The global gallium nitride semiconductor devices market size was estimated at USD 2.56 billion in 2023 and is projected to grow at a CAGR of 26.4% from 2024 to 2030. The growth of the market can be attributed to the ability of gallium semiconductors to provide high-speed performance as well as contribute to lower carbon emissions, which position them as effective devices in the field of electronics. Gallium Nitride (GaN) possesses a wide band gap that makes the device more compact and capable of handling larger electric fields.

As GaN possesses a wider band gap (approximately 3.4 eV) in contrast to silicon (1.2 eV), it facilitates higher carrier density, exceptionally low resistance, and capacitance, contributing to better speeds of 100 times faster. In addition, the integration of GaN technology across diverse sectors such as optoelectronics, automotive, and data centers has been instrumental in driving the growth of the market.

The automotive sector is currently experiencing a significant transformation towards electrification, with GaN semiconductor devices emerging as crucial components driving this change. Leveraging GaN's exceptional efficiency and robust power handling capabilities, various applications within electric vehicles, including onboard chargers, DC-DC converters, and power inverters, are being optimized for enhanced performance. As the global demand for electric vehicles escalates, the market for GaN semiconductor devices is positioned for substantial expansion, playing a pivotal role in accelerating the widespread adoption of electric transportation solutions. This evolution not only underscores the automotive industry's commitment to sustainability but also signifies a paradigm shift towards cleaner and more efficient mobility solutions on a global scale.

Gather more insights about the market drivers, restrains and growth of the Global Gallium Nitride Semiconductor Devices Market

Product Insights

The opto-semiconductors segment dominated the market with a revenue share of 37.37% in 2023. This can be largely attributed to the application of opto-semiconductors in devices such as LEDs, solar cells, photodiodes, lasers, and optoelectronics. The automotive sector is increasingly utilizing opto-semiconductors in automotive lights, indoor and outdoor lighting, and pulse-powered lasers. This is subsequently propelling the adoption of opto-semiconductors in the automotive and consumer electronics industries. Furthermore, opto-semiconductors are being widely used in applications such as Light Detection and Ranging (LiDAR) and pulsed laser, which bodes well for the growth of the segment.

Component Insights

The power IC segment dominated the market in 2023. The segment growth can be attributed to the increasing usage of GaN-based power ICs that offer features such as efficient navigation, collision avoidance, and real-time air traffic control. In addition, the segment growth is propelled by companies such as Fujitsu Ltd., Qorvo, Inc., and Toshiba Corporation, focusing on the development of power ICs for telecom and automotive applications. Furthermore, the ever-growing focus on energy efficiency and sustainability is fueling the adoption of GaN power ICs due to their inherently lower power losses and higher switching speeds compared to conventional silicon-based alternatives.

Wafer Size Insights

The 4-inch segment dominated the market in 2023. This is because 4-inch wafers facilitate the large-scale production of semiconductor devices. The implementation of 4-inch wafers is increasing rapidly as these wafers help overcome the limitations of 2-inch wafers and are widely used in semiconductor product-based industries. Furthermore, the increasing demand for gallium nitride devices with 4-inch wafers in high-power amplifiers, optoelectronics devices, telecom frontends, and high-temperature devices is driving the segment growth. Moreover, the suitability of a 4-inch substrate for space communication applications, owing to its radiation-hardened properties, is anticipated to be a key factor influencing segment growth.

Application Insights

The Radio Frequency (RF) segment dominated the market in 2023. In recent years, the gallium nitride semiconductor devices industry has witnessed a significant surge in demand, predominantly fueled by the escalating adoption of RF applications. This trend is primarily attributed to the inherent advantages of GaN technology, such as higher power density, enhanced efficiency, and improved thermal management capabilities compared to traditional silicon-based counterparts. In addition, companies across the globe are also focusing on launching GaN on SiC RF power transistors suitable for wideband applications. For instance, in January 2023, NXP Semiconductors N.V., a semiconductor device manufacturer, launched the MMRF5018HS, a GaN on SiC RF Power Transistor capable of delivering 125 W CW power. GaN on SiC RF Power Transistor is enclosed in a low Rth NI-400HS air cavity ceramic package and offers exceptional performance in terms of both gain and ruggedness. Its versatility makes it perfect for various RF applications, including pulse, continuous wave (CW), and wideband scenarios.

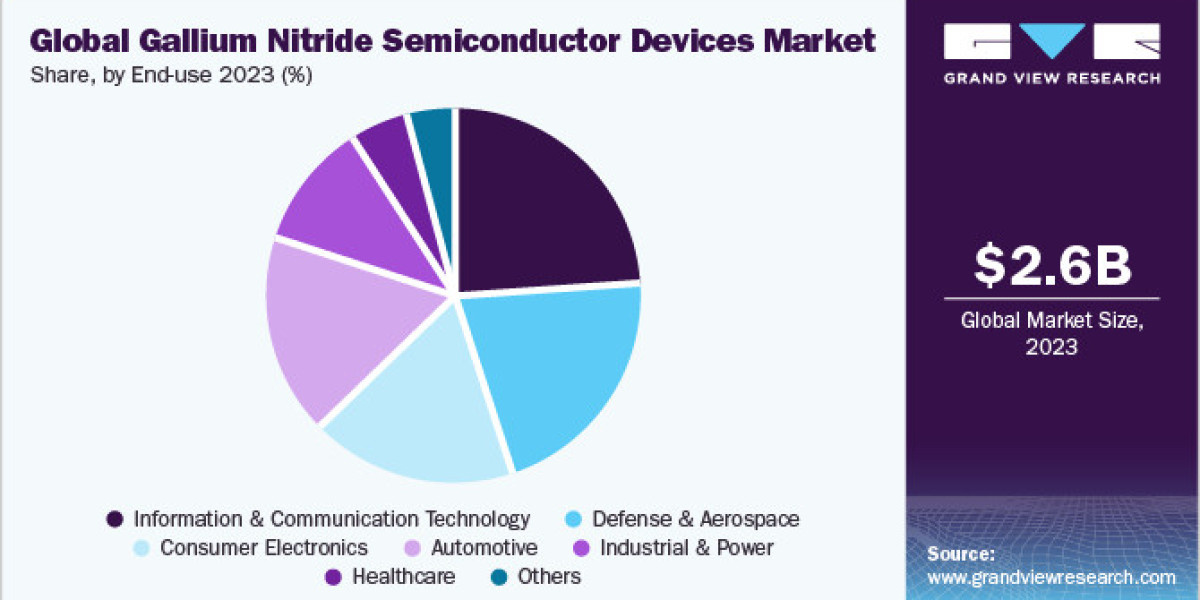

End-use Insights

The Information & Communication Technology (ICT) segment dominated the market in 2023. The segment growth can be attributed to the increasing adoption of Internet-of-Things (IoT) technology globally. IoT devices demand efficient and cost-effective components that facilitate a constant exchange of information. GaN-based semiconductors are expected to suffice low power consumption and high-efficiency requirements for the proper functioning of IoT-enabled products. In addition, these semiconductors are widely used in Distributed Antenna System (DAS), small cell, and remote radio head network densification. They are also used in data centers, servers, base stations, transmission lines, satellite communication, and base transceiver stations, among others.

Browse through Grand View Research's Semiconductors & Electronics Industry Research Reports.

· Reference Thermometer Market: The global reference thermometer market was valued at USD 11.4 million in 2023 and projected to grow at compound annual growth rate (CAGR) 5.4% from 2024 to 2030.

· Household Vacuum Cleaners Market: The global household vacuum cleaners market size was valued at USD 6.57 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.8% from 2024 to 2030.

Regional Insights

The North America gallium nitride semiconductor devices market dominated globally in 2023 with the largest revenue share of 35.48%. Increasing investments from the defense and aerospace industry in research & development are fueling the market growth in the region. Furthermore, funding provided by government bodies to semiconductor companies is expected to drive market growth in the region. Companies in this region are also focusing on launching the commercialization rights for a range of gallium nitride on silicon (GaN-on-Si) patents. For instance, in March 2024, 5N Plus Inc., a semiconductor technology company, launched the commercialization rights for a collection of gallium nitride on silicon (GaN-on-Si) patents. According to the company, these patents can facilitate the swift development of prototypes and the early market introduction of innovative vertical GaN-on-Si power devices.

Key Gallium Nitride Semiconductor Devices Company Insights

Some of the key players operating in the market are Infineon Technologies AG, NXP Semiconductors, and Toshiba Corporation.

· Infineon Technologies AG, one of the prominent players in the semiconductor industry, is strategically positioned to capitalize on the evolving opportunities within the GAN semiconductor market. With a rich legacy of innovation and a robust portfolio of semiconductor solutions, Infineon Technologies AG is well-equipped to leverage GaN technology to address the evolving needs of various industries. Infineon's foray into GaN semiconductor devices underscores its commitment to advancing power electronics and driving efficiency across diverse applications.

· NXP Semiconductors N.V. is an international electronics corporation headquartered in Austin, Texas, with Dutch-American roots. Renowned for its diverse product portfolio encompassing radio frequency, power management, analog, security, interface, and digital processing solutions, the company serves various sectors. Among its prominent offerings are automotive applications, including safety features, power management systems, radio frequency technologies, secure car access mechanisms, media and audio processing solutions, and in-vehicle network systems, all built upon the foundation of GaN.

Efficient Power Conversion Corporation, Qorvo, Inc., and GaN Systems are some of the emerging market participants in the market.

· Efficient Power Conversion Corporation (EPC) is one of the renowned players in the semiconductor industry, recognized for its cutting-edge power management solutions. With a focus on gallium nitride (GaN) technology, EPC specializes in developing high-performance GaN-based power conversion devices for various applications. The company's product portfolio includes power transistors, integrated circuits, and modules designed to deliver superior efficiency and performance.

· Qorvo, Inc., a company known for its diverse range of semiconductor products and solutions, boasts a comprehensive portfolio encompassing radio frequency (RF), power management, and semiconductor technologies. The company serves a wide array of industries, including telecommunications, automotive, and consumer electronics, with innovative solutions tailored to meet evolving market demands.

Key Gallium Nitride Semiconductor Devices Companies:

The following are the leading companies in the gallium nitride semiconductor devices market. These companies collectively hold the largest market share and dictate industry trends.

· Fujitsu Ltd.

· Efficient Power Conversion Corporation

· Transphorm, Inc.

· Infineon Technologies AG

· NXP Semiconductors.

· Qorvo, Inc

· Texas Instruments Incorporated.

· Toshiba Corporation

· GaN Systems

· NTT Advanced Technology Corporation.

Order a free sample PDF of the Gallium Nitride Semiconductor Devices Market Intelligence Study, published by Grand View Research.