The global urinalysis market was valued at USD 2.14 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Several factors are contributing to this market growth, including the rising prevalence of diseases such as Urinary Tract Infections (UTIs), diabetes, and kidney diseases. For example, the 2020 National Diabetes Statistics Report noted that around 34.1 million adults in the U.S. had diabetes, with one-third of these patients experiencing kidney-related issues due to elevated blood sugar and blood pressure. Urinalysis serves as a crucial, non-invasive diagnostic tool that allows clinicians to detect kidney diseases early, making the growing incidence of kidney disorders a major driver for increased demand in urinalysis products, which in turn fuels market expansion.

The COVID-19 pandemic initially had a moderate impact on the urinalysis market due to reduced hospitalization rates and a decrease in the demand for urine analysis tests. Government-imposed lockdowns restricted access to hospitals and diagnostic services, leading to a temporary decline in demand for diagnostic products. However, as movement restrictions eased, testing rates began to recover.

Gather more insights about the market drivers, restrains and growth of the Global Urinalysis Market

Urinalysis is becoming increasingly important in detecting post-COVID-19 complications, such as acute kidney and tubular injuries. A 2021 study conducted by Columbia University identified two sensitive biomarkers, kidney injury marker-1 (KIM-1) and urinary NGAL, which are effective in diagnosing tubular and kidney injuries. This emerging application is expected to drive further market growth.

Developing countries like South Korea, Brazil, India, and Mexico present significant growth opportunities for key market players. This potential is driven by the rising burden of chronic diseases, improved healthcare infrastructure, a large patient base, and increasing disposable income. For example, India’s healthcare expenditure grew from USD 232.73 million in 2020 to USD 507.97 million in 2021, showcasing the potential for growth in these markets.

Product Insights

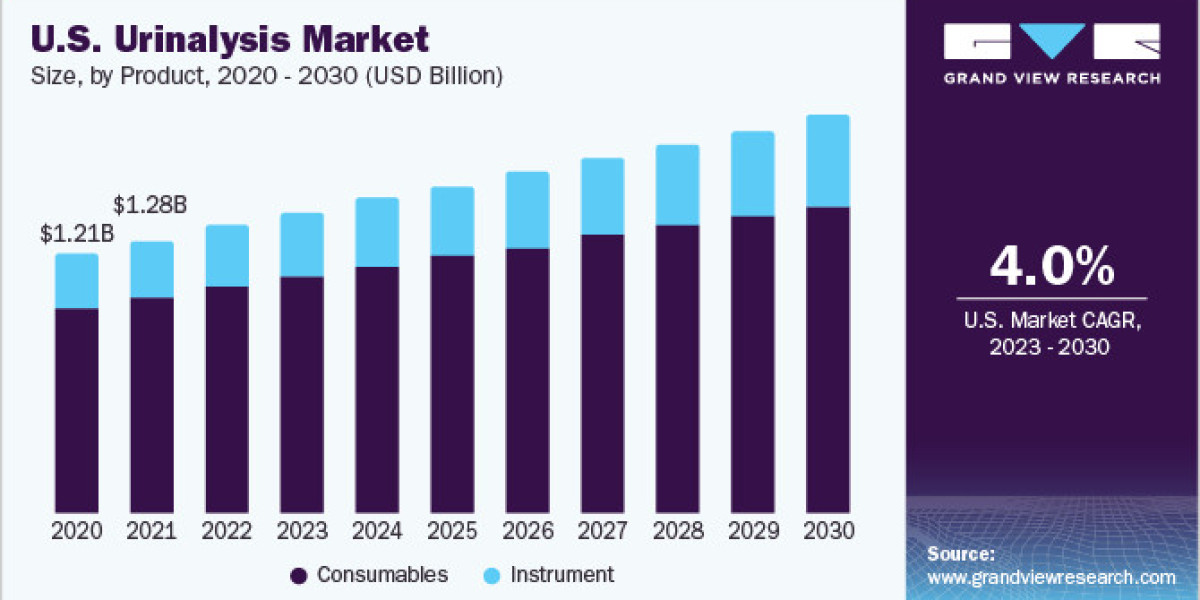

In 2022, the consumables segment dominated the market, capturing 78.61% of the total revenue. This is primarily due to the high demand and frequent purchases of reagents and dipsticks by clinical and hospital laboratories. Dipsticks are the most commonly used consumable in urinalysis and hold the largest market share. Reagents are used to measure specific substances in urine, and the continuous development of innovative consumables, such as rapid test kits and point-of-care devices, is making urinalysis more accessible and driving demand.

Several leading providers, including Siemens Healthcare GmBH, Abbott, and Roche, supply high-quality consumables for urinalysis testing, boosting the segment’s growth. For instance, Siemens Healthineers offers Multistix 10 SG Reagent Strips to diagnose UTIs, diabetes, and kidney diseases. In September 2022, Sysmex Corp. launched the UF-1500 Fully Automated Urine Particle Analyzer, which aids in urine sediment testing. The National Kidney Foundation raised over USD 600 million in 2022 to support kidney disease research, patient care, and advocacy efforts.

The instruments segment is expected to grow at the fastest CAGR of 5.1% during the forecast period, driven by the increasing approval and launch of new urinalysis instruments. For example, Bio-Rad Laboratories, Inc. launched qUAntify Advance Control in January 2019 to improve the precision of urinalysis procedures in clinical labs. In 2022, Olive Diagnostics introduced Olive KG, an AI-based device for rapid urine sample analysis, while Alere developed UrineSTAT, a rapid test kit that detects various UTIs within minutes.

Application Insights

In 2022, the urinary tract infection (UTI) screening segment led the market, accounting for a 25.06% revenue share, driven by the rising global incidence of UTIs. According to the National Center for Biotechnology Information (NCBI), around 150 million people suffer from UTIs annually worldwide.

The diabetes screening segment is expected to witness the fastest growth, with a projected CAGR of 7.3% during the forecast period. Urinalysis is a crucial screening tool for diabetes. In 2022, the Centers for Disease Control and Prevention (CDC) reported that approximately 37.3 million people in the U.S. had diabetes, with 28.7 million diagnosed and 8.5 million undiagnosed. The increasing number of diabetes patients is a significant driver for the urinalysis market.

Obesity, a major risk factor for type 2 diabetes, has also been on the rise, further contributing to the increasing prevalence of diabetes. According to the IDF Diabetes Atlas 2021, approximately 10.5% of adults aged 20 to 79 worldwide have diabetes, and nearly half are unaware of their condition. By 2045, it is projected that 783 million adults (1 in 8) will be living with diabetes, marking a 46% increase. Type 2 diabetes is the most common, affecting more than 90% of those diagnosed.

End-Use Insights

In 2022, the clinical laboratories segment held the largest revenue share of approximately 46.15%. This dominance is due to the easy accessibility of these labs for patients and the availability of advanced diagnostic products. In the U.S., more than 20,000 clinical laboratories provide services, including urinalysis. New techniques like proteomics, genetic testing, microarrays, biomarkers, and other innovations are improving the detection of kidney diseases in these labs.

The home care segment is projected to grow at the fastest CAGR of 5.8% over the forecast period due to the increasing availability of home-based UTI test kits. The demand for convenience, privacy, and the lower cost of home urinalysis tests compared to clinical tests are key factors driving this segment’s growth. For instance, TestCard launched a non-invasive at-home UTI test kit in the UK in August 2020. The results can be accessed via a mobile app, allowing users to share the information with healthcare professionals. The kit is available at retail pharmacies for USD 12.06.

Several innovative home UTI kits and services were introduced in 2023, including smartphone-based UTI tests from companies like TestCard and Scanwell Health. MyLAB Box also offers a range of home testing services, including UTI tests. Additionally, Uqora’s UTI Emergency Kit is a prominent home-based solution for UTI testing and treatment.

Order a free sample PDF of the Urinalysis Market Intelligence Study, published by Grand View Research.