In 2023, the global antifungal drugs market reached an estimated value of USD 15.8 billion, with an anticipated compound annual growth rate (CAGR) of 3.8% from 2024 to 2030. The rising incidence of fungal infections like aspergillosis and candidiasis is a major driver of this market. Fungal infections include both systemic and superficial infections, affecting areas such as the skin, eyes, mouth, and vagina. Antifungal drugs, known for their fungicidal properties, are widely prescribed to treat conditions like athlete's foot, ringworm, and fungal meningitis. The increasing number of hospital-acquired infections and other infectious diseases is also expected to drive market growth over the forecast period.

Fungal diseases present a significant public health challenge, affecting people of all ages. However, they pose an even greater risk to individuals with compromised immune systems, such as those with AIDS, who are more prone to developing opportunistic fungal infections. According to the CDC, approximately 152,000 new cases of cryptococcal meningitis, a life-threatening brain infection, are reported each year, leading to about 112,000 global deaths, with the majority occurring in sub-Saharan Africa due to high HIV/AIDS prevalence. This highlights an unmet need for potent antifungal medications in regions with limited resources.

Gather more insights about the market drivers, restrains and growth of the Global Antifungal Drugs Market

Increasing awareness of fungal infections is expected to improve diagnosis rates, thus boosting the adoption of antifungal treatments. For instance, in September 2022, the CDC organized Fungal Disease Awareness Week to emphasize the importance of early recognition, effective antifungal treatment, and reducing resistance to these drugs. Additional awareness initiatives include World Aspergillosis Day, established by organizations like the Aspergillosis Trust in collaboration with the Fungal Infection Trust, which aims to educate the public and raise funds for patient support.

Distribution Channel Insights

In 2023, hospital pharmacies dominated the antifungal drugs market. These pharmacies are vital in providing timely access to critical medications for both inpatients and outpatients, supporting the prompt treatment of fungal infections. Key factors for this segment’s leading position include proximity to medical facilities, which allows rapid access to drugs, adherence to clinical protocols, cost-effectiveness, and the rising global prescription rate, especially as drugs like fluconazole gain wider use. With changes in resistance patterns, drugs such as triazoles and terbinafine are being prescribed more frequently. However, despite their essential role, injectable antifungals like echinocandins and polyenes may not be fully utilized.

Retail pharmacies are expected to grow significantly over the forecast period, driven by industry trends toward chain formation and consolidation among key players. This horizontal integration bolsters market share by capitalizing on pharmacists' accessibility and expertise. Retail pharmacies hold a competitive advantage over online channels by providing immediate drug access, convenience, and assured quality. With rising fungal infection rates, the demand for early treatment encourages self-medication, especially through over-the-counter antifungal medications, which is anticipated to drive the growth of the retail pharmacy segment over the forecasted period.

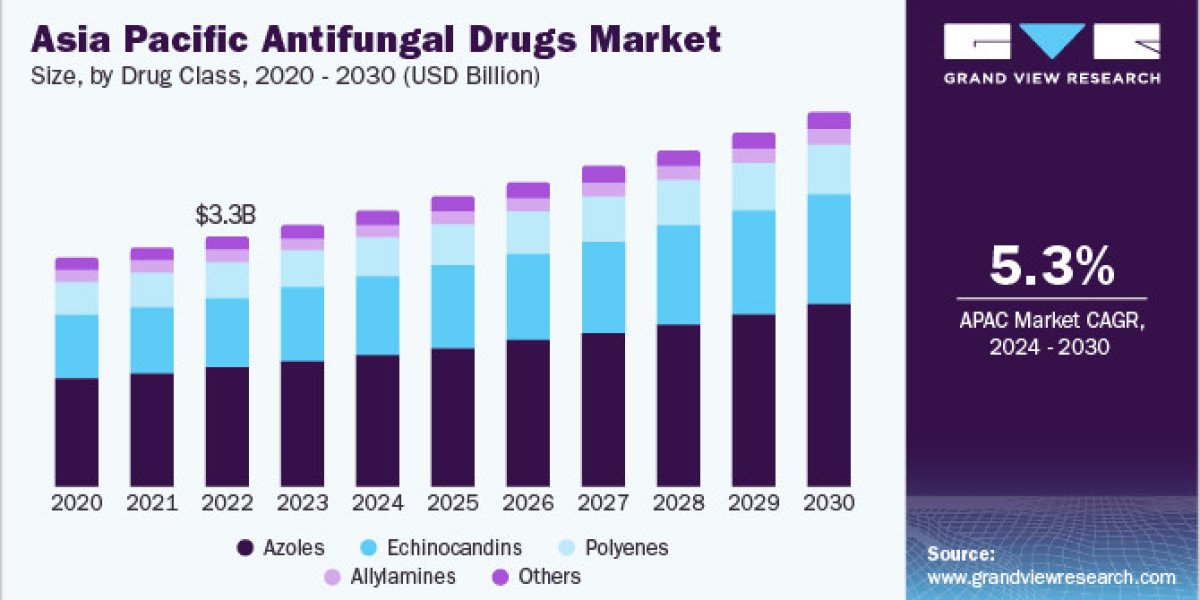

Drug Class Insights

The Azoles drug class led the antifungal market in 2023, with a revenue share of 47.6%. This prominence is largely due to major therapeutic agents like Noxafil, Vfend, Diflucan, and Cresemba, which drive the segment's performance. Azoles are known for their broad-spectrum efficacy in inhibiting fungal enzymes and providing fungistatic effects, making them highly effective against infections like candidemia, blastomycosis, systemic candidiasis, and eye-related fungal infections. The Azoles class includes triazoles and imidazoles; triazoles are preferred due to their enhanced safety profiles, fewer side effects, and better absorption, bolstering the growth of this drug class.

A significant example is the FDA’s acceptance of Astellas Pharma's supplemental New Drug Application (sNDA) for CRESEMBA in August 2023. This application aims to treat invasive aspergillosis or mucormycosis in pediatric patients, marking a pivotal step toward addressing fungal infections in children. The industry's support for azole drugs, specifically isavuconazole, reflects the commitment to expanding treatment options and potentially increasing the market share for this drug class.

Indication Insights

Candidiasis led the antifungal market in 2023, driven by rising incidences among immunocompromised patients and the high recurrence rate of this infection. An uptick in opportunistic fungal infections is expected to boost demand for antifungal treatments over the forecast period. Systemic candidiasis is particularly common, with candidemia being one of the most frequent bloodstream infections. According to the CDC, candidemia occurs at a rate of 9 per 100,000 people, affecting about 25,000 individuals annually.

Reports from BMC Infectious Diseases in 2021 indicate that 75% of women worldwide have experienced vulvovaginal candidiasis at least once, with 25% experiencing recurrent cases. Candida albicans, the primary cause, is projected to affect over 138 million women globally each year, potentially reaching 158 million cases by 2030, thus creating growth opportunities in the antifungal market. Furthermore, invasive Candida infections are associated with high morbidity and mortality rates, with a mortality rate reaching 25%.

Dosage Form Insights

Oral drug formulations dominated the antifungal market in 2023, mainly because certain antifungals are designed for ingestion to ensure proper absorption. Oral antifungals are commonly prescribed for infections in the throat and mouth, such as thrush. However, they carry a higher risk of drug interactions compared to topical creams available over-the-counter.

Initiatives by key industry players have further boosted growth in the oral drug segment. For example, in March 2023, GSK announced a licensing agreement for Brexafemme, an oral antifungal treatment for vulvovaginal candidiasis (VVC) and recurrent VVC. Brexafemme, developed by SCYNEXIS, is the only FDA-approved medication for these conditions, addressing an unmet need for innovative oral antifungals. This initiative is expected to support the oral drug segment’s growth by introducing new treatment options, enhancing GSK’s market presence, and meeting the demand for oral antifungal therapies.

Order a free sample PDF of the Antifungal Drugs Market Intelligence Study, published by Grand View Research.