The global oleochemicals market was valued at approximately USD 24.42 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 7.0% from 2024 to 2030. The outlook for the market remains positive, primarily due to the rising demand for biodegradable products and regulatory restrictions on petrochemical-based products.

Oleochemicals are derived from fats and oils, obtained from natural sources like plant oils and animal fats or from petrochemical sources. These chemicals are produced by manufacturers using various chemical or enzymatic reactions. Due to fluctuating crude oil prices, there has been a shift towards vegetable oils, particularly palm and palm kernel oil, as primary feedstocks for oleochemical production. The oleochemicals market benefits from the steady availability of raw materials, minimal toxicity, and an environmentally-friendly reputation.

The demand for oleochemical derivatives is steadily growing due to their increasing use in personal care, pharmaceuticals, and food products. Growth in personal care products is supported by rising disposable incomes, product innovations, and strong market penetration. Oleochemicals are widely used in fast-moving consumer goods (FMCG) such as soaps, toothpaste, and lotions. Demand for these products is fueled by efforts to increase visibility through online promotions, contests, and other marketing strategies in developed regions.

Gather more insights about the market drivers, restrains and growth of the Global Oleochemicals Market

A major opportunity for the oleochemicals industry is the shift towards sustainable, renewable products across industries. As consumers become more eco-conscious, there is greater demand for products with lower carbon footprints. Oleochemicals derived from natural fats and oils offer a sustainable alternative to petroleum-based chemicals. For instance, in the personal care industry, demand is rising for natural and organic ingredients, with oleochemicals like coconut and palm oil derivatives frequently used in soaps, shampoos, and skincare products due to their mild, eco-friendly properties.

One significant challenge in the oleochemicals market is securing consistent raw material sources and optimizing supply chain efficiency. However, many manufacturers have adopted vertical integration to address this challenge. For example, IOI Corp Bhd and Kuala Lumpur Kepong Bhd (KLK) have established downstream integration into refineries and oleochemical production facilities in Europe and China, and upstream integration through plantations in Indonesia and Malaysia.

Product Insights

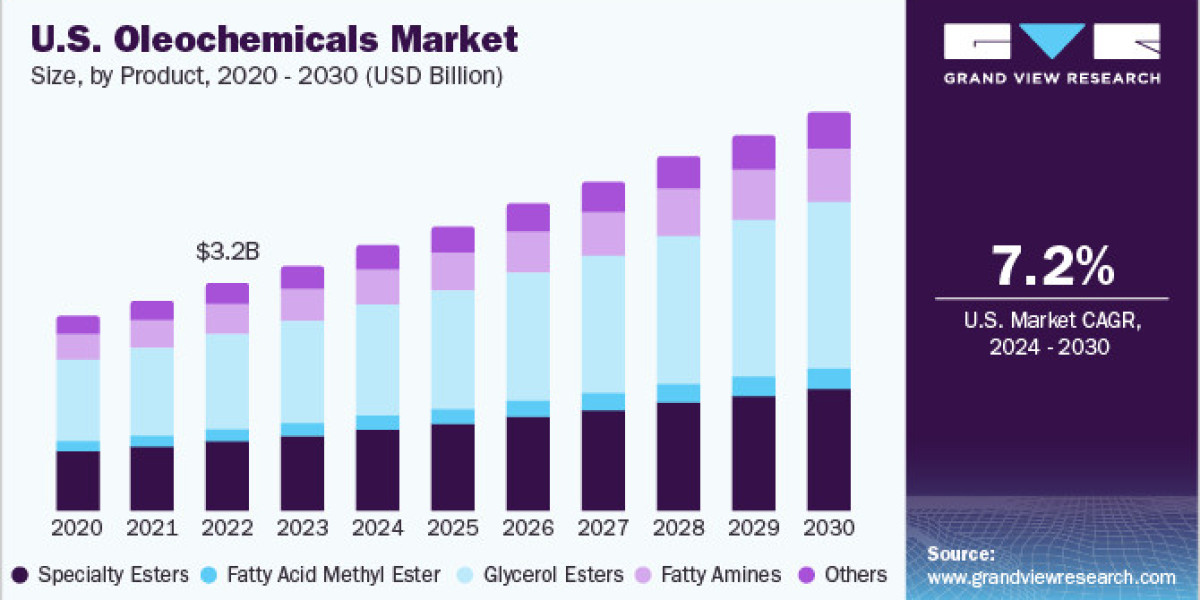

In 2023, glycerol esters led the market, representing roughly 35.55% of market share. These esters, formed from reactions between glycerol and fatty acids, are widely used in food items like ice cream, chewing gum, flavored beverages, and cosmetics. Glycerol can combine with one, two, or three fatty acids to create monoglycerides, diglycerides, and triglycerides, which are further utilized in producing glycerol monostearate (GMS), medium chain triglycerides (MCT), oleates, and other glycerides.

Specialty esters are increasingly used as alternatives to petroleum-based chemicals in various applications. They comply with Environmental Protection Agency (EPA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) guidelines, emphasizing biobased resources for environmentally sensitive uses to reduce carbon footprints. Specialty esters include compounds like isopropyl palmitate, glycol esters, sorbitan esters, and lactate esters. For instance, isopropyl palmitate, known for its anti-static, moistening, and emollient properties, is used in lipsticks, hair conditioners, moisturizers, anti-aging products, and various cosmetics.

Alkoxylates, a group of nonionic surfactants such as methyl ester, fatty amine, fatty acid, and fatty alcohol ethoxylates, are used as emulsifiers in fabric softeners, agrochemicals, and household care products. Alkoxylates serve as wetting agents, dispersing agents, detergents, stabilizers, and cleaning agents across various industries, with alcohol alkoxylates particularly preferred for their eco-friendly properties in shampoos, detergents, and soaps. While alcohol alkoxylates may cause mild skin and eye irritation, they are still acceptable in body care and cleaning products, per the EPA.

Application Insights

The personal care and cosmetics sector dominated the market in 2023, holding approximately 22.29% of market share. Specialty oleochemicals are used in various personal care products, including creams, skincare, sun care, hair care, and oral care. The demand for anti-aging and organic products to preserve youthful looks drives growth in this segment, supporting demand for oleochemical derivatives in personal care and cosmetics. Over the past decade, this industry has consistently grown, with an increasing presence in supermarkets, hypermarkets, retail stores, and boutique shops globally.

The industrial segment encompasses applications in oilfield chemicals, pulp and paper chemicals, construction chemicals, lubricant additives, metalworking fluids, agrochemicals, water management chemicals, and rubber processing. Specialty oleochemicals are highly demanded in lubricants and oil additives, which are essential across industries such as construction, rubber processing, metalworking, and oilfields.

In the food processing segment, specialty oleochemicals are widely used in frozen foods, confectionery, and beverage processing. Common derivatives in this sector include alcohol ethoxylates, sulfates, sucrose esters, and glycerol esters. Shifting consumer preferences towards healthier diets and weight-loss initiatives are expected to drive long-term demand for these products in food additives and processing applications.

Order a free sample PDF of the Oleochemicals Market Intelligence Study, published by Grand View Research.