The global industrial refrigeration systems market size is anticipated to reach USD 27.66 billion by 2030, registering a CAGR of 4.4% from 2023 to 2030, according to a new report published by Grand View Research, Inc. The demand for industrial refrigeration is increasing due to the fast-moving consumer goods and retail food which needs efficient storage for perishable edible items. Governments are taking initiatives to support and strengthen the cold chain infrastructure and shifting towards eco-friendly refrigeration systems.

Global warming and climate change have alarmed nations to take the necessary step to curb the crisis. As a result, industrial refrigeration system manufacturing companies have expressed concerns regarding the potential of global warming and ozone depletion of their refrigerants. As a result, companies are focusing on technologies to offer improved cost-effectiveness, lesser toxic refrigerants, lower energy consumption, and less toxic materials.

Access the Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report 2024-2030, published by Grand View Research

For instance, DanFoss, a prominent manufacturer of industrial refrigeration systems, introduced Cool selector 2 to help them design and optimize their air conditioning and refrigeration systems. System designers, engineers, and consultants can use the software to make optimum use of energy and HVACR systems. The benefits of using CO2 refrigeration systems are recognized worldwide as CO2 has a GWP (Global Warming Potential) of 1. The new update allows you to calculate components from the standpoint of an application for transcritical high-pressure side systems.

With the advancements in technology, industrial refrigeration systems have shown enhancement in their processes. Innovations have led to the manufacturing of smart and intelligent devices that monitor, set temperature, and notify the person as and when needed. The incorporation of Artificial Intelligence (AI) in the systems became a breakthrough in the market by enhancing productivity and lowering the operational cost for the organizations.

The industry growth in Asia Pacific is anticipated to observe the fastest growth during the forecast period. This expansion is attributed to the rapid growth prospects of cold-chain storage infrastructure in the countries such as Japan, India, and China. For instance, India is the second-largest fruit and vegetable producer, worldwide. The cold storage and handling the refrigeration of this huge vegetable and fruit produce is a challenging job thus fueling the market growth.

Order Your Sample Copy of the Industrial Refrigeration Systems Market Size, Share & Trends Analysis Report By Component (Compressors, Condensers, Evaporators, Controls, Others), By Capacity, By Refrigerant, By Application, By Region, And Segment Forecasts, 2024 - 2030

Industrial Refrigeration Systems Market Report Highlights

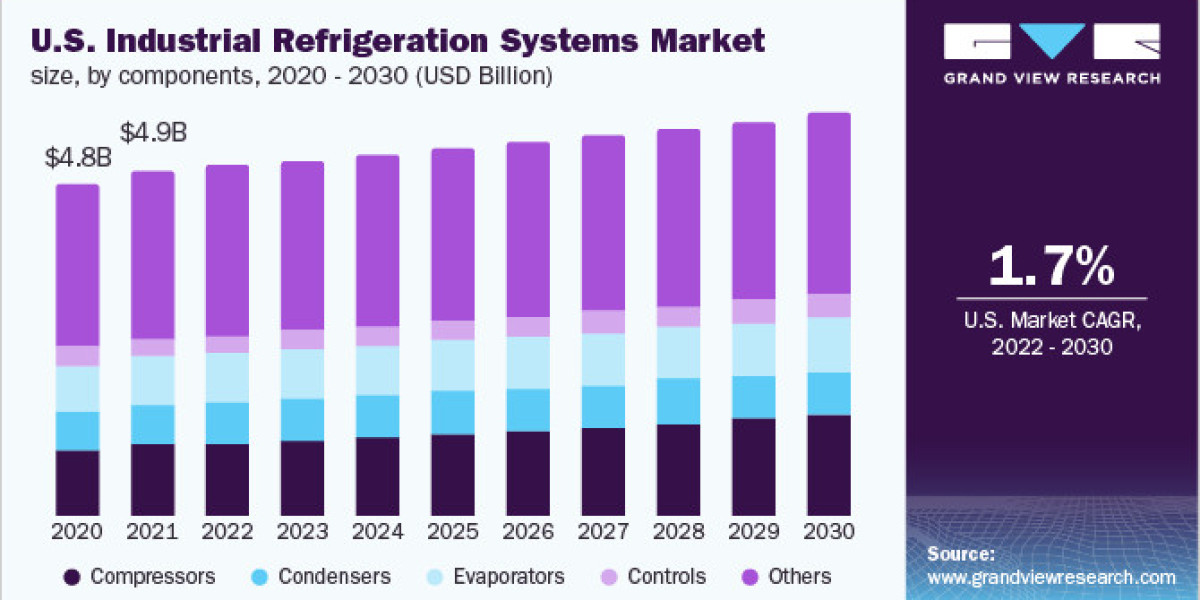

- The compressor segment is the largest growing component in the refrigeration system as they are used in commercial as well as industrial refrigeration, heat pumps, and air conditioning applications

- Food and beverage applications accounted for the largest market share due to the growing disposable income and the rising population. It has augmented the demand for frozen and processed food products

- The 500-1000kW capacity segment led the industrial refrigeration systems market as they helped extend the shelf life and reduce product wastage

- Asia Pacific is the highest-growing region in the market due to the maximum number of fruits and vegetable producers and also a requirement for cold-chain storage

Recent Developments

- In November 2023, DAIKIN Industries Ltd. introduced a fully electric and plug-in hybrid transport refrigeration product range aimed at reducing emissions from internal combustion engines.

- In June 2023, Johnson Controls acquired M&M Carnot, a provider of natural refrigeration solutions with ultra-low global warming potential (GWP). This acquisition is projected to support Johnson Controls’ move to help customers meet sustainability goals. The acquisition also strengthened the portfolio of Johnson Controls, which meets environmental regulations.

- In March 2023, Emerson launched the new Vilter-branded trans-critical CO2 compressor. According to the company, this compressor is designed for handling high-pressure industrial CO2 refrigeration.

- In February 2023, Danfoss announced the construction of a compressor and sensor manufacturing facility in Apodaca, Mexico. This expansion strategy was aimed at meeting the demand for cooling technology from the U.S.

Explore Horizon, the world's most expansive market research database

About Grand View Research

Grand View Research, U.S.-based market research and consulting company, provides syndicated as well as customized research reports and consulting services. Registered in California and headquartered in San Francisco, the company comprises over 425 analysts and consultants, adding more than 1200 market research reports to its vast database each year. These reports offer in-depth analysis on 46 industries across 25 major countries worldwide. With the help of an interactive market intelligence platform, Grand View Research helps Fortune 500 companies and renowned academic institutes understand the global and regional business environment and gauge the opportunities that lie ahead.

Contact:

Sherry James

Corporate Sales Specialist, USA

Grand View Research, Inc.

Phone: 1-415-349-0058

Toll Free: 1-888-202-9519

Email: [email protected]