The global smart home market was valued at USD 79.16 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 27.07% from 2023 to 2030. The market offers a variety of products, including smart cameras, lighting, streaming devices, and appliances like dishwashers. The growing integration of Artificial Intelligence (AI) within smart home products is a major factor fueling demand, enabling enhanced functionality. Moreover, rising smartphone and internet penetration worldwide has boosted the demand for connected smart home devices, where AI-driven digital assistants provide hands-free, user-friendly operation, greatly influencing consumer preferences.

The increasing popularity of virtual assistants, such as Siri, Google Assistant, and Alexa, also enables users to manage tasks through voice commands. New features in these assistants, like Bluetooth speakers and hands-free navigation, are further driving demand. For instance, Google’s 2022 update enabled its assistant to support voice-input messaging, including emoji insertion, enhancing user convenience. Advancements in technology like the Internet of Things (IoT), blockchain, smart voice recognition, and AI are further propelling market growth.

Gather more insights about the market drivers, restrains and growth of the Global Smart Home Market

Voice recognition technology, for example, enables smart home devices equipped with microphones to recognize user voices and offer personalized responses. IoT adoption is rising in both developing and developed regions, supporting market expansion by enhancing device connectivity. The COVID-19 pandemic disrupted manufacturing but also spurred demand, as people sought in-home entertainment and increased convenience through smart home products amid lockdowns. Despite supply chain challenges and semiconductor shortages, the pandemic highlighted infrastructure gaps and heightened demand for smart devices as people spent more time at home.

Product Insights

The security and access control segment led the market in 2022, holding over 30.40% of total revenue. The growth stems from a heightened need for smart security solutions and controlled access to high-value areas within homes. Products like smart locks and cameras utilize features such as live feeds, fingerprint scanners, and custom PINs to provide secure access. Amazon's 2022 launch of Ring Spotlight Cam Plus, Ring Spotlight Cam Pro, and the second-generation Ring Alarm Panic Button, featuring radar and 3D motion detection, exemplifies this trend.

The home healthcare segment is expected to grow fastest, driven by the demand for self-diagnosis tools amidst rising healthcare and insurance expenses. Increasing health consciousness is fueling the uptake of home healthcare products for monitoring vitals like oxygen and blood pressure, which previously required clinical visits.

Protocol Insights

The wireless protocols segment is projected to experience the highest CAGR of 27.75% through the forecast period and held the largest market share in 2022. The growth is attributed to advantages such as mobile connectivity and location flexibility offered by protocols like ZigBee, Wi-Fi, Bluetooth, and Z Wave. These protocols provide seamless communication with minimal battery impact and long range. For instance, ZigBee protocol enhances battery life through low-latency, low-duty cycle communication. Wired protocols are also projected to grow significantly, as they provide secure, central connections for smart home hubs, supporting low-latency products.

Application Insights

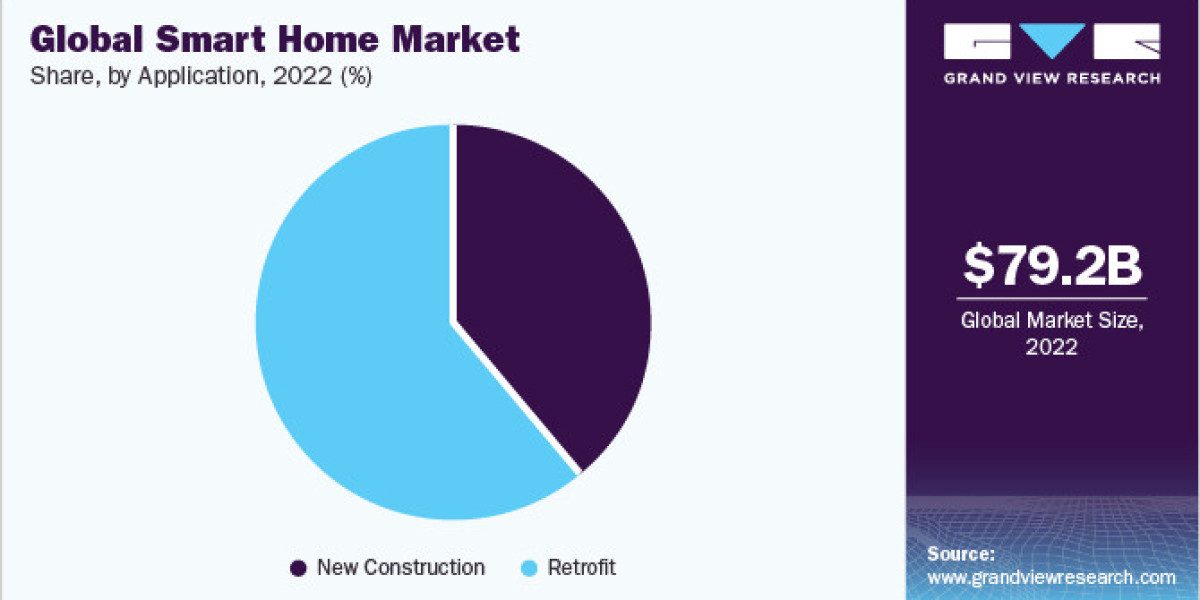

The market is segmented by applications into new construction and retrofit. The new construction segment is expected to grow fastest, with an anticipated CAGR of 28.55%, due to the ease of integrating smart devices during construction. A growing number of residential projects are opting for smart features, especially in security and access control. New construction project owners find it logistically easier to incorporate smart home devices at this stage. The retrofit segment, which led in 2022, continues to thrive as many homeowners prefer retrofitting with one or multiple smart devices based on individual needs and budget, bolstered by wide product availability.

Order a free sample PDF of the Smart Home Market Intelligence Study, published by Grand View Research.