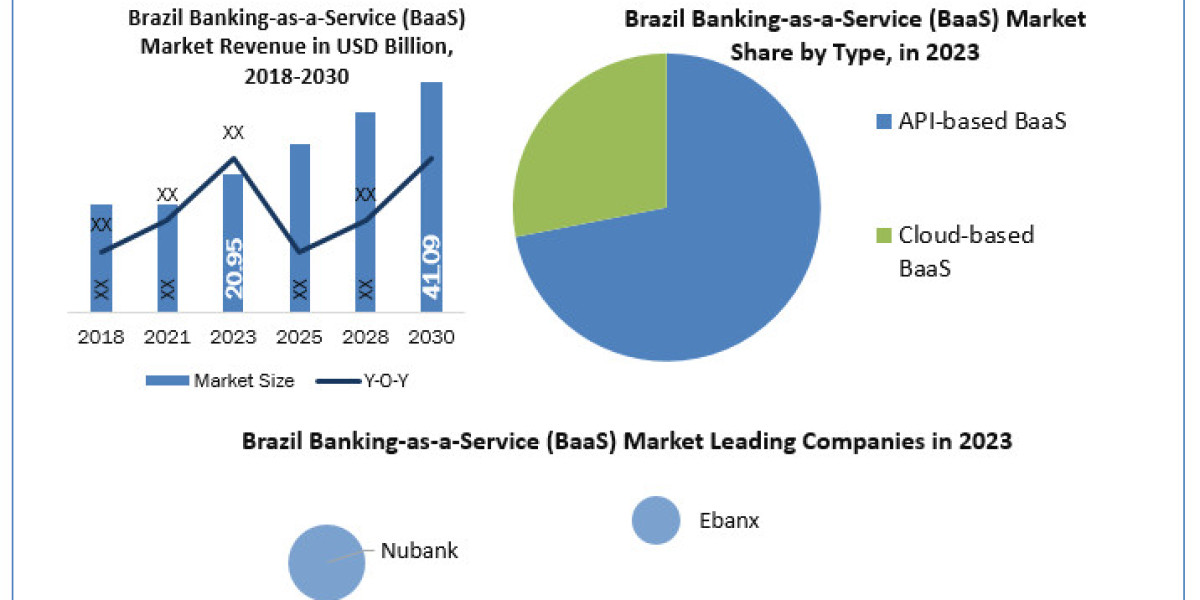

Brazil Banking-as-a-Service (BaaS) Market size was valued at US$ 20.95 Billion in 2023 and the total Brazil Banking-as-a-Service (BaaS) revenue is expected to grow at 10.1% through 2024 to 2030, reaching nearly US$ 41.09 Billion.

Brazil Banking-as-a-Service (BaaS) Market Overviews

Maximize Market Research study in comprehensive market analysis, providing insights into the current status, historical evolution, and CAGR of the Brazil Banking-as-a-Service (BaaS) market. The key factors for market size estimations are trend analysis, revenue forecasts, and market dynamics, this study equips clients with invaluable data to strategize market entry approaches and enables investors to grasp the prevailing landscape within the Brazil Banking-as-a-Service (BaaS) industry.

Request free sample:https://www.stellarmr.com/report/req_sample/Brazil-Banking-as-a-Service-BaaS-Market/242

Brazil Banking-as-a-Service (BaaS) Market Scope and Methodology:

The research delivers a comprehensive examination of the global Brazil Banking-as-a-Service (BaaS) market, covering vital aspects such as market size, share, growth trends, supply-demand dynamics, innovations, and recent advancements. Stakeholders in the Brazil Banking-as-a-Service (BaaS) companies can use the report's tables, statistics, and figures for strategic planning aimed at achieving organizational objectives. Detailed company profiles of key players in the Brazil Banking-as-a-Service (BaaS) market are provided, featuring revenue insights, company profiles, product specifications, pricing strategies, and sales margins. Employing Porter's Five Forces Analysis, the report delineates, characterizes, and evaluates the competitive environment within the Brazil Banking-as-a-Service (BaaS) market, employing a bottom-up approach to gauge market size. The report includes a listing of major competitors in the Brazil Banking-as-a-Service (BaaS) market, alongside new entrants, offering a comprehensive view of the market's competitive landscape. SWOT analysis is used, with a specific focus on global key players.

Brazil Banking-as-a-Service (BaaS) Market Regional Insights

The industrial study of MMR provides comprehensive details into the impact of regional dynamics on economic, social, and political factors across North America, Europe, Asia Pacific, the Middle East, Africa, and South America. It study the key countries within each region, examining their unique characteristics.

Brazil Banking-as-a-Service (BaaS) market:https://www.stellarmr.com/report/Brazil-Banking-as-a-Service-BaaS-Market/242

Brazil Banking-as-a-Service (BaaS) Market Segmentation:

By Type

API-based BaaS

Cloud-based BaaS

By Enterprise

SMEs

Large Enterprises

By Service

Banking IaaS

Banking as a Platform

FinTech SaaS

NBFCs

Brazil Banking-as-a-Service (BaaS) Market Key Players:

- Nubank

- Ebanx

- PagSeguro

- Creditas

- Banco inter

Request free sample:https://www.stellarmr.com/report/req_sample/Brazil-Banking-as-a-Service-BaaS-Market/242

Key questions answered in the Brazil Banking-as-a-Service (BaaS) Market are:

- What is Brazil Banking-as-a-Service (BaaS)?

- What was the Brazil Banking-as-a-Service (BaaS) market size in 2023?

- What is the growth rate of the Brazil Banking-as-a-Service (BaaS) Market?

- Which are the factors expected to drive the Brazil Banking-as-a-Service (BaaS) market growth?

- What are the different segments of the Brazil Banking-as-a-Service (BaaS) Market?

- What growth strategies are the players considering to increase their presence in Brazil Banking-as-a-Service (BaaS)?

- What are the upcoming industry applications and trends for the Brazil Banking-as-a-Service (BaaS) Market?

- What are the recent industry trends that can be implemented to generate additional revenue streams for the Brazil Banking-as-a-Service (BaaS) Market?

- Who are the leading companies and what are their portfolios in Brazil Banking-as-a-Service (BaaS) Market?

- What segments are covered in the Brazil Banking-as-a-Service (BaaS) Market?

- Who are the key players in the Brazil Banking-as-a-Service (BaaS) market?

Key Offerings:

- Past Market Size and Competitive Landscape (2018 to 2022)

- Past Pricing and price curve by region (2018 to 2022)

- Market Size, Share, Size & Forecast by Different Segment | 2024−2030

- Market Dynamics – Growth Drivers, Restraints, Opportunities, and Key Trends by Region

- Market Segmentation – A detailed analysis by segment with their sub-segments and Region

- Competitive Landscape – Profiles of selected key players by region from a strategic perspective

- PESTLE Analysis

- PORTER’s analysis

- Value chain and supply chain analysis

- Legal Aspects of Business by Region

- Lucrative business opportunities with SWOT analysis

- Recommendations

For additional reports on related topics, visit our website:

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Banglore Highway, Narhe,

Pune, Maharashtra 411041, India

+91 96071 95908, +91 9607365656