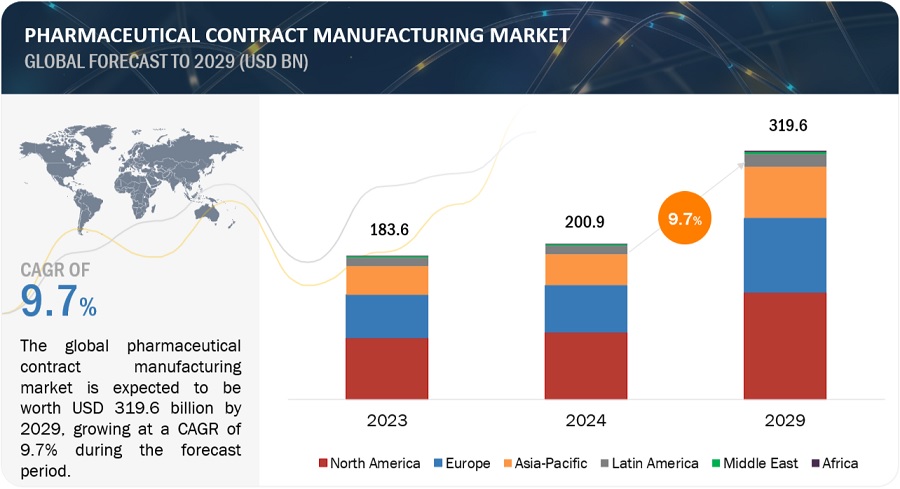

The global pharmaceutical contract manufacturing market growth forecasted to transform from USD 200.9 billion in 2024 to USD 319.6 billion by 2029, driven by a CAGR of 9.7%. Increasing use of generic drugs and funding, developments in the field of CMOs technology, the high cost of in-house drug discovery, and regulatory filing by the CMOs drive the growth of the pharmaceutical contract manufacturing market. Pharma CMOs using Al in drug development and manufacturing will bring efficiency and quality. In April 2024, Lonza launched its AI-powered Route Scouting Service: This service integrates Lonza's global expertise in the chemical supply chain with Elsevier Al technology (Reaxys) for the fast-tracking of artificial route identification for new APIs. Strict rules may limit the growth of the market. Moreover, applies AI in predictive analytics for supply chain management, planning efficient production schedules, and inventory levels. AI also optimizes clinical trials through incidental candidate identification, predictions of clinical trial results, and patient compliance monitoring4 which will lower the costs and raise success rates of clinical trials. It paves the way for further innovations and developments, as bringing Al to pharmaceutical contract manufacturing transforms the whole industry in terms of efficiency, guarantees the quality, and accelerates development processes.

Pharmaceutical Contract Manufacturing Market Dynamics

DRIVER: Expensive In-House drug development

Drug research and development is very expensive and long for a small and medium size pharmaceutical company. Pharmaceutical companies find another cost effective and efficient way to outsource their drug development activities to the contract development and research organisations. Furthermore, medication development requires compliance rigorous FDA criteria, and maintaining standards of quality regarding formulation development. This, in turn, adds to the internal cost of expenses on research and production of the therapeutic formulation. As a result of the rise in costs incurred in developing drugs, including discovery and pre-clinical development, clinical development, capital, and the limited funding with high rates faced with the failure of drugs in human trials, the pharmaceuticals have sought to outsource their drug development processes to contract development and manufacturing organizations.

RESTRAINT: Varying regulatory requirements across regions

The failure of the respective authority to adhere to standards and regulations, as well as the production of substandard pharmaceuticals, have significant repercussions for the business and its brand reputation. Therefore, adherence to regulatory rules is of utmost importance in the pharmaceutical industry. CDMOs sell the drug substance/formulation that they manufacture on a contract basis under their own brand. The medication development and clinical trial process necessitates the submission of substantial quantities of data to the regulatory body. Therefore, the management of the data and the submission of diverse formulations in different countries provide challenges for COMOS and heighten the likelihood of errors in regulatory filings. This aspect is expected to impede the market expansion of pharmaceutical Contract Development and Manufacturing Organizations (CDMOs) in the foreseeable future.

OPPORTUNITY: Emerging Markets

Emerging countries offer a trained labor and cost advantages, hence they become hubs of bioprocess outsourcing. Furthermore, the increasing interest of pharmaceutical companies in outsourcing medications discovery is ascribed to the growing need for vaccines, declining availability of antibiotics, and rising research and development costs fueling the increase of pharmaceutical contract development and manufacturing activities in developing countries. Moreover, the use of contemporary manufacturing technology and the availability of low-cost manufacturing and labor in underdeveloped nations are motivating market players to invest in Asia Pacific over the expected horizon. Given their growth as growing economies, India and China are expected to present significant opportunities for the near future expansion of the pharmaceutical contract manufacturing and development market based on their features. Furthermore, Biosecure Act seeks to limit technology transfer and reduce the reliance on China for biopharmaceuticals. It basically forbids US federal government agencies from purchasing goods or services from Chinese drug businesses. Under this Act, growing nations like India would have great chances in the pharmaceutical industry. As production moves from China to India against present trends, India's contract manufacturing sector will expand dramatically in the next three years. The segment of contract research in India will also grow noticeably during the same time. US companies are already posing more questions to Indian pharmaceutical companies. Though there is a chance that nations like Ireland or maybe Singapore could possibly present some fierce competition, the Act has no short-term financial advantage due of the common contracts with China. All things considered, the Act speeds India's expansion in the pharmaceutical industry, therefore strengthening its role as one of the main participants in contract manufacturing and research markets.

CHALLENGE: Introduction of Serialization

Serialization—that is, coding every service or product item—allows each one to have a distinct identity. The special identity helps to trace and follow the feet around the supply chain. For companies all around and regulatory authorities, counterfeiting is a major problem. For contract manufacturing, CDMOs all over need a practical pharmaceutical serialization solution. Software, hardware, training, implementation, manufacturing lines—all of which the pharmaceutical sector must make a major capital investment in—all of which need for software handling competent employees spread over multiple locations. This is challenging for a COMO as well. One of the more challenging tasks the pharmaceutical contract research and manufacturing company has ahead of it.

The pharmaceutical manufacturing services segment dominated pharmaceutical contract manufacturing industry in 2023.

Based on service the pharmaceutical contract manufacturing market is segmented into drug development services, pharmaceutical manufacturing services, biologics manufacturing services, packaging & labelling services, fill-finish services, and other services. Rising demand for biologics and biosimilars in the region and variables such the growing biopharmaceuticals and pharmaceutical markets worldwide help to attain the dominating share that pharmaceutical manufacturing services account for in 2023. Moreover, important participants in the market are funding drug development, which would probably help the growth of segment.

The big pharmaceutical companies segment of the pharmaceutical contract manufacturing industry is expected to grow at the highest CAGR during the forecast period.

Based on end user, the pharmaceutical contract manufacturing market is segmented into big pharmaceutical companies, small & mid-sized pharmaceutical companies, generic pharmaceutical companies, and other end users (Academic Institutes, Small CDMOs, and CROs). Over the projected period, the big pharmaceutical companies segment is expected to show the highest CAGR. Rising demand for targeted medication therapies, more biologics now under pipeline research, and more investment in the development of cell and gene therapies are responsible for this significant growth of the segment.

North America was the largest regional market for the pharmaceutical contract manufacturing industry in 2023.

The global pharmaceutical contract manufacturing market is segmented into six major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. North America was the largest segment in 2023 in the pharmaceutical contract manufacturing market, followed by Europe and the Asia Pacific. Factors such as the presence of a large number of pharmaceutical companies and the growing demand for generics, increased research funding for pharmaceutical contract manufacturing and thus supporting the pharmaceutical contract manufacturing growth.

Key players in the pharmaceutical contract manufacturing market include Thermo Fisher Scientific, Inc. (US), Lonza Group (Switzerland), WuXi Apptec (China), WuXi Biologics (China), AbbVie, Inc. (US), Catalent, Inc. (US), Samsung Biologics (South Korea), Evonik Industries AG (Germany), FUJIFILM Holding Corporation (Japan), Siegfried Holding AG (Switzerland), Boehringer Ingelheim International (Germany), Merck KGaA (Germany), Almac Group (UK), Charles River Laboratories (US), Asychem Inc. (China), Vetter Pharma (Germany), and Alcami Corporation (US).

Recent Developments of Pharmaceutical Contract Manufacturing Industry:

- In May 2024, Siren Biotechnology and Catalent, Inc. entered in partnership for manufacturing of AAV Gene Therapies for cancer.

- In March 2024, Lonza has signed an agreement to acquire the Genentech manufacturing facility in Vacaville (US) from Roche for USD 1.2 billion in cash.

About MarketsandMarkets™

MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report.

MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients.

Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes.

The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing.

Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry.

Contact:

Mr. Rohan Salgarkar

MarketsandMarkets Inc.

1615 South Congress Ave.

Suite 103, Delray Beach, FL 33445

USA : 1-888-600-6441

UK +44-800-368-9399

Email: [email protected]

Visit Our Website: https://www.marketsandmarkets.com/

Content Source:

https://www.marketsandmarkets.com/PressReleases/pharmaceutical-contract-manufacturing.asp

https://www.marketsandmarkets.com/ResearchInsight/pharmaceutical-contract-manufacturing-market.asp