The global Intelligent Transportation System market size was valued at USD 51.16 billion in 2023 and is expected to grow at a significant CAGR of 8.5% from 2023 to 2030. Growing demand for traffic control solutions & smart vehicles, the improved safety and monitoring offered by License Plate Recognition (LPRs), modern cameras, and the emergence of smart cities, are contributing to the growth. Intelligent Transportation System (ITS) provides traffic management solutions that enable enhanced road safety, traffic flow, and mobility, creating a positive market outlook. The COVID-19 pandemic hampered the implementation projects and new ITS sales & installations in 2020. However, the ITS market witnessed significant growth from mid-2021 owing to increasing investment by various countries' governments in infrastructure development activities to recover the pandemic-affected economy.

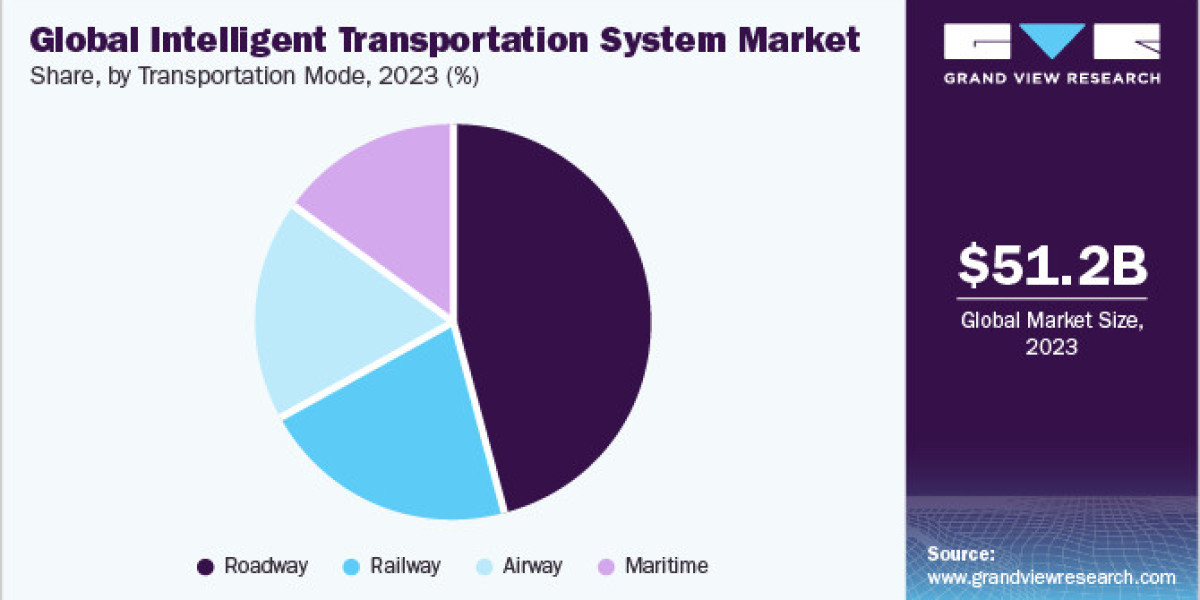

The growing number of vehicles, boats, planes & rails, aging infrastructure, and a looming lack of traffic data management are some of the other factors anticipated to contribute to the ITS market’s growth. As a result, the rising need for traffic management solutions across various transport modes such as airways, maritime, roadways & railways has triggered the need for advanced traffic management solutions. The implementation of smart technologies and several efforts have been taken by both public and private organizations by varying measures, demonstrating the role of technology will help in the intelligent transportation system market growth.

Gather more insights about the market drivers, restrains and growth of the Global Intelligent Transportation System Market

Detailed Segmentation:

Transportation Mode Insights

The roadway segment accounted for the largest market share in 2022. The constant increase in traffic congestion and greenhouse gas emissions is driving the adoption of roadways intelligent transportation systems, including the use of electric vehicles, Advanced Traffic Management Systems (ATMS), Advanced Public Transportation System (APTS), and the deployment of smart infrastructure, among others. The use of big data analytics in traffic management is increasing. Intelligent Traffic Signal System uses data from a variety of sources, including sensors, cameras, and connected cars, to gain insights into traffic patterns and enable more informed decisions about signal control and overall traffic management. Furthermore, governments of several countries are heavily investing in road infrastructure projects to support sustainable transport, enhance interoperability among various systems, and improve road safety. For instance, in June 2022, the European Union (EU) invested around USD 6.14 billion to support around 135 transport infrastructure projects across Europe.

Roadway Offering Insights

The hardware segment accounted for the largest market share of over 45.0% in 2022. Increasing public and private investment in smart cities and the growing need to improve the roadway infrastructure to manage the increasing number of vehicles are driving the growth of the hardware segment. Hardware’s abilities to satisfy different computational requirements of ML algorithms in various ITS systems are expected to contribute towards segment growth in the roadway intelligent transportation system market through 2030.

Railway Offering Insights

The hardware segment accounted for the largest market share of over 45.0% in 2022. The high revenue share of the hardware segment in the railway ITS market can be attributed to the growing concern related to railway collision, which has propelled the adoption of digital signaling & control systems and Positive Train Control (PTC) & Automatic Train Control (ATC) systems. Moreover, the adoption of reliable and high-speed communication networks for robust data exchange between control centers, trains, and infrastructure is further driving the segment growth.

Airway Offering Insights

The hardware segment accounted for the largest market share of over 42.0% in 2022. The improved air traffic management & safety, continuous increase in air travel demand, and heightened concerns related to aviation safety & security are resulting in higher market share of the hardware segment. Moreover, advancements in navigation and satellite communication system are expected to create lucrative opportunities for segment growth in the forecast period.

Regional Insights

North America held the majority share of over 35.0% in 2022. The region is home to major global players and is well-equipped with several technologies for the development and implementation of the latest and advanced technologies, such as machine learning, big data, and cloud computing, to manage the increasing traffic and public transportation system. Strong emphasis of the regional governments on improving transportation infrastructure is driving the growth of the ITS market.

Intelligent Transportation System (ITS) market in Europe is experiencing a significant challenge in terms of traffic congestion, leading to higher traffic volumes, longer commuting times, and waste of energy and non-renewable resources. In response, governments and transportation authorities are shifting to ITS technologies to optimize traffic flow, reduce congestion, and modernize existing infrastructure. Furthermore, key companies in the region are actively participating in the region’s drive against environmental protection and focusing on minimizing energy consumption.

Browse through Grand View Research's Technology Industry Research Reports.

· Data Science Platform Market: The global data science platform market size was valued at USD 96.25 billion in 2023 and is projected to grow at a CAGR of 26.0% from 2024 to 2030.

· Automatic Emergency Braking Market: The global automatic emergency braking market size was valued at USD 69.5 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030.

Key Companies & Market Share Insights

The key players operating in the intelligent transportation system (ITS) market include Thales Group; Hitachi, Ltd.;NEC Corporation; Siemens AG; and others.

· Thales Group has a diverse portfolio of solutions spanning various aspects of transportation, including traffic management, rail signaling, communication systems, navigation, and aerospace. This comprehensive range allows Thales to offer end-to-end solutions for complex ITS requirements.

· NEC Corporation provides advanced traffic management systems that leverage real-time data, analytics, and communication technologies. These systems aim to optimize traffic flow, reduce congestion, and enhance overall transportation efficiency.

Spire Global, TransCore and others are the emerging players operating in the intelligent transportation system market.

· Spire Global's satellite-based data collection capabilities could be utilized for traffic monitoring and analytics. This might involve obtaining real-time data on traffic patterns, congestion, and road conditions from a satellite perspective.

· TransCore offers traffic management and control solutions to optimize the flow of traffic, reduce congestion, and improve overall transportation efficiency. This includes systems for adaptive traffic signal control, real-time monitoring, and dynamic message signs.

Key Intelligent Transportation System Companies:

· Advantech Co., Ltd.

· Aireon

· Alstom SA

· Cubic Corporation

· EFKON GmbH

· Hitachi, Ltd.

· Indra Sistemas, S.A.

· Iteris, Inc.

· Kapsch TrafficCom AG

· KONGSBERG

· L3Harris Technologies, Inc.

· Navico Group

· NEC Corporation

· Siemens AG

· Spire Global

· Teledyne Technologies Incorporated

· Thales

· TransCore

· Wabtec Corporation

Recent Developments

· In July 2023, Hitachi Rail, a division of Hitachi, Ltd., announced the expansion of its digital transport app named 360Pass. Based on this development, Hitachi Rail signed a new contract with Genoa’s (U.S.) city transit authority to connect Genoa's whole public transport infrastructure, including 600,000 citizens and 3,500,000 annual visitors, with the 360-pass digital transport app.

· In August 2023, Hitachi Rail, a division of Hitachi, Ltd., announced that it had won a contract worth USD 1.96 billion to design and implement digital signaling systems and tracks for a new High Speed/Capacity (HS/C) line traversing the Italian city of Vicenza.

· In August 2023, NEC Corporation announced that it has been selected by the UP State Road Transport Corporation (UPSRTC) as an master system integrator for VLT-PSIS project. This will help curb safety concerns for buses and improve the overall experience as well.

· In October 2023, DENSO CORPORATION and KOITO MANUFACTURING CO., LTD., a lighting equipment manufacturer for the automobile sector, collaborated to introduce a system to improve nighttime driving safety by enhancing the object recognition accuracy of vehicle image sensors through the coordination of lamps and sensors.

Order a free sample PDF of the Intelligent Transportation System Market Intelligence Study, published by Grand View Research.