The global commercial refrigeration equipment market was valued at USD 40.82 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is driven by the rapid expansion of the hospitality and tourism sectors and the increasing preference for takeaway meals among consumers. Additionally, regulations aimed at reducing global warming potential (GWP) refrigerants and ongoing technological advancements will offer further growth opportunities for the market.

The rise in international food trade has increased the demand for commercial refrigeration systems, especially for frozen and processed foods, as well as seafood, which require refrigeration during storage and transportation. Technological innovations, such as liquid-vapor compression and ammonia absorption systems, have further fueled demand for these products. Leading manufacturers are investing in research and development (R&D) to improve product design and temperature control, giving them a competitive edge. The growing need to monitor and control commercial kitchen environments is expected to further drive the market’s growth.

Gather more insights about the market drivers, restrains and growth of the Global Commercial Refrigeration Equipment Market

Products featuring smart or automated refrigeration controls are gaining popularity. For example, commercial refrigerators certified by ENERGY STAR consume only 1.89 kWh of energy per day on average, compared to 4.44 kWh for less efficient models. The demand for energy-efficient refrigeration units is rising due to growing awareness of their cost-effectiveness and environmental benefits, encouraging companies to innovate their designs.

Environmental concerns over the high GWP of refrigerants, such as those contributing to global warming and ozone depletion, are pushing manufacturers to find alternative solutions. As a result, there is growing interest in advanced technologies like magnetic refrigeration systems, which not only address environmental concerns but also enhance energy efficiency, reducing operational costs. According to the U.S. Department of Energy, these systems can save up to 30% in energy costs.

The COVID-19 pandemic temporarily disrupted the production and shipment of commercial refrigeration equipment due to lockdowns and containment measures. However, the crisis also led to a surge in demand for cold storage solutions to support vaccine production and distribution. This is expected to drive demand for transportation refrigeration equipment in the coming years.

Product Insights

In 2022, the refrigerators and freezers segment accounted for the largest revenue share, exceeding 22%. This is primarily due to the global expansion of the travel and tourism industry, leading to the opening of new food joints and restaurants. Blast chillers, which quickly cool items at lower temperatures to prevent bacterial growth, are also contributing to this segment’s growth. The use of chillers in the healthcare industry, for tasks such as storing vaccines and tissue samples, is another factor driving demand.

The beverage refrigeration segment is expected to grow at a CAGR of over 6.0% from 2023 to 2030. This growth is attributed to the increased demand for medium-capacity beverage coolers, which cater to travelers and vacationers. The rising popularity of “grab and go” and “sip and shop” trends in retail chains is also expected to boost demand for beverage refrigerators.

System Type Insights

In 2022, the self-contained refrigeration system segment dominated the market due to its easy and cost-effective installation, low maintenance, and affordable relocation. However, this segment also accounted for around 26% of global hydrofluorocarbon (HFC) emissions in 2020. Stringent emission regulations are driving manufacturers to switch from R-404A to R-448A refrigerants, which can reduce the GWP of refrigeration equipment by around 70%.

The remotely operated refrigeration system segment is anticipated to experience significant growth from 2023 to 2030. These systems are increasingly popular in restaurants with limited kitchen space, as they reduce the heat generated by refrigerators. While they offer quieter operation than self-contained units, they are less energy-efficient and require professional installation, which adds to their already high cost.

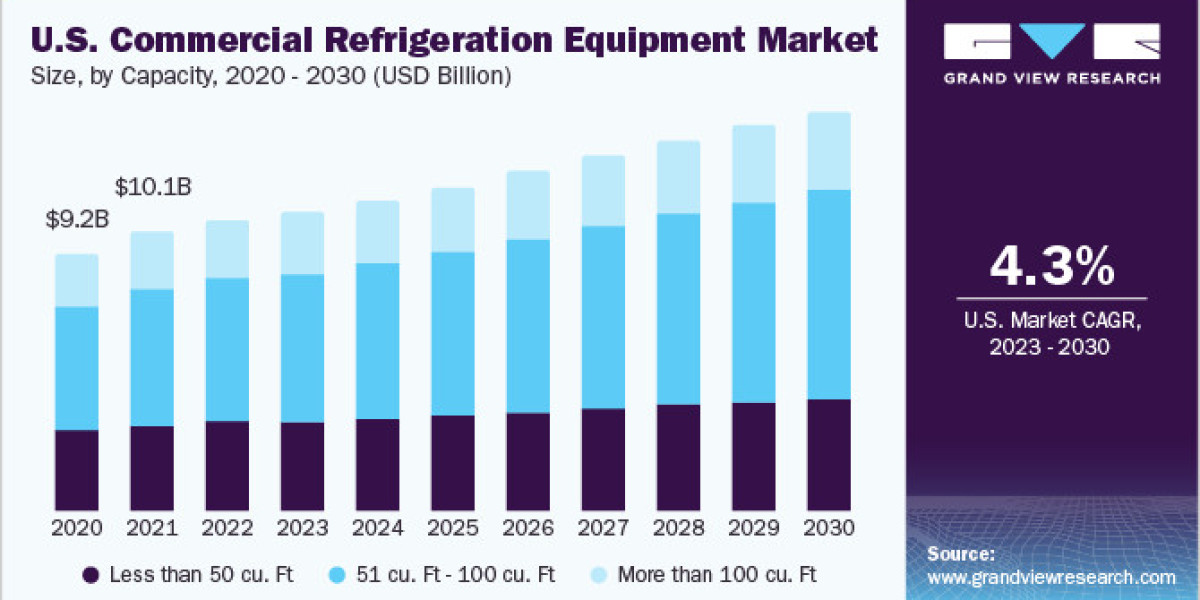

Capacity Insights

In 2022, the 51 to 100 cubic feet segment held the largest revenue share, driven by the growth of specialty food stores, hypermarkets, and supermarkets. These retail chains stock a wide variety of perishable products, such as fresh produce, dairy, meat, and frozen foods, which require extensive refrigeration. Regulatory compliance concerning food quality also boosts demand for commercial refrigerators in this capacity range.

The less-than-50 cubic feet segment is expected to grow the fastest from 2023 to 2030. These smaller refrigerators are in demand due to their compact size, energy efficiency, and suitability for businesses with limited space, such as convenience stores, cafes, and smaller restaurants. These units are also popular in cold chain logistics and food service applications due to their ability to store perishable items in space-constrained environments.

Application Insights

The food and beverage retail segment is expected to grow at a substantial CAGR from 2023 to 2030. The development of cold chain logistics for transporting temperature-sensitive products is driving growth in this segment. Additionally, there is a growing demand for high-end, temperature-controlled refrigerators used in transportation vehicles to ensure the reliable distribution of beverages, biopharmaceuticals, and perishable foods. Capital-intensive customers in the food and beverage distribution industry are also increasingly investing in sectional refrigerated trailers, which will contribute to the segment’s growth.

In 2022, the food service segment accounted for approximately 32% of the total market revenue. The growth of quick-service restaurants (QSRs) and food trucks is fueling demand for refrigeration equipment in this sector. According to the National Restaurant Association (NRA), the U.S. had over 1 million restaurant locations in 2022, including QSRs, full-service restaurants (FSRs), bars, and taverns, all of which require commercial refrigeration equipment. The expansion of major food and beverage chains like McDonald’s, Subway, and Starbucks is expected to further increase demand in the commercial refrigeration market.

Order a free sample PDF of the Commercial Refrigeration Equipment Market Intelligence Study, published by Grand View Research.