The global data center cooling market size was estimated at USD 18.65 billion in 2023 and is expected to grow at a compounded annual growth rate (CAGR) of 16.8% from 2024 to 2030. The increasing demand for energy-efficient data centers is anticipated to create lucrative growth opportunities for the market. Several key companies are preparing for the expansions. Moreover, the favorable growth prospects can be attributed to the rapid increase in data generation and the subsequent rise in the demand for data centers across the globe. Data centers consume a large amount of power, which generates a massive amount of heat, which creates the need for efficient cooling equipment.

Furthermore, the growing popularity of OTT platforms and streaming services has led to a remarkable increase in data volumes; which is projected to fuel the demand. The rapid growth experienced by cloud services, the growing prominence of big data, and improved penetration of connected devices are encouraging organizations to increase their investments in building new data center facilities. All these factors are anticipated to boost the demand for data center cooling systems. This demand is directly proportional to an increase in the number of data center facilities globally. The increased spending on IT infrastructure after the pandemic is creating avenues for the expansion of new and existing data center facilities across the world. Moreover, software-based data centers are also contributing to market growth by offering an enhanced level of automation.

Gather more insights about the market drivers, restrains and growth of the Global Data Center Cooling Market

Detailed Segmentation:

Component Insights

The solution segment accounted for the largest market share in 2023. Businesses can maintain a suitable temperature and guarantee the correct operation of data centers with the help of data center cooling solutions. In addition, to reach appropriate cooling levels when the weather is warm, cooling solutions are frequently used to pre-cool the air. These factors are expected to support the segment expansion.

Solution Insights

The air conditioners segment held the largest share of over 30.0% of the overall revenue in 2023. Air conditioners are a popular choice among most end-users since they meet the demand for 24-hour protection while lowering energy costs. During storage and analysis of data for effective decision-making, heavily packed racks generate a large amount of heat. As such, air conditioners enable businesses to maintain an adequate temperature level and ensure the proper functioning of data centers. In addition, air conditioners are heat exchangers that maintain the required level of room temperature in a sensitive IT environment.

Services Insights

The installation & deployment segment led the market and accounted for the highest revenue share in 2023. Increased installation and deployment of liquid-based heat removal equipment can have a major effect on power-supporting climate control systems, which is driving the segment growth. Higher-density installations are influencing the IT power plan. Other coolants and fan installations are included in the service, which makes it easier to balance design and optimization. When optimization and strategic deployment are coupled, cooling equipment can operate without overheating and with less of an adverse effect on the environment.

Type Insights

The non-raised floor segment held the largest revenue share of nearly 52% in 2023. Non-raised floor is essential to the integration of contemporary surveillance and thermal assessment systems. It allows the service providers to detect and resolve problems before they arise by giving real-time monitoring of temperature variations across the data center. The streamlined construction process uses less labor and material, which reduces upfront costs. A growing number of non-raised floor options are being offered to meet the demands of sustainability and energy efficiency. Enhancements in material science, design, and cooling technology would reduce the detrimental environmental effects caused by data centers.

Containment Insights

The containment segment is further segregated into raised floor with containment and raised floor without containment. The raised floor with containment segment is further segregated into Hot Aisle Containment (HAC) and Cold Aisle Containment (CAC). The segment captured a considerable share of over 56% in 2023 owing to the increased adoption of hot and cold aisle containment methods. The hot aisle containment segment is expected to grow at the highest CAGR exceeding 15% from 2024 to 2030 owing to the presence of an enhanced return airflow management option.

Application Insights

IT & telecom, retail, healthcare, BFSI, and energy are the key sectors with massive data center requirements. In 2023, the demand for data center cooling solutions in IT & telecom witnessed massive growth, which is attributed to the pandemic. As the world moved toward the adoption of a remote working culture, the demand for IT infrastructure witnessed a surge, creating avenues for new cooling solutions. The retail segment is likely to grow at a CAGR exceeding 16.0% from 2024-2030. This is attributed to the extensive use of Image Processing Verification Tools (IPVT), social media, smartphones, and tablet computers, which led to the increasing volume of data, thereby boosting the demand for data center cooling solutions.

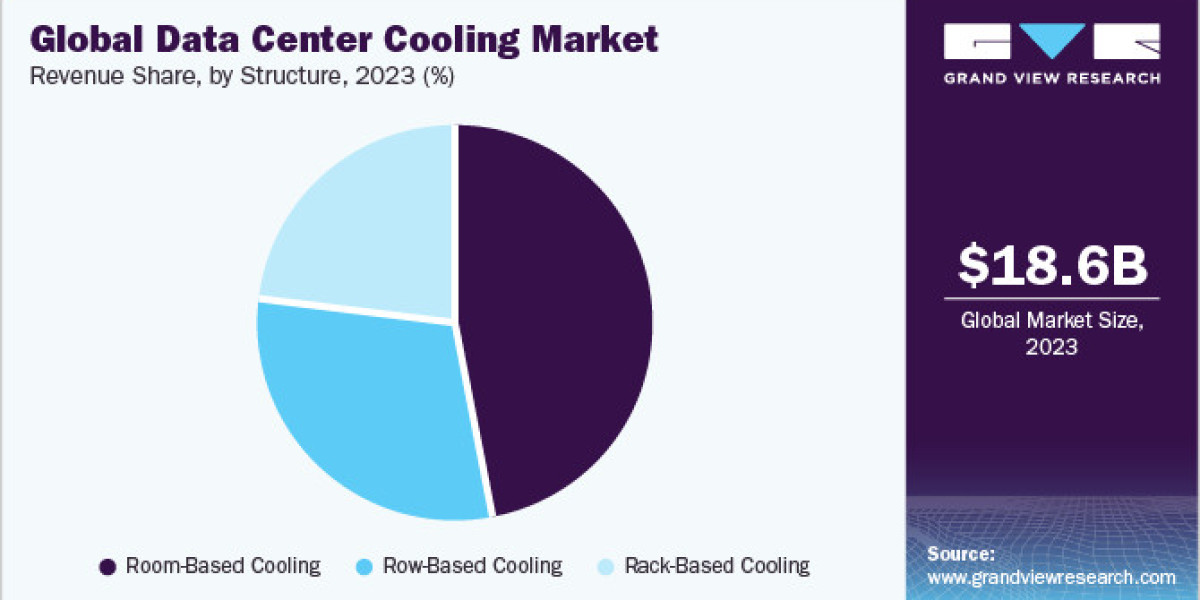

Structure Insights

Rack, row, and room-based cooling are the major cooling types by structure. Of the three, room-based cooling captured a significant share in 2023 and the segment is expected to grow at a CAGR exceeding 15.0% from 2024 to 2030. The room-based cooling technique has become a widely used technique, resulting in a higher market share. The method is popular as it maintains adequate temperature by continuously mixing hot & cold air, ensuring the prevention of hot spots.

Regional Insights

In 2023, North America led the global demand for data center cooling solutions and is projected to grow at an estimated CAGR exceeding 12.0% from 2024 to 2030. The region promises to undergo advanced adoption of new technology-based solutions with the prevalence of technology giants, including Facebook, Amazon Inc., and Google Inc. The region has a substantial number of data centers marked by the presence of several IT companies, creating avenues for the data center cooling solutions industry. Thus, driving market growth in North America.

Browse through Grand View Research's Technology Industry Research Reports.

· Automatic Identification And Data Capture Market: The global automatic identification and data capture market size was valued at USD 69.81 billion in 2024 and is projected to grow at a CAGR of 11.7% from 2025 to 2030.

· Data Science Platform Market: The global data science platform market size was valued at USD 96.25 billion in 2023 and is projected to grow at a CAGR of 26.0% from 2024 to 2030.

Key Data Center Cooling Company Insights

Some of the key players operating in the market include Vertiv Group Corp. and Schneider Electric.

· Schneider Electric offers automation management electricity distribution solutions. The company also manufactures components for energy management systems. It operates through two primary business segments, namely Energy Management and Industrial Automation.The Energy Management segment is further divided into medium voltage, low voltage, and secure power subsegments. The secure power subsegment offers products and solutions for hospitals, data centers, and homes & buildings. The data center cooling market belongs to the secure power subsegment

· Vertiv Group Corp. provides critical infrastructure that caters to vital applications for three primary end markets, namely communication networks, data centers, and commercial and industrial facilities. These end markets are operated through various brands, namely Liebert, NetSure, Geist, and Avocent. The data center market has been further categorized into cloud/hyper-scale, Colocation, Enterprise, and Edge. Vertiv has three principal offerings, namely critical infrastructure and solutions, IT and edge infrastructure, and service and solution

· Rittal Gmbh & Co. K.G. and STULZ GMBHare some of the emerging market participants in the data center cooling market.

· Rittal Gmbh & Co. K.G. supplies power distribution, enclosures, climate control, IT infrastructure, and other software & service solutions. The company operates as a part of the Friedhelm Loh Group. The company's sister companies include Cideon, German Edge Cloud (GEC), EPLAN, Stahlo, LKH, and iNNOVO Cloud

· STULZ GMBH is one of the leading manufacturers and solution providers of cooling and humidity management technology for mission-critical applications. It offers air conditioning solutions for data centers, low-load applications, homes, IT rooms, chilled water production centers, shelters, free cooling spaces, air handling and chiller units, and shelter cooling products. The company offers its air-cooling products to the data center, telecom, medical, and industrial cooling sectors. It also develops customized in-house energy management systems and solutions to monitor energy consumption

Key Data Center Cooling Companies:

The following are the leading companies in the data center cooling market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these data center cooling companies are analyzed to map the supply network.

· Air Enterprises

· Asetek, Inc.

· Climaveneta

· Coolcentric

· Dell Technologies Inc.

· Fujitsu

· Hitachi, Ltd.

· Johnson Controls

· Mitsubishi Electric Corporation

· Nortek Air Solutions, LLC

· NTT Limited

· Rittal GmBH & Co. KG

· Schneider Electric SE

· STULZ GMBH

· Telx Inc

Order a free sample PDF of the Data Center Cooling Market Intelligence Study, published by Grand View Research.