The global specialty food ingredients market was valued at USD 101.9 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2024 to 2030. This growth is fueled by the rapid expansion of industries such as food and beverages, pharmaceuticals, and personal care, along with the increasing presence of organized retail and e-commerce globally. Specialty food ingredients are essential in processing food, enhancing its texture, emulsifying, preserving, adding color, and providing extra health benefits. These ingredients range from micro-ingredients, like vitamins, minerals, and enzymes, to macro-ingredients, including specific proteins, fats, fibers, and carbohydrates. A growing demand for products without artificial additives has driven the development of clean-label ingredients, which use natural and simple components.

These ingredients play a crucial role in ensuring that processed foods are tasty, safe, nutritious, sustainable, and affordable. Specialty foods, which align with consumer preferences for health, wellness, and freshness, are outpacing non-specialty alternatives in nearly every category.

Gather more insights about the market drivers, restrains and growth of the Global Specialty Food Ingredients Market

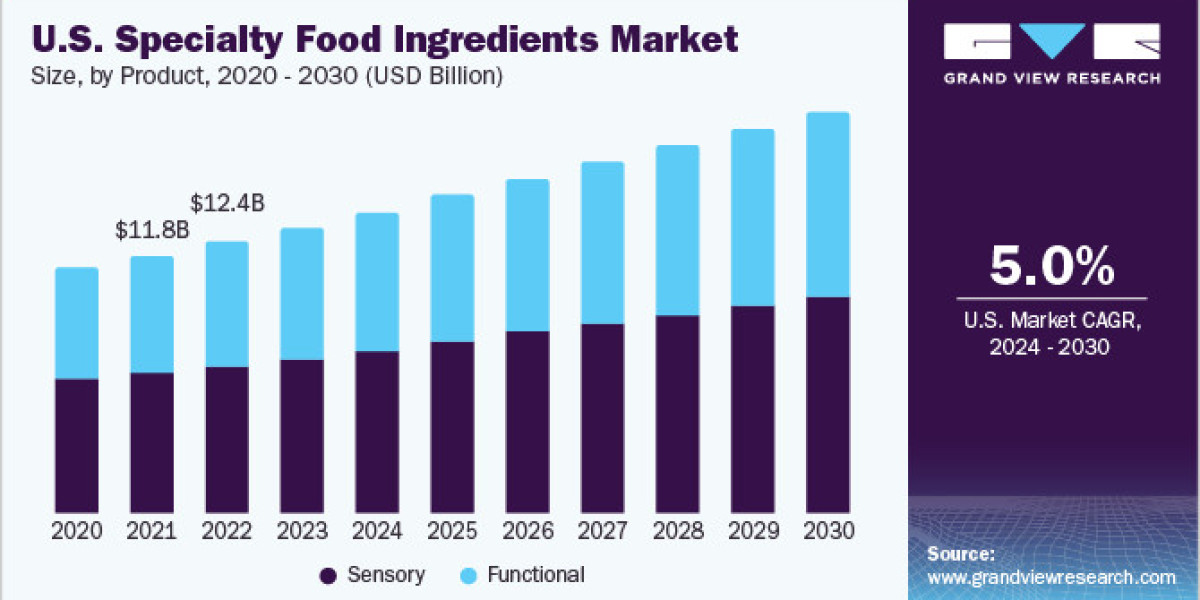

In the U.S., functional specialty food ingredients are expected to see significant growth from 2024 to 2030, driven by the expansion of organized retail. Changing consumer lifestyles, growing urban populations, rising economic activity in emerging markets, and the increasing popularity of e-commerce are macro factors contributing to the global market's expansion.

As the global population is projected to grow from 7.3 billion in 2015 to 9.7 billion by 2050, the demand for food is set to increase, fueling the need for specialty food ingredients. Additionally, changes in consumer shopping behavior during the COVID-19 pandemic have led to increased sales for companies offering center-of-the-store retail products that use specialty ingredients.

Product Insights

In 2023, the sensory ingredients segment accounted for 58.8% of the market’s revenue, as these ingredients are crucial for enhancing the flavor, aroma, texture, and appearance of food products. The rising demand for sensory ingredients in packaged and convenience foods and confectioneries is a major growth driver.

The flavor market is driven by a preference for organic and natural ingredients. Consumer tastes are constantly evolving, leading to increased demand for diverse flavors, especially in ready-to-eat products. This is further supporting the growth of the flavor segment. Key sensory elements include flavors, enzymes, colorants, and emulsifiers. Enzymes, in particular, are valued for their ability to enhance food processes, extend shelf life, and reduce the need for chemical additives. Flavors are integral to the taste profile of finished food products, and the segment's growth is supported by consumers’ changing lifestyles and their increasing demand for convenience foods.

Vitamins, widely used in foods, supplements, oils, and infant formulas, play a vital role in dietary fortification. Minerals are equally important, contributing to human nutrition and aiding the absorption of vitamins, such as calcium helping in vitamin D absorption.

Antioxidants are another essential ingredient, protecting products from spoilage, such as fat rancidity and color degradation, by preventing oxidation caused by bacteria, fungi, or yeast. Their use depends on the dietary formulation, while preservatives help extend the shelf life of foods. Changing consumer preferences toward safe, hygienic packaged foods, especially in developed regions, are expected to drive demand for these ingredients over the coming years.

Application Insights

In 2023, the food and beverage segment held a dominant market share of 70%, driven by shifts in consumer lifestyles and dietary preferences, which have boosted the processed food manufacturing sector. This is expected to continue driving demand for specialty food ingredients. Rising consumption of both alcoholic and non-alcoholic beverages, especially among younger consumers, is another contributing factor.

Increased awareness of health issues has led to a surge in demand for functional foods as consumers become more mindful of their diets. This has increased the demand for healthier ingredients in packaged foods, foodservice industries, and the broader food and beverage sectors.

The personal care industry has also seen notable growth as consumers increasingly seek natural and safe products free from harmful chemicals. This shift has encouraged manufacturers to incorporate specialty ingredients into their personal care offerings.

In the pharmaceutical industry, specialty food ingredients are becoming more valuable in the development of products aimed at improving health outcomes. These ingredients are used in a variety of pharmaceutical applications, including drug delivery systems, nutraceuticals, and functional foods.

Order a free sample PDF of the Specialty Food Ingredients Market Intelligence Study, published by Grand View Research.