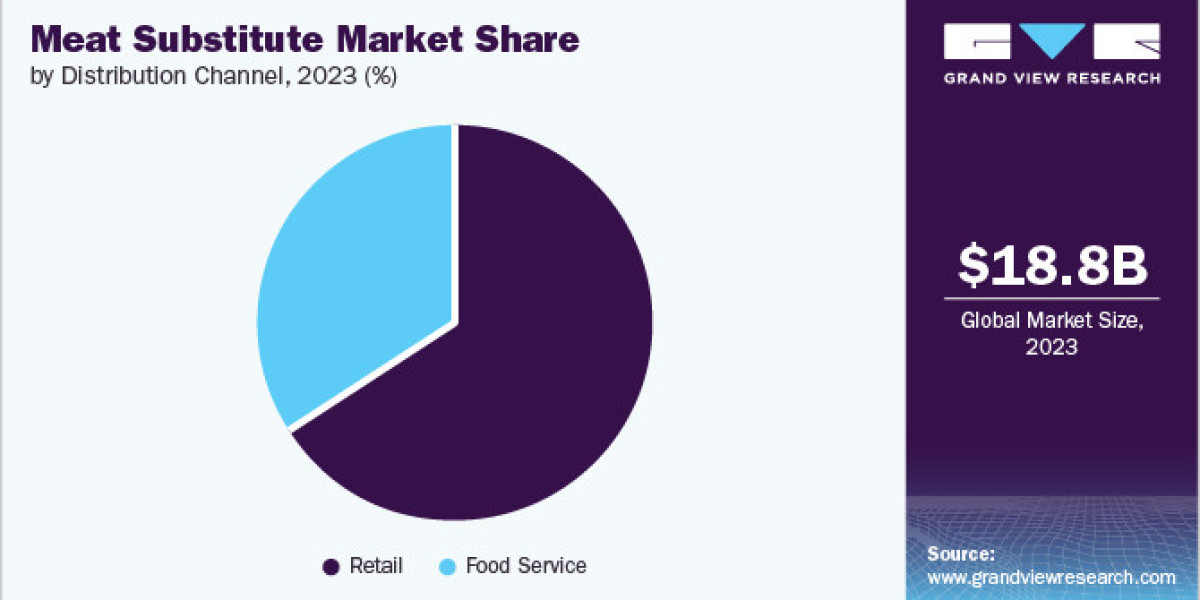

Distribution Channel Insights

Retail led the market in 2023, holding the major share. Plant-based meat companies are increasingly forming strategic partnerships with these grocery stores to introduce and expand their product offerings in the market. For example, Impossible Foods has significantly expanded its presence in the retail sector by collaborating with major U.S. retailers like Kroger Co. The company also partnered with Walmart, securing placement for its products in over 2,000 neighborhood market locations and supercenters, alongside various other retail partnerships. Additionally, Impossible Foods' products are available for purchase on the Walmart website.

Regional Insights

Meat substitutes market in North America accounted for a share of 32.45% in 2023. Various health organizations have taken initiatives to increase awareness about the health issues associated with high consumption of red meat. The American Medical Association has passed a resolution to provide healthy plant-based meals and eliminate the use of processed meats in hospitals. The resolution was co-sponsored by the American College of Cardiology and the Medical Society of the District of Columbia.

Browse through Grand View Research's Consumer Goods Industry Research Reports.

· Home Beer Brewing Machine Market: The global home beer brewing machine market size was valued at USD 44.40 billion in 2023 and is projected to grow at a CAGR of 10.2% from 2024 to 2030.

· Caffeinated Beverage Market: The global caffeinated beverage market size was valued at USD 256.26 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030.

Key Meat Substitute Company Insights

Companies like Tofurky, known for manufacturing vegan foods, are expanding their partnerships with ingredient companies to strengthen their market presence. They are also exploring new and emerging technologies, such as mycelium and algae-based innovations, to enhance their brand positioning.

Market players are adopting various strategies to improve their market standing, including expanding production capacity, forming partnerships, and developing new products. These strategies are driven by the rising consumer demand for plant-based proteins and the growing popularity of vegan foods. The increasing demand for plant-based meat products and heightened awareness about plant-based diets are compelling manufacturers to enhance their production capacities to meet the surging market demand.

Key Meat Substitute Companies:

The following are the leading companies in the meat substitute market. These companies collectively hold the largest market share and dictate industry trends.

· Amy’s Kitchen, Inc.

· Beyond Meat

· Impossible Foods Inc.

· Quorn Foods

· Kellogg Co.

· Unilever

· Meatless B.V.

· VBites Foods Ltd.

· SunFed

· Tyson Foods, Inc.

Recent Developments

· In May 2024, Tofurky, a prominent producer of tasty plant-based meats in the U.S., is unveiled an enticing new product line for foodservice clients at the National Restaurant Association Show, booth #687: Next Generation Plant-Based Deli Slices.

· In March 2024, The Kraft Heinz Not Company LLC introduced NotHotDogs and NotSausages, marking the first plant-based offerings under the Oscar Mayer brand and the inaugural plant-based meat innovation from the collaboration between The Kraft Heinz Company and TheNotCompany, Inc. Their mission is to craft irresistible plant-based foods for everyone.

· In February 2024, Beyond Meat introduced its most recent advancement in plant-based beef products through the debut of the Beyond IV platform. This signifies the release of the fourth generation of its primary products, Beyond Burger and Beyond Beef, scheduled to launch exclusively at stores throughout the U.S. in spring.

· In December 2023, Quorn, the top meat-free brand in the U.K., reintroduced its vegetarian Quorn Fillet Pieces.

· In October 2023, Beyond Meat announced the inauguration of a unique dedicated concession stand at Madison Square Garden in New York City, known as the GO BEYOND GRILL. This collaboration with MSG Entertainment and MSG Sports marks a significant milestone as Beyond Meat becomes the primary vegan meat partner of the New York Knicks, Madison Square Garden, and the New York Rangers.

· In September 2023, MorningStar Farms introduced the MorningStar Farms Steakhouse Style Burger, a high-quality plant-based alternative that authentically captures the essence of its namesake with enhanced flavor.

· In August 2023, Beyond Meat, Inc. expanded its burger lineup by introducing its latest product innovation, the Beyond Stack Burger.

Order a free sample PDF of the Meat Substitutes Market Intelligence Study, published by Grand View Research.