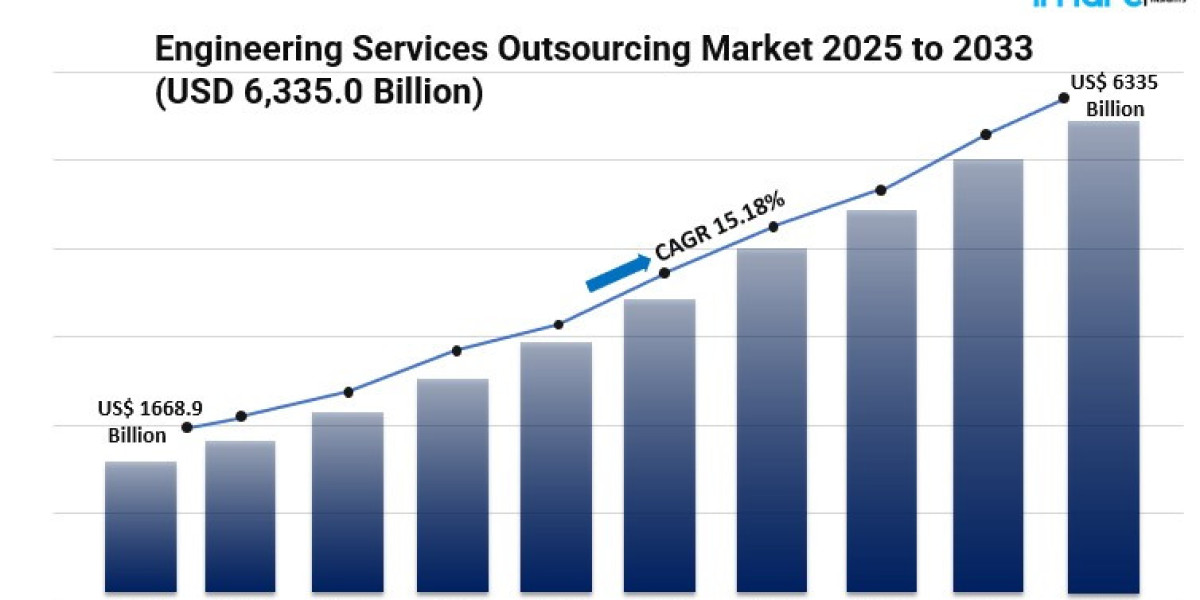

The global engineering services outsourcing (ESO) market is experiencing unprecedented growth, propelled by the increasing demand for cost-effective, high-quality engineering solutions. As businesses strive to innovate and remain competitive, outsourcing engineering tasks has become a strategic move to access specialized skills, reduce operational costs, and accelerate product development. According to IMARC Group, the ESO market was valued at USD 1,668.94 billion in 2024 and is projected to reach USD 6,335.04 billion by 2033, growing at a CAGR of 15.18% during 2025-2033. This surge is driven by advancements in automation tools, the integration of sophisticated engineering systems, and the global push towards digital transformation.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Years: 2025-2033

Engineering Services Outsourcing Market Key Takeaways

- Market Size & Growth: The ESO market reached USD 1,668.94 billion in 2024 and is expected to grow to USD 6,335.04 billion by 2033, registering a CAGR of 15.18% during the forecast period.

- Regional Dominance: Asia Pacific leads the market with a 42.1% share in 2024, attributed to its skilled workforce, cost advantages, and robust infrastructure in countries like India and China.

- Service Segmentation: Testing services dominate due to the critical need for quality assurance and the complexity of modern engineering systems.

- Location Preference: Onshore services hold the largest market share, as clients prefer proximity for better collaboration, quicker turnaround times, and regulatory compliance.

- Application Areas: Key sectors utilizing ESO include aerospace, automotive, construction, consumer electronics, semiconductors, pharmaceuticals, and telecom, driven by the need for specialized engineering solutions.

What Are the Major Growth Drivers Fueling the Engineering Services Outsourcing Market?

Rising Demand for Automation Tools

The increasing demand for automation tools is a primary driver of the ESO market. Automation assists in reducing employee workload while enhancing productivity and revenue. These tools facilitate efficient analysis, testing, and design of engineering systems. Companies are increasingly adopting automation to focus on business-critical activities, thereby propelling market growth.

Integration of Advanced Engineering Systems

The notable increase in the use of engineering systems such as computer-aided design (CAD), computer-aided engineering (CAE), computer-aided manufacturing (CAM), and electronic design automation (EDA) software across various industries contributes to a positive market outlook. Businesses aim to reduce product lifecycles and costs, and the application of ESO aids in minimizing maintenance of office space, infrastructure, staffing, and operations, further bolstering market growth.

Industrial Automation and Integrated Solutions

The rapid pace of industrial automation, coupled with the rising adoption of integrated solutions for analyzing and designing engineering systems globally, is propelling market growth. The increased use of outsourcing services provides expert advice and advanced technologies from skilled professionals worldwide, offering enticing growth opportunities to industry investors.

Market Segmentation

Breakup by Service

- Designing: Involves creating detailed engineering designs to meet specific client requirements.

- Prototyping: Development of early samples or models to test concepts and processes.

- System Integration: Combining various subsystems into one cohesive system to ensure they function together.

- Testing: Assessing products or systems to ensure they meet specified requirements and standards.

- Others: Includes additional services such as maintenance, support, and consultancy.

Breakup by Location

- Onshore: Provision of services within the same country as the client, facilitating better communication and compliance.

- Offshore: Services provided from a different country, often to leverage cost advantages and specialized skills.

Breakup by Application

- Aerospace: Outsourcing for design, testing, and manufacturing support in aircraft and spacecraft development.

- Automotive: Engineering services for vehicle design, development, and testing.

- Construction: Structural engineering, design, and project management services.

- Consumer Electronics: Design and development services for electronic consumer products.

- Semiconductors: Services related to chip design, testing, and fabrication support.

- Pharmaceuticals: Engineering support for drug development, manufacturing, and compliance.

- Telecom: Network design, optimization, and support services.

- Others: Includes industries like energy, utilities, and more.

Breakup by Region

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Which Region Leads the Engineering Services Outsourcing Market, and Why?

Asia Pacific dominates the ESO market, holding a 42.1% share in 2024. This leadership is attributed to the region's large pool of skilled engineers, competitive labor costs, and robust infrastructure in countries like India and China. Additionally, growing industrialization, government support for digital innovation, and an expanding base of international clients seeking cost-effective and high-quality engineering solutions contribute to the region's prominence.

What Are the Latest Trends and Innovations in the Engineering Services Outsourcing Market?

The ESO market is witnessing several notable trends and innovations. Companies are increasingly adopting flexible, on-demand outsourcing models, allowing them to scale resources quickly and adapt to changing project requirements. Advancements in collaboration tools and technologies are facilitating more effective communication and project management between clients and ESO providers. There's also a growing emphasis on sustainable practices and green engineering solutions, with clients seeking partners who can support their sustainability goals. Furthermore, the integration of advanced technologies like AI, IoT, and virtual reality is revolutionizing the engineering landscape, creating a demand for specialized expertise that outsourcing firms can provide.

Who Are the Key Players in the Engineering Services Outsourcing Market?

Accenture Plc, Altair Engineering Inc., ALTEN, Cybage Software Pvt. Ltd., EPAM Systems Inc., HCL Technologies Limited, Infosys Ltd., QuEST Global Services Pte. Ltd., Sonata Software Limited, Tata Consultancy Services Limited, Tech Mahindra Limited (Mahindra Group), Wipro Limited, etc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, considerations studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyzes, pricing and cost research, and procurement research.