In 2023, the global plastics market was valued at approximately USD 624.8 billion, with an anticipated compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The growing substitution of materials such as glass, metals, wood, and natural rubber with plastics is expected to fuel the market’s expansion. The plastic resins sector, one of the most heavily regulated worldwide, comprises a diverse range of products from numerous global providers. Key plastic resins include polystyrene (PS), polyethylene (PE), acrylonitrile butadiene styrene (ABS), polypropylene (PP), polybutylene terephthalate (PBT), polyphenylene oxide (PPO), polyurethane (PU), polyether ether ketone (PEEK), polyvinyl chloride (PVC), polyethylene terephthalate (PET), polycarbonate (PC), polysulfone (PSU), polyamide (PA), and polyphenylsulfone (PPSU).

Polypropylene (PP) is the most widely used resin in various industries, applied in packaging, automotive parts, toys, and other industrial components due to its chemical and electrical resistance, durability, high melting point, stress tolerance, and flexibility. Demand for polypropylene is anticipated to rise in the automotive and construction sectors, supported by increased consumer spending and growth in vehicle ownership, which, in turn, contributes to the market's overall growth.

Gather more insights about the market drivers, restrains and growth of the Global Plastic Market

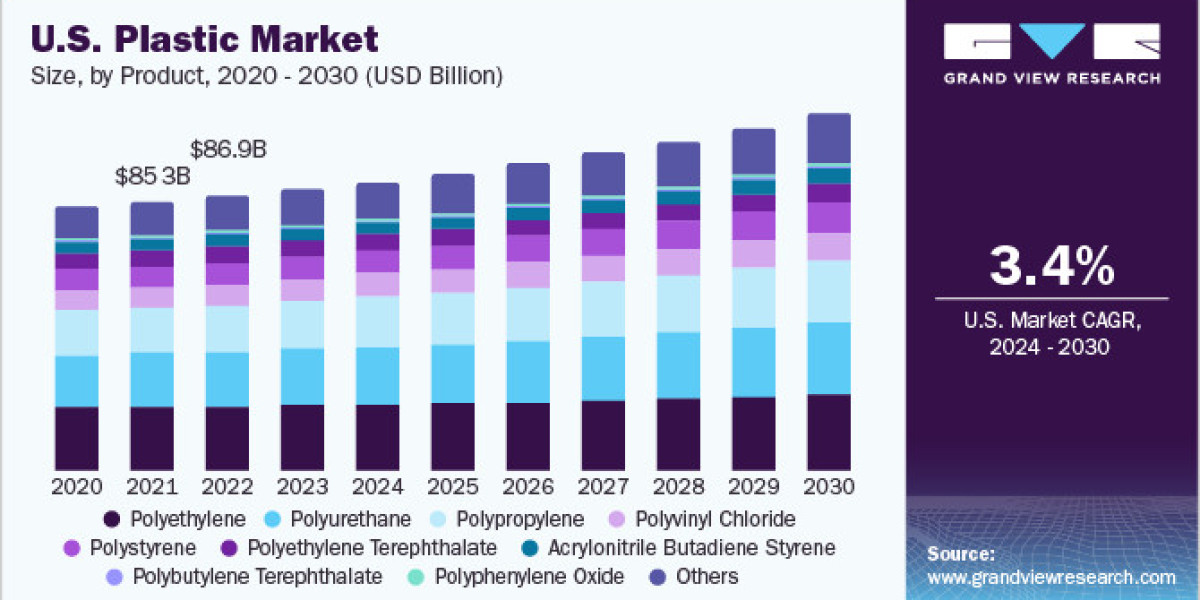

The U.S. led the North American plastics market in 2023 and is projected to maintain its dominance through the forecast period. This demand is largely driven by the growing automotive industry and an increase in construction activities. Expansion of capacity and new plants by automotive manufacturers in the U.S. is expected to further increase the demand for plastics in compounding processes.

Polyethylene terephthalate (PET) is expected to be one of the fastest-growing segments in the U.S. plastics market due to its significant use in packaging, particularly in bottle production. Many U.S.-based PET processors are implementing Good Manufacturing Practices (GMPs) to improve resource utilization, resource conservation, and production efficiency, further supporting PET market growth in the coming years.

The shift towards replacing materials like glass, metals, wood, and natural rubber with plastic alternatives such as olefins, PVC, polystyrene, and PET is anticipated to drive the global plastics market. Plastics are increasingly being used in the automotive, healthcare, construction, and consumer goods industries. Additionally, the need to reduce carbon emissions and comply with regulatory measures has promoted the use of lightweight plastics over metals in automotive and industrial applications.

However, the plastic market is vulnerable to fluctuations in crude oil prices, which impact petrochemical costs. Since plastics are primarily produced from petrochemicals, crude oil price volatility is expected to influence plastic market prices throughout the forecast period.

Product Insights

In 2023, polyethylene (PE) held the highest market share in the product segment, accounting for over 24.0% of revenue. Demand for polyethylene is particularly high in agriculture, where it is used for products like drippers, microtubes, nozzles, and emission pipes in irrigation. Polyethylene films are widely used in agriculture to reduce moisture loss and regulate soil temperature, resulting in higher crop yields.

Polypropylene (PP) followed, holding over 20.0% of the market share in 2023. The automotive industry, especially in Asia and Latin America, has shown significant growth, driving demand for plastic polymers in vehicle production. As regulatory trends push manufacturers to reduce vehicle weight and improve fuel efficiency, demand for polypropylene in automotive applications is expected to grow significantly.

Polyurethane (PU) represented more than 17.0% of the market share due to its excellent insulation properties, making it ideal for refrigeration and building insulation. Rising demand for insulation in buildings, driven by environmental concerns, is likely to fuel polyurethane demand over the forecast period.

Application Insights

Injection molding dominated the application segment in 2023, accounting for over 43.0% of the revenue share. This method, which involves injecting molten plastic into molds, is widely used to manufacture automotive parts, medical devices, containers, and other products.

Thermoforming, which held over 27.0% of the market share in 2023, involves softening thermoplastic sheets to form them into desired shapes. Thermoforming is primarily employed in the packaging industry through pressure and vacuum forming techniques.

Blow molding accounted for above 13.0% of the application market share. This process, used to make hollow plastic products like bottles, tubes, cans, and containers, involves expanding heated plastic to fit the mold. Blow molding typically uses polyethylene and polypropylene, and its lower cost compared to injection molding is expected to drive its growth.

End-use Insights

The packaging sub-segment dominated the end-use segment in 2023, with a market revenue share exceeding 36.0%. Growing industries such as personal and household care, pharmaceuticals, and food and beverages, along with the global expansion of e-commerce, are increasing demand for plastic packaging. Plastics are favored in packaging due to their durability, low cost, and resistance to extreme conditions, which maintains product integrity for items like cosmetics and food and beverage products. Additionally, plastics offer affordability and high printability, making them highly desirable as packaging materials.

Building and construction followed with over 18.0% market revenue share. Plastics are widely used in various construction applications, including piping, roofing, flooring, and insulation, due to their versatility and cost-effectiveness.

Order a free sample PDF of the Plastic Market Intelligence Study, published by Grand View Research.